AAA Budding Beasts PMS plan is a portfolio of 30-50 companies which are emerging giants with strong corporate governance and high growth potential with an investment horizon of 3-5 years.

AAA Budding Beasts PMS

Overview

Product Profile

Why Invest in AAA Budding Beasts PMS?

- India investment strategy with strong emphasize on superior and sustainable growth

- Focus on companies with strong balance sheet and high return on capital employed

- Focus on companies which are emerging giants

Experience in High Quality Growth Investing

Mr. Rajesh Kothari

Founder & Managing Director

29+ years of experience

A High Conviction & Quality Approach

Based on our proprietary 3M Investment Approach, we invest in a portfolio of 30-50 small-midcap organisations that are poised to become large companies Predicated on their strong fundamentals, a robust competitive advantage and excellent corporate governance, we are convinced in their ability to tide over short-term turbulence to deliver superior risk-adjusted returns for investors with a 3-5 year investment horizon.

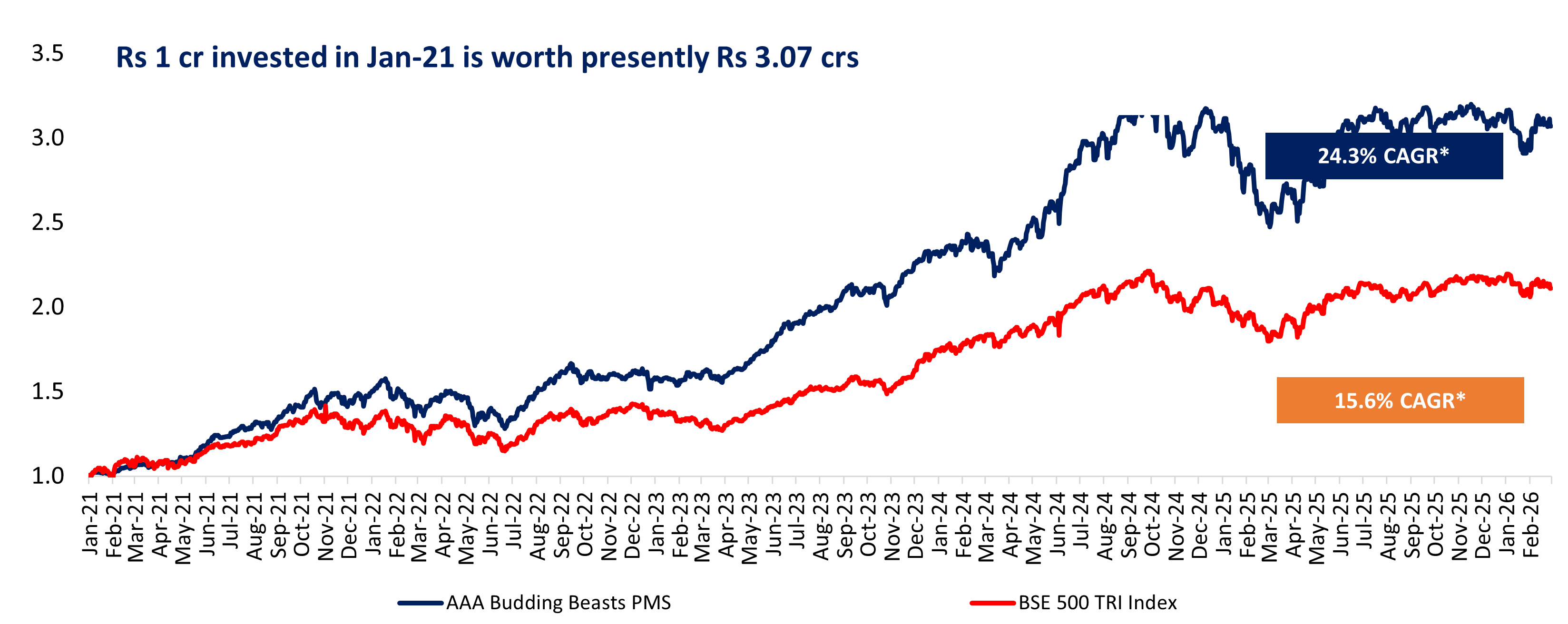

Rs 1 cr invested in Jan21 is currently worth Rs 3.07 crs

Disclaimer: *(1 Jan 2021 – 28 Feb 2026) Performance figures are net of all expenses and fees till last quarter. Index performance is calculated as per Total Return Indices in accordance with the SEBI Guidelines. Returns of individual clients may differ depending on time of entry in the Strategy. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI. For Performance relative to other Portfolio Managers within the selected Strategy, please visit: bit.ly/APMI_PMS