The average S&P500 company’s life duration has reduced from 90 years in 1935 to 18 years in the present, according to a Mckinsey study. The fast-changing dynamics make the world volatile, uncertain, complex, and ambiguous. That VUCA effect in turn brings challenges to the corporate world and forces the corporate to adapt, innovate and respond with agility. Constant changes in industry dynamics results in changes in corporate earnings, sectoral leadership, and the consequent weightages in the equity indices.

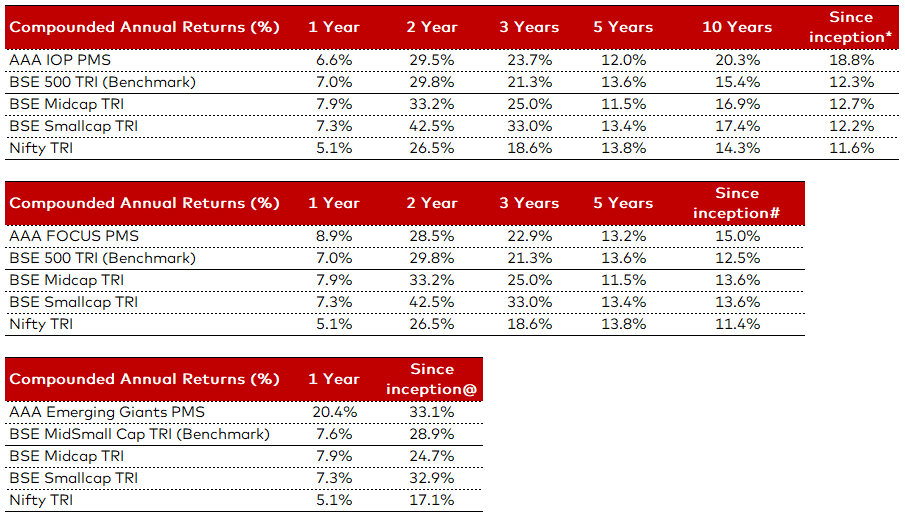

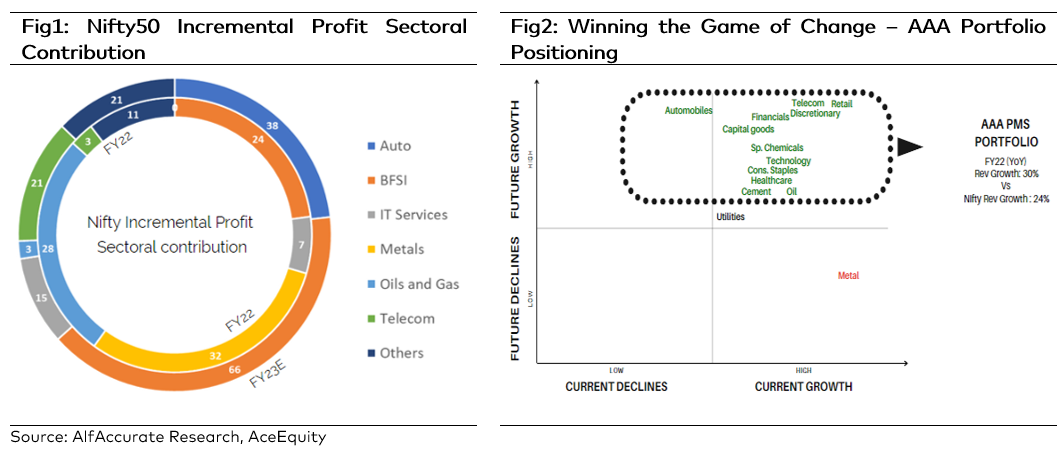

During FY22, Corporate India was impacted by the second wave of the pandemic, supply chain complexities, the Russia-Ukraine war, and higher raw material prices. However, as the economy normalises, FY23 is likely to see a reversal of such trends and improvement in demand causing significant changes in incremental contribution to Nifty earnings growth. For instance, metal, which made up 30% of Nifty’s incremental profit in FY22, is probably going to make a negative contribution in FY23. However, the auto sector is expected to make up 38% of Nifty’s incremental profit in FY23 (v/s negative contribution in FY22) (refer Fig1).

