In our September 2020 insights titled “Key Investment Themes to Capitalize on the Covid-19 Crisis”, we highlighted how companies at the forefront of automation and innovation would be the big beneficiaries of economic growth and recovery, post-pandemic world. This would enable them to gain more market share, a critical component of our unique 3M Investment Approach. Moreover, we believe that automation and innovation will further increase as unprecedented restrictions on travel, physical interactions, and changes in consumer behavior have changed the way companies operate and serve their customers. This has spurred digital transformations in a matter of weeks rather than months or years.

Why Automation and Innovation is vital for the future of Indian businesses?

As per a McKinsey report, automation is transforming the world economy and workforce. 60% of all occupations encompass at least a third of the activities that can be automated. In addition to this, some jobs are only possible with Artificial Intelligence and Machine Learning because of their operational efficiency.

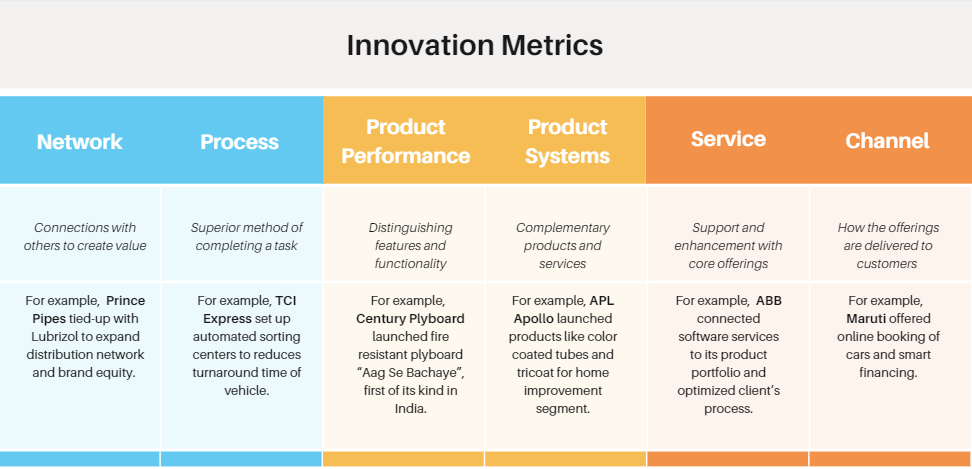

Innovation is not only about new product launches, but it is also about changing profit models like how Netflix transformed the video rental industry by implementing a subscription model. Another example is the innovation in product systems like Nike+ parlayed shoes and devices into a sports lifestyle suite. It can be process innovations such as Zara’s fast-fashioned strategy, which moves its clothing from sketches to shelves in record time, or opening a new channel like Nespresso locks in customers with its valuable members-only club, et al.

At AAA, Innovation is always one of the essential criteria for stock selection. Accordingly, we took Deloitte’s framework of innovation to gauge our portfolio companies’ progress on innovation. Upon deep diving into FY21 annual reports of our portfolio companies, it is evident that our holding companies have further accelerated their pedal on automation and innovation in the past year.

Equity market strategy:

Inflation, interest rates, and Federal Reserve policy will be dominating the discussions for the rest of 2021. In his Jackson Hole speech, Fed’s Chair Powell said the Fed may start paring bond purchases this year, but is in no hurry to raise interest rates and would be guided by data to weigh risks from the delta virus variant, soothing the recent concerns about tapering. Back at home, Nifty is at an all-time high, as India vaccinates half of its adult population with at least one dose. India’s structural outlook has improved significantly (PLI, China+1, Formalization of the economy), and it offers one of the fastest growth among major economies. With their thrust on innovation & automation, our portfolio companies will sustain their competitive moats, remain resilient, and emerge as market winners.

Key Risks: Severe Covid third wave, the slower vaccination drive, significant increase in commodity inflation, geopolitical risks.

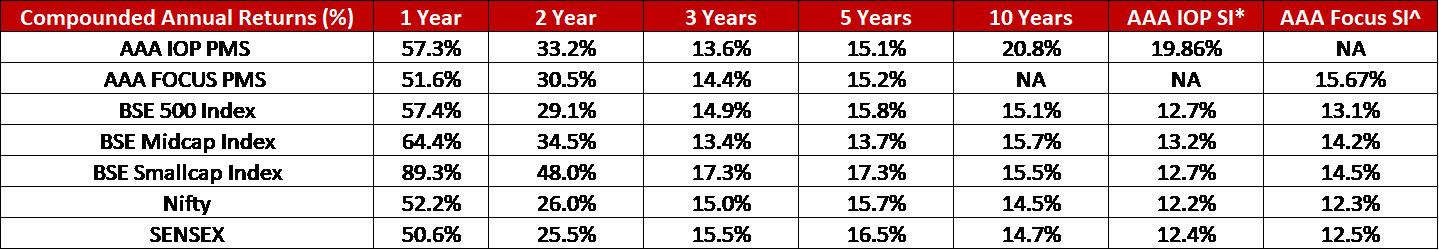

AAA PMS Performance