During the last six months, as Sensex is making new lifetime high, the investors are increasingly getting concerned about the market valuations. The common perception is that liquidity is a significant reason for a sharp rally in the global and Indian equity markets. While that is partially true, we firmly believe that in the long-term market mirrors earnings growth. High valuation multiples accompany strong earnings growth; hence, it is critical to understand the driving forces of earnings growth.

After a lull of almost the last 12 years, we expect corporate India to deliver strong double-digit earnings growth during the next 2-3 years. Our conviction is driven by 1. The big getting bigger; 2. Corporate India’s strong balance sheet; 3. Healthy Government Capex; and 4. China+1 & PLI.

1. The Big is getting Bigger

In our previous note (read more), we mentioned the acceleration of formalisation in the country. Since then, the pace has intensified, driven by the second wave of pandemics and supply chain disruptions. The big players backed by the economics of scale are much better positioned than small players in managing supply chain challenges. They have also witnessed strong pricing power in the environment of rising inflation compared to small players. As a result, big players are witnessing gain in market share across sectors. That will result in solid revenue growth and earnings growth for such firms.

2. Corporate India deleveraging

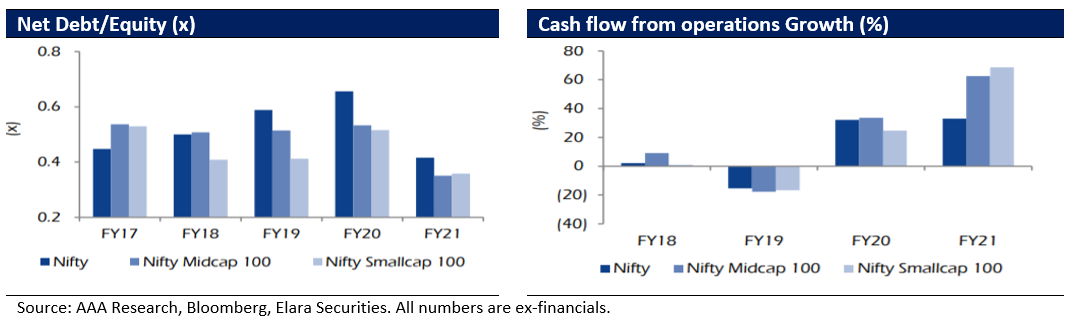

During FY21, corporate India worked to restructure costs and preserve cash. That resulted in improvement in EBITDA margins despite plummeting sales. Moreover, as their cash flows conversions were healthy, they saw deleveraging across (Nifty net debt at 0.4x in FY21 against 0.7x in FY20). This improvement in the balance sheet will increase its capacity to borrow and lessen risk averseness in bond capital markets.

3. Healthy Government capex

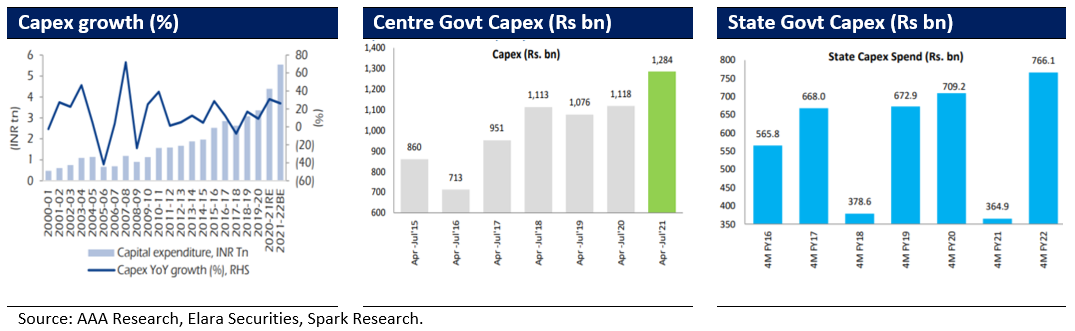

During the last few years, Government capex remained healthy despite pandemic. Further, the Government has announced National Infrastructure Pipeline (NIP) worth INR 111tn to drive upcoming government capex in the near-to-medium term. During Apr-Jul21, both Centre and State capex registered heathy growth despite pandemic challenges which shows the government’s commitment to revive the economy.

4. PLI and China+1

Global supply chain diversification away from China has added renewed focus on India’s manufacturing capability, which is finding further support from production linked incentives provided by the Indian government to boost output. Government has committed incentives worth INR 2trn through PLI scheme. This will help to revive capex cycle.

Equity Market Outlook

The strong earnings growth combined with improvement in ROE is a major reason for our positive view on the Indian equity market. While we do not rule out corrections, we advise investors to use bouts of volatility as an opportunity to add to the equity asset class with 3-5 years horizon.

Key Risks: Severe Covid third wave, the slower vaccination drive, significant increase in crude oil prices, geopolitical risks.

AAA PMS Performance