Nifty50 has finally crossed 19000, a reason to celebrate considering this achievement when many global economies are likely to undergo recession in 2023. With this new mark, many investors perceive that Nifty50 has turned expensive and the markets are overvalued. However, we believe that the best is yet to come, with India at an inflection point with immense growth potential.

India – Bigger and Better

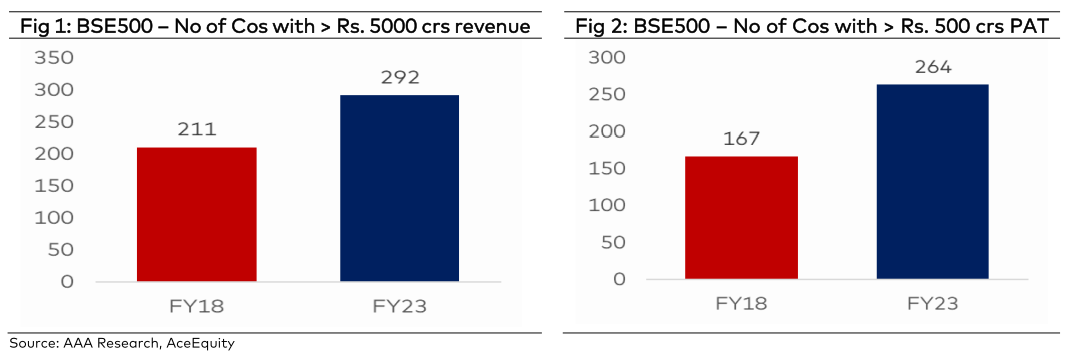

Looking at India’s growth over the past five years, Indian businesses have strongly capitalized on structural reforms. As a matter of fact, during this period, the number of Indian companies with revenues exceeding Rs 5000 crores increased by 37%. Additionally, the number of Indian companies with net profit exceeding Rs 500 crores grew by a staggering 60% from 2018, as seen below. This is a tremendous accomplishment and demonstrates the robustness of Indian incorporations, given the delicate macroeconomics during the pandemic and the accompanying geopolitical instability. Outperforming emerging economies show that large companies with annual revenues above $500 million not only contribute to increasing GDP and productivity but also act as catalysts for change – promoting exports, investing in job training, and paying better wages, among other things. Additionally, they are more dynamic and innovative at the adoption of new technologies. For Indian companies, this self-cycle will result in faster and more effective earnings growth. In our opinion, India will continue to add to this basket of large size companies, which will result in stronger growth for corporate India earnings.

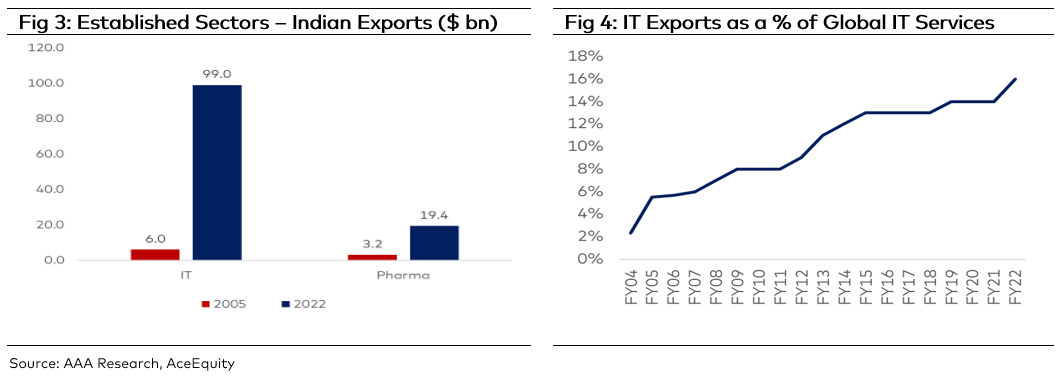

Growth in size brings with it the benefits of economies of scale, which boosts competitiveness. This has been evident over the past seventeen years in a number of industries, including the textile, pharmaceutical, and IT sectors. For instance, the Indian IT industry had a sixteen-fold increase in exports, which led to a rise in market share from 8% to 16% as seen in the figures below. The same is true for the Indian pharmaceutical industry, which saw a six-fold expansion in size.

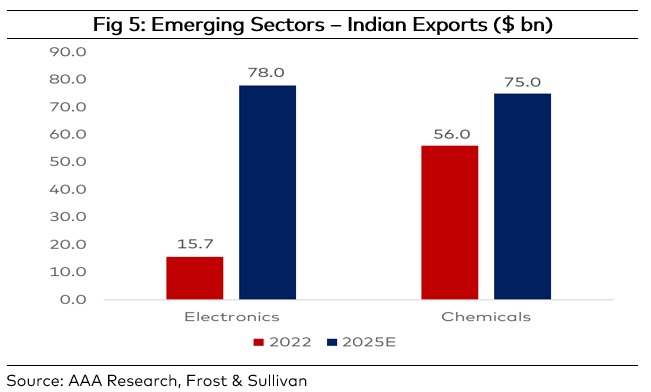

We think India is doing everything it can to compete internationally in a variety of industries, including electronics, specialty chemicals, engineering items, etc. For instance, PLI would help electronics exports increase 8-fold over the next three years to USD78 billion, as seen below. Furthermore, chemical exports are also expected to increase by 33% over the coming years. This would further contribute to India’s economic growth and resilience.

