Despite the global wall of worry over the last two years, the Indian equity markets stood resilient, outperforming many of its emerging market peers. Consequently, Indian markets witnessed a great number of IPOs over the past two years, buoyed by the investor faith in India’s growth story. Investors put up Rs. 3.6 lakh crores for five IPOs last week alone. As a result, many investors are experiencing FOMO – the Fear Of Missing Out – from IPO investing. This trend poses the question – should one invest in IPO companies?

While IPOs can prove to be a good entry point, they also come with substantial risk. In our opinion, IPOs come in waves – some IPO investments are good, some are bad and some can get ugly. When a few IPOs succeed, more promoters try their luck as the market sentiment is optimistic. Although the underlying businesses may appear to be strong on the surface, it is essential to dive deeper and identify the optimal IPO companies for wealth creation. Thus, it is prudent to have a selective approach to IPOs.

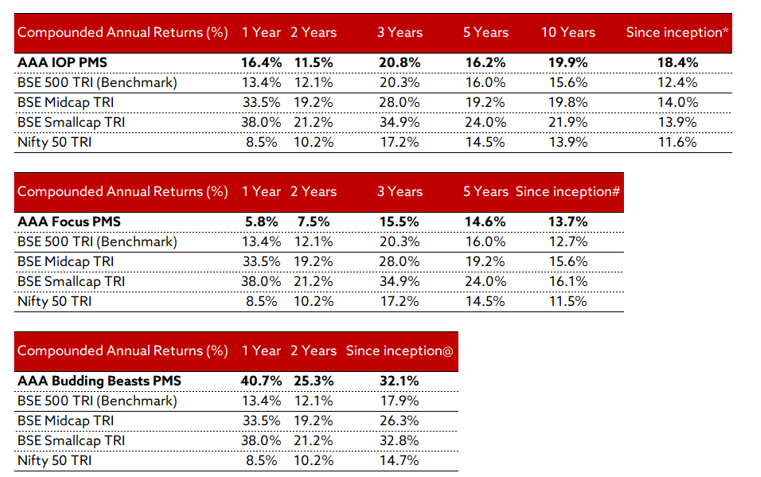

Snapshot: Returns & Earnings

As seen in Figure 1, nearly a fourth of the companies with IPOs in the last ten years have not appreciated, i.e., their returns are negative. ~20% of the companies have underperformed the benchmark with annualized returns of less than 10%. To the contrary, more than a third of the companies have exhibited great annualized stock returns of more than 20%. Hence, subscribing to IPOs due to FOMO is as good as flipping a coin. Rather, it is better to have a structured approach to IPOs to increase the chances of being successful.

Upon evaluating the earnings trends of these companies, this performance gap between IPO companies becomes less surprising. As depicted in Figure 2, more than a third of the IPO companies have delivered subdued earnings growth. On the other hand, more than 40% of the IPO companies have performed exceedingly well with annualized profit growth exceeding 20%. This affirms our thesis that markets are a mirror of earnings growth.

The AAA Way for IPOs

Being quality stock-pickers to the very core, we believe it is important to analyse the quality of any IPO company before jumping in on the bandwagon. In our view, it is essential to conduct a holistic assessment of the company and understand its long-term vision. This would lead to more informed decisions and help us better predict the company’s position three to five years down the line. Since inception, our approach to buying recently listed businesses has been extremely selective. Normally, we wait for these companies to deliver numbers for two to eight quarters before we buy them. Many a times, we find existing listed players showcasing greater value creation at lesser risk levels compared to their recently listed counterparts.

Amongst a multitude of other factors, it is necessary to judge the executional capabilities of newly listed companies. During IPO days, many companies estimate significantly higher earnings than the industry average, and at times even higher than their historical performance. Such overly optimistic estimates put significant pressure on the management, and many a times the actual results greatly detract from their own guidance.

