The COVID-19 pandemic has upended daily life and disrupted traditional asset valuations, leaving investors of all stripes bewildered and questioning how to tide through this crisis intelligently. Recent market volatility – with some stocks recovering too quickly and other stocks that have borne the brunt of rushed exits – has proved the importance of building diversified portfolio that are aligned with investors’ long-term goals.

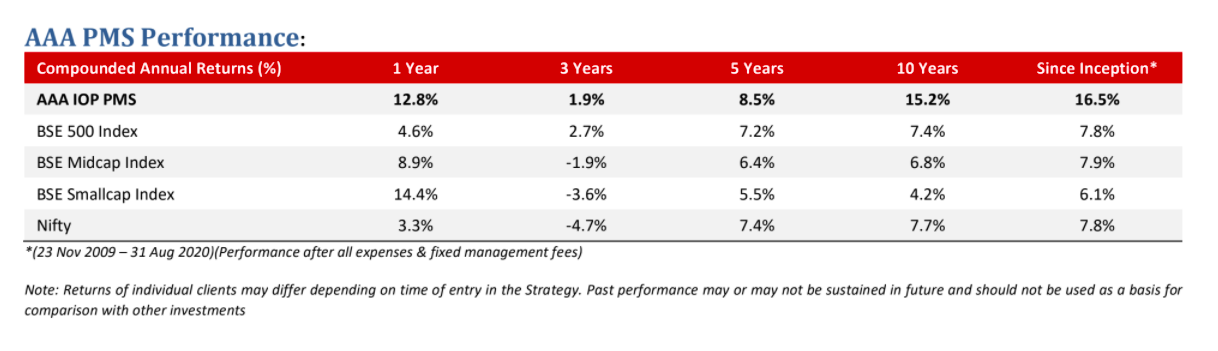

There are several companies which are taking bold steps not only to recover from the initial impact of this global pandemic but to seize opportunities to gain further market share. We have consolidated 3 core themes for investors that will define the contours of economic recovery, portfolio rebalancing and long-term growth.

Theme 1: The Acceleration of Formalisation

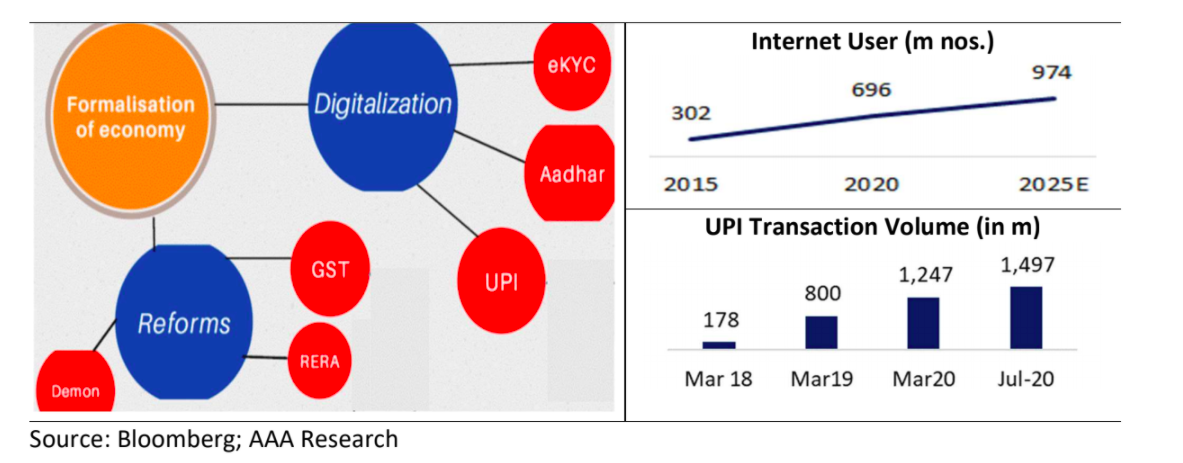

In the wake of the COVID-19 pandemic, the market is shifting at a never-before pace from unorganised to organised players. Governmental reforms and Digitization together, are a potent combination to accelerate formalisation of the Indian economy.

