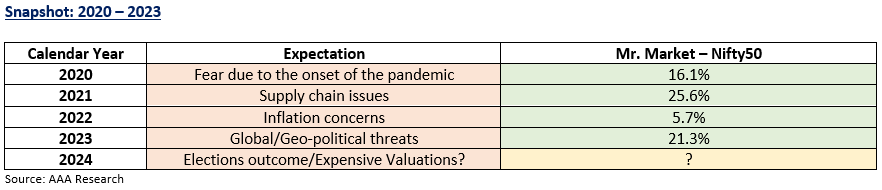

As everyone looks forward to 2024, the street is trying to predict the new theme which will catch the eye. In 2020, it was the pandemic. In 2021 supply chain issues plagued companies and consumers. By 2022, inflation hit a fever pitch. In 2023, markets were fearful amidst global ebbs and flows. The recent rally and worries about the national election outcome have puzzled investors for 2024, with some being concerned that the markets are expensive. While the theme changes every year, one thing is consistent: they usually fade and give way to the next big thing, reminding investors not to allow distractions to derail them from their investment plans.

As seen above, markets have taken investors off-guard. In many ways, each year can be used as evidence that investors must learn to “expect the unexpected” – Indian markets surged massively despite global concerns, the U.S. economy avoided a recession, and the Federal Reserve pushed interest rates higher. AAA accurately recommended investors to increase their participation in public equities, as highlighted in our July’s newsletter – Nifty50 at 19000, the best is yet to come.

Rather than estimating the theme over the next year, we believe it is more effective to holistically assess the markets from a long-term perspective and review the intrinsics.

Growth so far

Growing at 6.5% on a yearly basis, India is unquestionably the fastest growing economy in the world in real terms. However, when looked at this growth in relative terms, India’s resilient footing stands out as the global real GDP growth for FY23 was less than half of India’s at approximately 3%. Now, with the inflation probably behind us, the macros seem to support the thesis of a better global economic outlook going forward. This would translate into further accelerated growth for India, as exports would pick up again, and the horizon of opportunities would widen.

Growth Quality

The quality of earnings bears great testimony to a company’s resilience. Leverage levels, ROCE, and cash conversion cycles should all be given careful consideration during the process. The quality of Indian companies has improved over the past decade as the median net debt to equity reduced from 0.26x in FY13 to zero in FY23, as outlined in our October 2023 newsletter,

Consistency of Growth

Sensex increased five times between 2003 and 2008, marking the heyday of the stock market, with an annualised EPS growth of 32%. For the first time post GFC, this pattern of consecutive double digit earnings growth can be seen repeating over the past three years, albeit in a smaller way. Nifty has delivered double digit earnings growth, with the upcoming year to be on track for a 15% EPS growth as well. Thus, we could see this earnings growth trickle down to the market, which can prove to be rewarding for investors positioned advantageously to benefit from the same.

Sustainability of Growth

The markets have an eye on the future rather than the past. Although predicting the future is akin to being an astrologer, it is crucial to regularly assess the foundational elements. The digitalization of the economy, PLI, and the push for infrastructure all suggest that the real economic growth trajectory at the current 6% annual pace will hold for the foreseeable future. This suggests a 12% revenue rise for Indian companies, and a range of 13% to 15% revenue growth for the organised sector. Given the reduced levels of leverage, margins can rise in the presence of robust demand and benign raw material costs, effectively resulting into 15%+ sustainable earnings growth.

Market Outlook

As all four growth parameters seem to be in favour, we are bullish on the markets in the long-term. On the valuation front, Nifty’s valuation ~20x PE FY25E does not seem to be exorbitant, as the last seven-year P/E hovers around ~19x. With that being said, there are some pockets of exuberance, particularly in the micro-cap and small-cap buckets. We continue to remain QuAgile, and eagerly optimising all opportunities consistent with our philosophy of “Protect Capital, Create Wealth”.

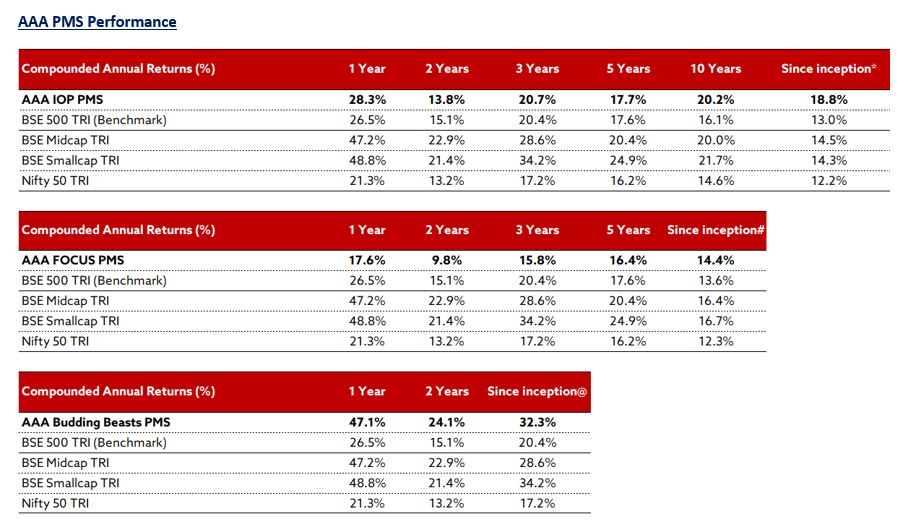

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

*(23 Nov 2009 – 31 Dec 2023); #(17 Nov 2014 – 31 Dec 2023); @(01 Jan 2021 – 31 Dec 2023)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.