What are the various investment strategies offered by AlfAccurate Advisors PMS?

We currently offer three strategies:

- AAAIOP PMS: AAA India Opportunity Plan (IOP) PMS plan is a portfolio of 40-60 companies that are market leaders with strong corporate governance and high growth potential with an investment horizon of 3-5 years.

- AAA Budding Beasts PMS: AAA Budding Beasts PMS plan is a portfolio of 30-50 companies that are emerging giants with strong corporate governance and high growth potential with an investment horizon of 3-5 years.

How do I signup for PMS account with AAA?

You can either leave your details here, or drop us an email at [email protected], and one of our executives will contact you shortly.

How can I top-up (add more funds) to my PMS Account?

Topping up your account is very easy – it is the same process as funding your account the first time. Only there is no additional paperwork required.

Just transfer the funds (into the same account you transferred funds at account opening), and email us the cheque/proof of transfer along with the name of strategy at [email protected], and we shall confirm the receipt of funds by the end of the day.

We usually don’t need anything else, but we will contact you if we need more info to satisfy regulatory and compliance needs.

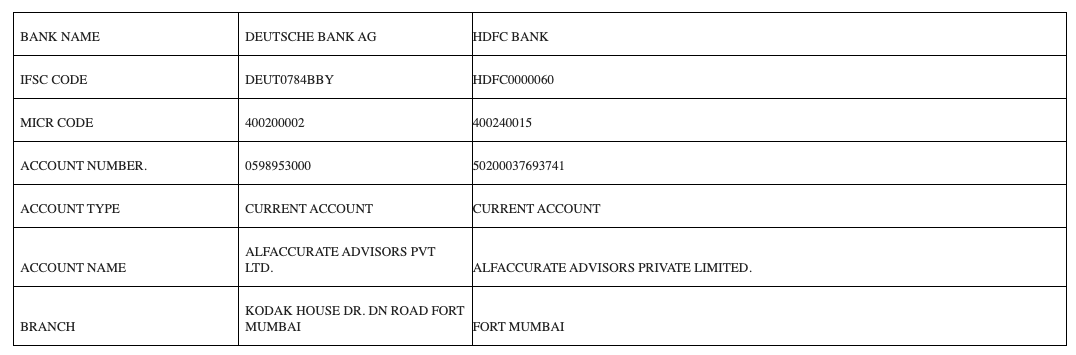

What are the bank details for funding PMS account?

Resident Investors with Pooled Bank Account can remit funds into the following based on the bank for Fresh funding and Top ups for all strategies:

Non-Resident clients must drop an email to [email protected] for account details.

What are the fee options of AAA PMS plans?

We offer both a fixed fee PMS plan and Profit sharing PMS plan. For more details, please send an email to [email protected]

What reports will I get once I sign up with AAA PMS?

We will send you a monthly fact sheet, quarterly financials, and yearly audited financials.

How long does it take to get a PMS account set-up for investing?

For resident Indian individuals, it takes about 3-4 working days. For a non-resident, it may take 5-7 working days. Please note that the above timeline assumes AAA gets discrepancy-free, signed, and KRA compliant application pack.

What happens to dividends?

Dividends are reinvested into your PMS account. You can track dividends from your PMS reports which we send you every quarterly and yearly.