In the last 5 years, the government has unleashed bold policy reforms including demonetisation, GST, RERA, and IBC. This along with huge digital push via Jan-Dhan accounts and UPI is having their desired socio-economic effects in terms of rapid financial inclusion and ease of doing business. Additionally, initiatives such as e-KYC, AADHAR and e-Signing documents have transformed the banking and finance sector and led to massive growth in the fin-tech space.

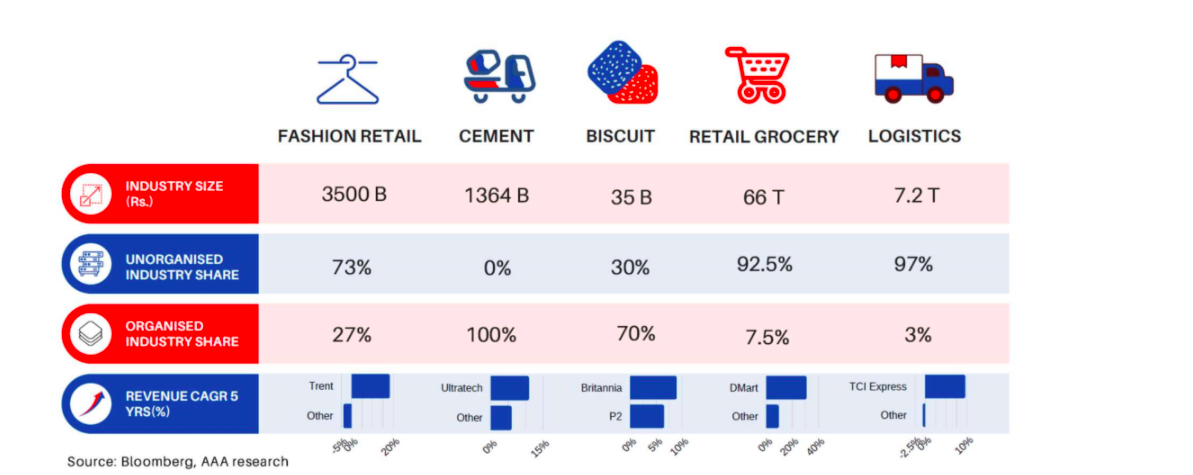

It is important to note that within the organised sector as well – the emergent winners will be organisations that are sectoral leaders with unleveraged balance sheet and agile in responding to changing consumer behaviour. Britannia Industries, one of our portfolio companies, launched Britannia Essentials Store whereby customers can order Britannia staples right to their doorstep through the Dunzo app and enjoy seamless, contact-less delivery in less than an hour. It reported 26% revenue growth and a staggering 100% profit growth in 1QFY21. Similarly, our portfolio company, TCI Express, a leading player in an otherwise unorganised logistics market – harnesses the latest technology in its sector – from barcoding and RFID to GPS facilitating 24/7 tracking to dynamic routing systems and a specialized mobile app for hassle-free pick-up and delivery. The company reported 9% CAGR in revenue compared to 0% revenue CAGR reported by its nearest competitor, Gati Kenkutsi in the last 5 years. Trends are similar across sectors as depicted below:

Theme 2: China + 1

China is the world’s largest exporter accounting for 13% of the world’s exports. There is a growing realisation amongst countries across the world that acute dependence on just one source for most of their key inputs is a highly risky and unsustainable situation. Improving infrastructure, cheaper labour availability and improving ease of doing business rank (currently, India ranks 63rd) is likely to make India an extremely viable alternative for manufacturing and product development especially in the segments of pharma, chemicals and electronics.

Pharma: As the world’s largest supplier of low-cost generics, vaccines and affordable medicines, India is touted as the pharmacy to the world with 20-22% global generic export volume market share. However, in the last 5 years, Indian pharma companies have battled pricing pressure in USA, stricter compliance norms and suffered a loss of product launch opportunities. On the back of stability in US pricing environment and plants ready to meet stricter compliance norms, the India pharma industry is poised to unlock its enormous potential. We believe leading pharma companies ROCE to expand to 18%+ driven by better capacity utilisation and new product launches.

