“We’ve really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high-quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.”

– Charlie Munger

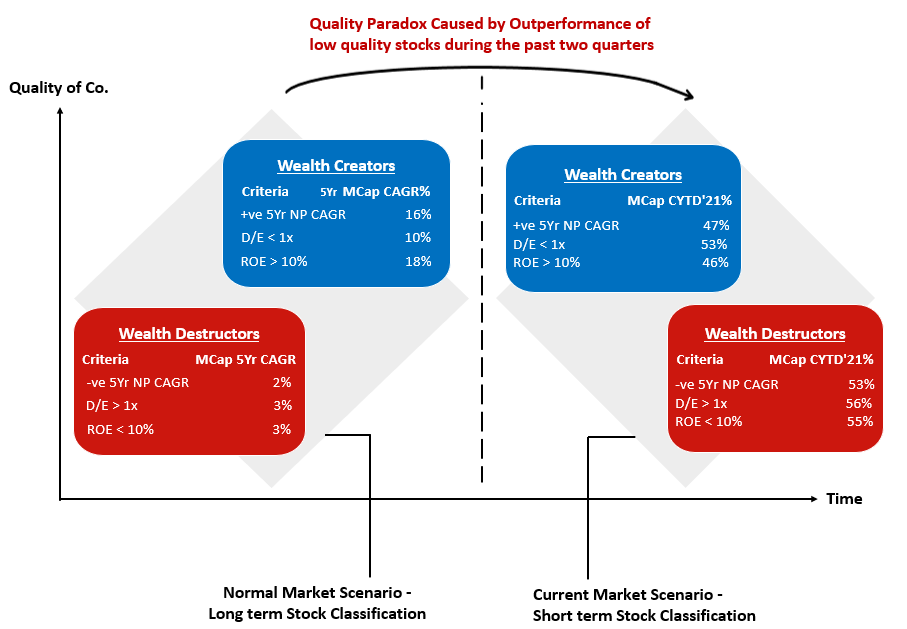

Quality of business has remained a significant driver for wealth creation for the investors. Companies with predictable and robust cash generation, sustainably high returns on capital, and attractive growth opportunities have outperformed their peer group significantly in the long term. However, in recent months, poor-quality stocks witnessed a powerful run, outperforming the high-quality companies by a wide margin. Announcement of effective vaccination, and opening up of the global economy, are the primary reasons cited for the decisive run in the poor-quality stocks. It is a classic paradox as companies with high debt, low ROE, and historic negative earnings growth has done better than companies with robust financials (refer below chart). These companies were traditionally wealth destructors with a minimal CAGR of 2-3% over five years, but delivered ~55% in the last seven months. On the other hand, high-quality stocks that have delivered a robust five year CAGR of 10-18% have registered comparatively lesser returns in the range of 46-53% in the last seven months.

(Source: AAA Research, Ace Equity)

At AAA, we embrace quality, and we firmly believe that high quality will continue to outperform low-quality stocks in the long term. In addition, as the economy normalises, investors will also get concerned about a rise in inflation and interest rates, which could increase volatility in the market in general, but could particularly pressure low-quality businesses as they do not enjoy the pricing power.

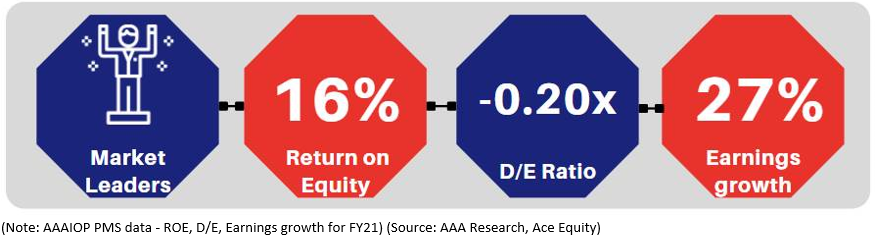

AAA Portfolio Characteristics:

We invest in companies that have proven management, a strong balance sheet, superior earnings growth, and stellar corporate governance. We believe that by investing in companies with resilient fundamentals and sustainable competitive advantage while taking a long-term investment approach, we can preserve capital and provide stability across market cycles.

Equity market strategy:

Indian economy is coming back to normalcy post-second covid wave. Corporate India commentary is cautiously optimistic as it awaits for whole opening up of the economy across states. Strong global recovery and proactive steps taken by India’s government (PLI, Capex spend, etc.) will help corporate India deliver strong earnings growth over FY21-23. The recent underperformance of high-quality stocks provides an excellent opportunity to invest in it with a longer-term time horizon.

Key Risks: Severe Covid third wave, the slower vaccination drive, significant increase in crude oil prices, geopolitical risks.

AAA PMS Performance