AAA FOCUS PMS plan is a portfolio of 30 companies which are market leaders with strong corporate governance and high growth potential with investment horizon of 3-5 years.

AAA Focus PMS

Overview

Product Profile

Why Invest in AAA Focus PMS?

- India investment strategy with strong emphasize on superior and sustainable growth

- Concentrated portfolio of 30 high quality growth companies

- Focus on companies with strong balance sheet and high return on capital employed

Experience in High Quality Growth Investing

Mr. Rajesh Kothari

Founder & Managing Director

29+ years of experience

A High Conviction & Quality Approach

Based on our proprietary 3M Investment Approach, we invest in companies that have proven management, a strong balance sheet, superior earnings growth and stellar corporate governance. We believe that by investing in companies with resilient fundamentals and sustainable competitive advantage while taking a long term investment approach, we can preserve capital and provide stability across market cycles.

Our radically resilient strategy is in accordance with our 3M approach of Market Size, Market Share, and Margin of Safety.

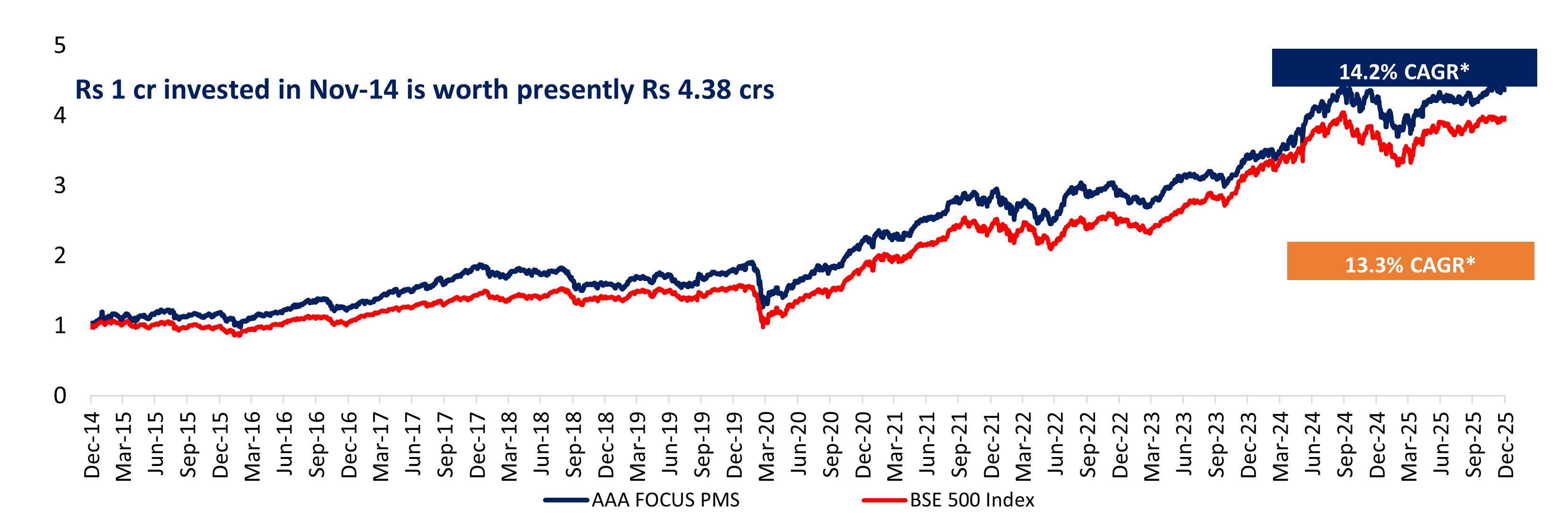

Rs 1 cr invested in Nov14 is currently worth Rs 4.38 crs

Disclaimer: *(17 Nov 2014 – 31 Dec 2025) Performance figures are net of all expenses and fees till last quarter. Index performance is calculated as per Total Return Indices in accordance with the SEBI Guidelines. Returns of individual clients may differ depending on time of entry in the Strategy. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI. For Performance relative to other Portfolio Managers within the selected Strategy, please visit: bit.ly/APMI_PMS