Additionally, the newly listed companies often trade at premium valuations compared to their listed peers. We tend to avoid such companies as time correction can result in underperformance, even if the results are in accordance with the guidance.

On the flip side, there could be a host of companies which have solid business fundamentals, brand franchise, multi-decadal track record, and strong growth potential. If these companies get listed at reasonable valuations, IPOs could be the perfect entry point to become a part of their growth journey.

Our prudent and selective approach to IPO companies has been rewarding. Our framework for evaluating IPO companies is the same as our framework for the listed universe – 3M investment approach (Market size, Market share, Margin of Safety). This approach has helped us to invest in companies like Polycab, Prince Pipes, and Craftsman Auto. These companies are multi-baggers today, with their stocks multiplying more than three-fold.

Quarterly Update

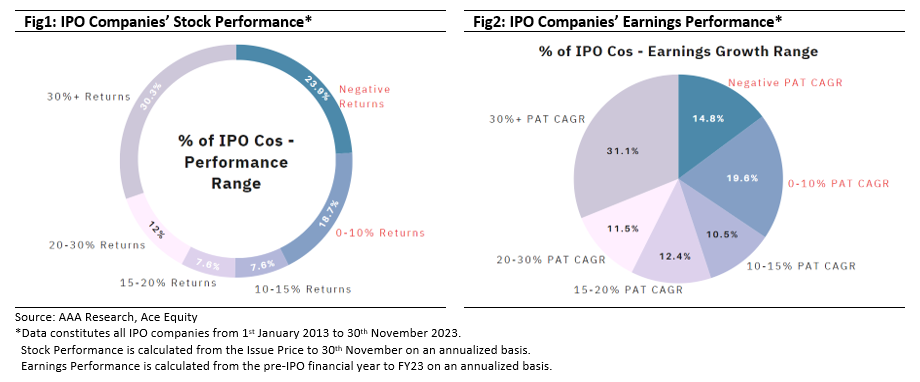

This quarter again, corporate India earnings growth was propelled by the auto and BFSI sectors. Barring the chemicals, FMCG and IT sector, all sectors witnessed healthy earnings growth, thereby showcasing the underlying resilience of the Indian equity markets. All in all, the AAA portfolio companies delivered a good quarter, with the portfolio earnings exceeding the Nifty earnings, as seen in the figures below.

Market Outlook

As BJP won with clear majority in the three states of Madhya Pradesh, Rajasthan, and Chhattisgarh, the overall market narrative is quite positive. This political win reduces the uncertainty of the central elections outcome next year, thereby hinting a continued path to political stability going forward. Cumulatively, this indicates the prospects of government capex to continue, which would further enable higher economic growth. Global macros seem to be in favour with the US 10-year yields falling from 5% to 4.25%. Commodity prices are benign, which is a good sign for earnings growth. Nifty is trading at a P/E of 18.4x – below its 10-year average P/E of 20.1x – which seems quite reasonable, given the growth going forward. Altogether, the investment backdrop seems to be resilient and positive.

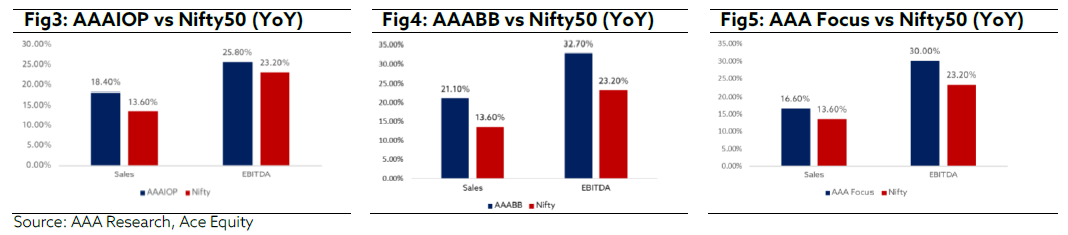

AAA PMS Performance