2024 started with a bang, as all major market indices – Nifty, Nifty Midcap and Nifty Small cap – surged to new highs. With increasing retail investor participation, risk appetites are poised to grow, as there is a transition from FOMO (Fear of Missing Out) to ROMO (Regret of Missing Out). With that being said, we believe that earning easy money will not be so easy from here on. It is time to start focusing on capital protection, while ensuring to capitalise on opportunities presented to create wealth.

A Structurally Different India

We strongly believe that the Indian economy is not only likely to grow faster than the world economy but is also becoming more resilient. For instance, India used to greatly be dependent on oil, but now it is slowly detracting from this dependence, owing to the increase in renewable energy, as well as better infrastructure resulting in greater fuel efficiency. For instance, total renewable energy installation has more than tripled from 80 GW in FY15 to 172 GW in FY23 and is expected to grow three-fold in accordance with the country’s energy target of reaching 500 GW by 2030. More importantly, non-fossil fuel capacity has increased from 29% to 42% of the total energy capacity over the past eight years. On the exports front, services, which contribute significantly to our economy have continued to show strength, with services exports growing more than 20% over the last three years despite tepid global growth.

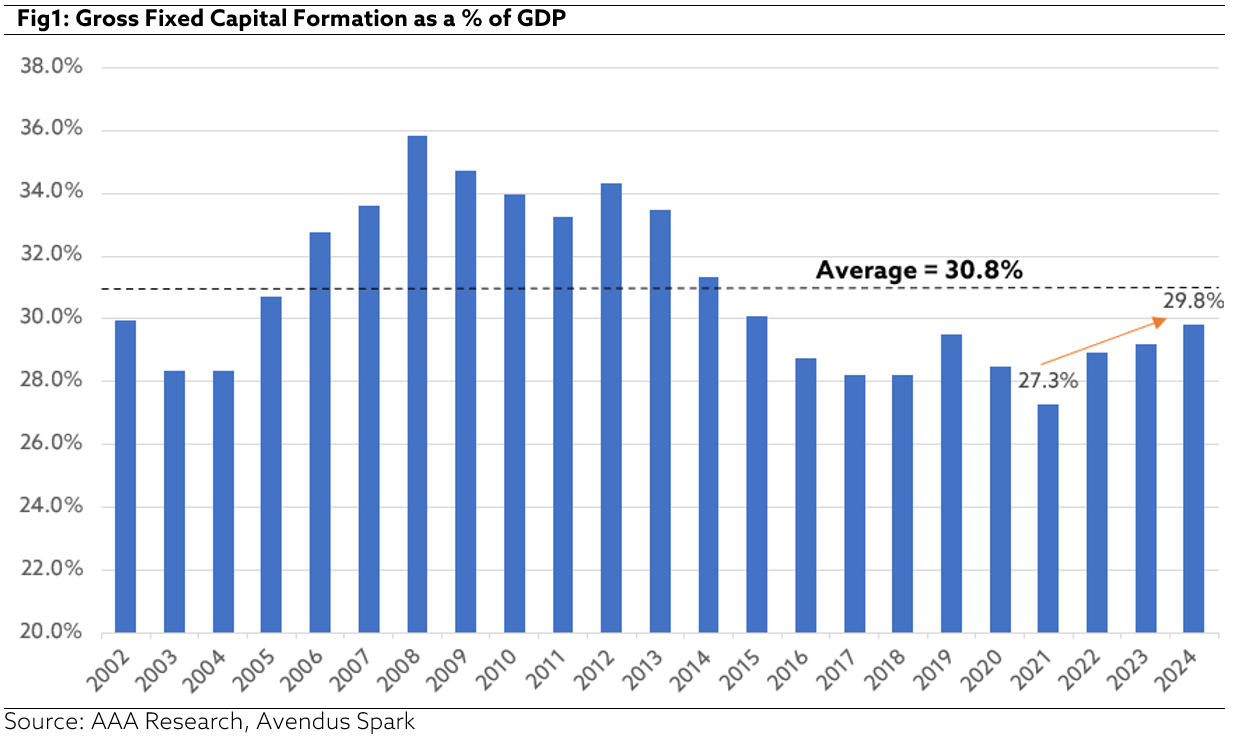

On the manufacturing side, gross fixed capital formation has improved from 27.3% to 29.8% (refer Fig1) and we expect it to improve further to 35% driven by the government’s thrust on capex. To throw some light, central government capex has surged by 20% this financial year and is expected to grow at a staggering 18% in FY25.

Significance of Prudence – Looking to History as a Guide

The market rally has been spectacularly broad-based, reflecting little differentiation between companies with high quality fundamentals and poor-quality fundamentals. However, if history tells us something, it is that in the long term, companies with poor earnings’ quality are punished the most, often wiping out all the investor gains and at times resulting in losses.