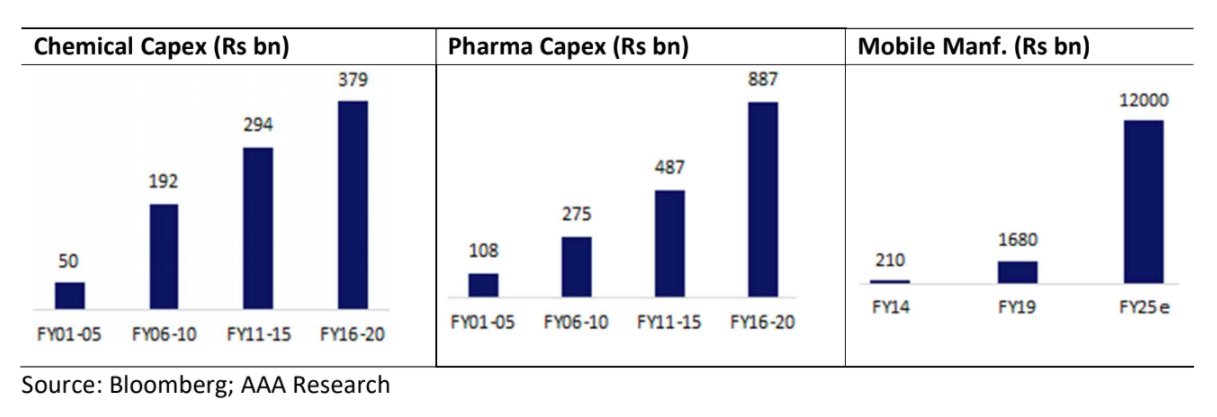

Chemicals: India’s speciality chemical sector is gaining favour with global players as they seek to de-risk their supply chains from China. With capex of Rs 379 bn in capital expenditure in the last 5 years, the sector is at inflection point. Indian companies have powerfully demonstrated their capabilities to the global customers like BASF, DOW, Syngenta and the like. For instance, one of our portfolio company, Navin Fluorine got new order of Rs2900 crs (spread over 7 years) from the global innovator. Importantly, this High-Performance Polymer chemical is outsourced for the first-time by the innovator, reflecting confidence of the customer in Indian company.

Electronics: With its wealth of engineering talent, India has always had an opportunity to make its mark on the global map – but the missing link was the government support to combat China’s cost advantages. However, with the recent announced Production Linked Incentive Scheme (PLI) by GOI, Indian electronics sector can unlock its underlying massive potential. Under NPE policy, the government has set an ambitious target of mobile handset manufacturing of Rs 12 lakh crores (FY25) compared to Rs 1.68 lakh crs (FY19). That will tremendously benefit our portfolio holding, Dixon Technologies – as it has the potential to generate revenue of Rs 25,000 crs i.e. 5x more than its current revenue size from mobile handsets alone.

Theme 3: The Rise of Automation & Innovation

Technological innovation and automation have led to an unprecedented redistribution of jobs and wealth in the past few years – the pandemic will only accelerate this trend. With remote working set to continue in major cities for the foreseeable future, the change in consumer behaviour and revenue reductions has jolted leadership teams to innovate and automate faster than ever before. In an effort to build both resiliency and speed into their business models, we see organisations taking bigger risks and getting products to market faster than ever before.

Organizations such as 3M India and Honeywell India, both part of the AAAPMS portfolio, have a strong parentage and are appropriately positioned to capitalise the opportunity. For instance, Honeywell Forge is an Enterprise Performance Management System – a cloud-based ecosystem that collects operational data from various assets into an engine that transforms that data into actionable insights and recommendations using ML algorithms. This powerful tool spans across all of the different industries where Honeywell has its presence. 3M Global on the other hand, has paired up with MIT Professor Hadley Sikes and her team to jointly develop a rapid, paper-based COVID-19 diagnostic test with novel processes for scaling it.

Market Outlook:

US Fed announced a new strategic framework heralding significant changes in the conduct of US monetary policy. The Fed will now adopt a flexible 2% average inflation target (FAIT) and will no longer pre-emptively raise interest rates to counter perceived inflation risk. It implies that US monetary policy will remain accommodative for a long time. In many ways, this pandemic has presented enterprises with a never-before opportunity to drop cumbersome, legacy ways of doing business and create agile, transparent and resilient organisations that can withstand future crises. While we remain positive on market, we do not rule out short term correction – in deed, correction would be healthy for the market. We will use such opportunity to capitalize on the aforementioned themes with a long-term outlook in the best interest of our valued customers.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.