The Valuation Story – correcting the illusion

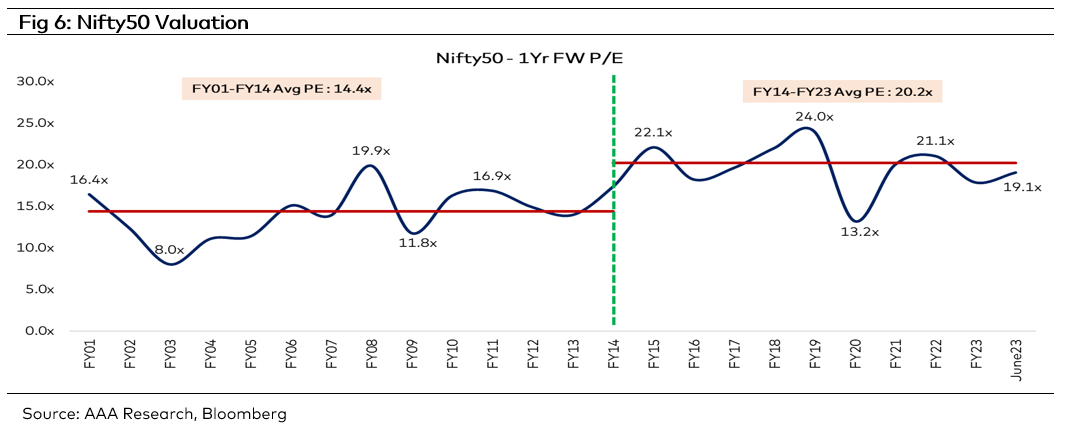

The Nifty50’s average one-year forward PE multiple from FY01 to FY23 stands at ~16.5x. From this lens, the current multiple of 19.1x looks higher and suggests that the index is trading at a 15% premium. However, we believe that this is not the most optimal manner to assess market valuations. For a more holistic assessment, one must break the cycle into pre-2014 and post-2014 periods. Prior to 2014, India’s economy was struggling due to a heavy reliance on oil imports, an underinvestment in infrastructure, free-falling rupee, and an unstable political system. India’s economy pivoted after 2014 as a result of the massive structural and economic reforms implemented by the new administration. The average earnings multiple from FY14 to FY23 is 20.2x, in stark contrast to the pre-reform period multiple of 14.4x. This is the new normal for India, in our view, and we believe there is further potential of valuations rerating given higher growth potential compared to other world economies.

Market Outlook

We are optimistic about the Indian equity markets and anticipate that Indian equities will deliver strong returns over the long-term. Inflation is cooling down, which has further mitigated global concerns. Healthy demand traction as indicated by RBI surveys, along with lower commodity prices (LME metal index down 17% YoY and Brent crude oil down by 30% YoY) is likely to result in double digit corporate earnings growth in 1QFY24. Signs of a pick-up in rural consumption are also visible. On the capex side, improvement in capacity utilization, PLIs schemes, China +1, Europe+1, along with an increase in the scale of operations led by better opportunities in the domestic market bodes well for the outlook across sectors. We continue to optimize bottom-up opportunities by looking at companies with solid fundamentals and a strong business moat.

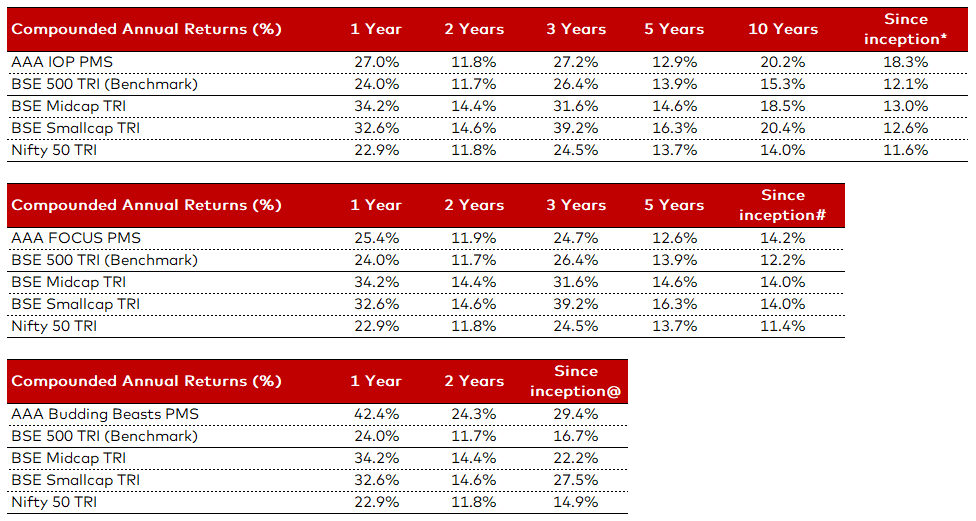

AAA PMS Performance