It is during such a time of wild bullishness of markets that one might get carried away and reduce their investment rail guards, thereby reducing their prudence and making their hard-earned capital vulnerable to market volatility.

After decades of experience, we have cultivated our quality rail guards. Our understanding of what makes a quality business has been improved by two significant occurrences in financial history: the tech bubble of the early 2000s and the Global Financial Crisis (GFC). During the Tech Bubble, several companies faltered not because of the lack of a compelling vision, but rather due to ineffective execution and lack of a sustainable business model. The GFC subsequently brought attention to how important financial discipline is. Thus, the companies with financial flexibility survive while many others are thrown out. Many of these companies were considered blue chips and were a part of the Nifty indices but then became Non-Performing Assets and suffered huge losses, with some instances of 90%+ decline from their 2008 peak levels.

To sum up, profitable, high-quality businesses with strong balance sheets typically showed better ability to preserve a long-term orientation and make the required investments for sustainable growth during times of uncertain economic climate, when more susceptible competitors had to re-trench. Therefore, we contend that one must remain bullish on India, albeit prudently.

Budget Snapshot

The FY25 Interim Union Budget focused on fiscal consolidation. As against the market expectation of 5.3% of GDP as the fiscal deficit target for FY25, the govt presented a fiscally more prudent budget, with a target of 5.1%. The finance minister also mentioned that the FY26 target is lower than 4.5%. Bond market sentiments should be buoyed by lower-than-expected dated securities gross borrowings. The Government’s intention to boost the investment cycle could not have been clearer. Govt capex is budgeted to rise by 17% YoY in the next financial year (FY25) as against non-capex (excluding interest payments) outgo budgeted to decline by 1% YoY – the key driver for fiscal consolidation. The railway and the road capex are expected to increase only by a small 3.0% and 2.0%; but the Govt has kept aside Rs. 705bn (US$8.5bn) for some ‘new schemes’ – details of which would be shared probably in the final July budget.

Market Outlook

A decent budget, along with positive structural changes make us bullish on India. However, we believe that there might be certain pockets of irrational exuberance, and hence remain prudent in our stock-picking approach. We continue to be highly active and agile, to ensure sustainable levels of risk to protect capital.

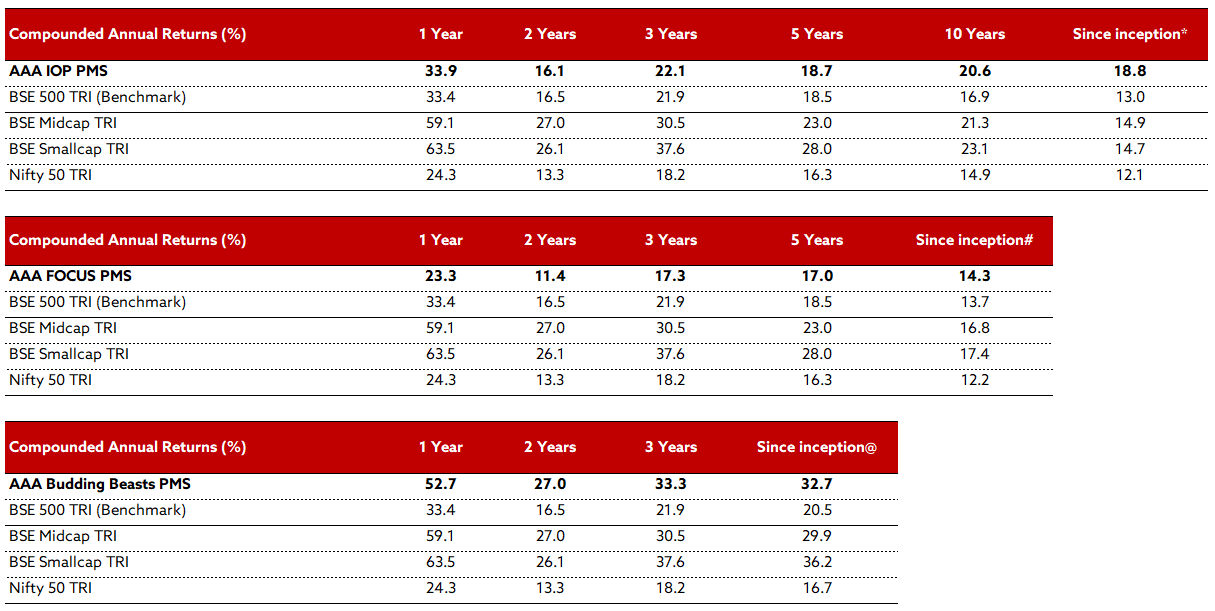

AAA PMS Performance

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

*(23 Nov 2009 – 31 Jan 2024); #(17 Nov 2014 – 31 Jan 2024); @(01 Jan 2021 – 31 Jan 2024)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.