At AAA, we strongly believe that buying the best business is just one leg of a successful investment journey. It is extremely important to have the foresight to change the portfolio ahead of market dynamics to align it with future earnings growth. In Mar 2020, we increased our weight in pharma to 8%. Within 4-8 months of our purchase, most of our pharma companies witnessed sharp share price gains in the range of 40-60% driven by one-time high demand for covid-related drugs in the world markets. Then, we decided to trim the exposure as we could foresee a delay in US FDA approvals, pressure on domestic pharma business, increasing input cost, and unsustainability of covid-related demand. On the other hand, cyclical sectors like the banking and automobile sector’s valuations became attractive and we took that as an opportunity as structural growth drivers were intact, hence we increased weight in those sectors. Our disciplined exit strategy enabled us to capture the profit in the pharma sector and at the same time, it created space to buy the cyclical sectors at a high margin of safety.

Our assumptions on earnings growth proved right. Pharma sector profit growth reduced drastically to 19.8% in FY22 – and consequently, many pharma companies’ stock prices came down to two-year lows wiping out entire gains it witnessed during the Apr-Oct20 period.

The importance of exit strategy is under-appreciated and underrated but at AAA, we use it judiciously to meet our Investment Philosophy objective of protecting capital and Create Wealth.

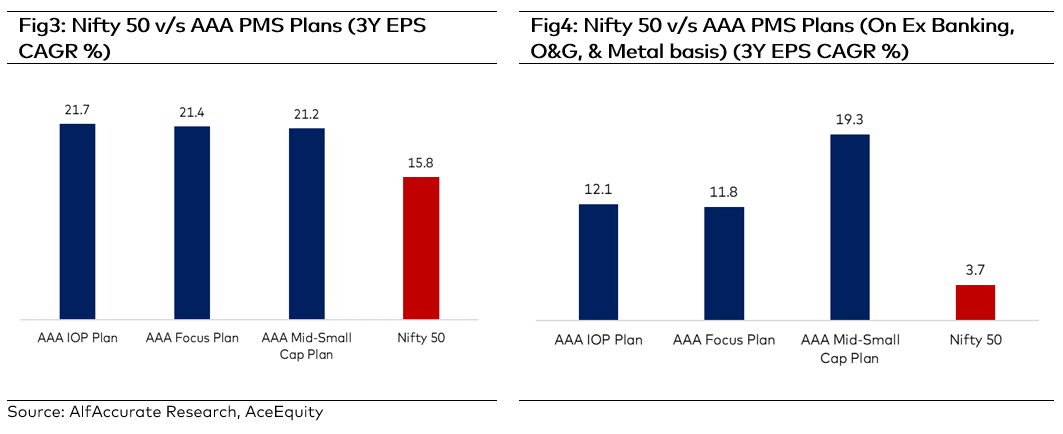

1QFY23 corporate India reported strong earnings growth not only compared to 1QFY22 (low base effect) but also when compared on a 3 years CAGR basis. During the same period, all our PMS plans reported strong earnings growth of about 21.4% on 3-year CAGR basis (v/s Nifty earning growth of 15.8%). Excluding Banking, Oil & Gas, and Metal, Nifty reported only 3.7% CAGR (3 Years Basis) against which our PMS plans (IOP and Focus) reported a solid 14.4% CAGR. Our Mid and Small cap PMS plan companies continued to grow at a faster pace as it delivered 19.3% CAGR. The impressive earnings performance is driven by gains in market share with improved profitability.

The markets have recovered sharply since its lows in Jun 22. Easing raw material prices and supply chain management as well as improving demand trends are key reasons for underlying optimism. We maintain our view that stock specific strategy will be more rewarding notwithstanding the higher volatility in the market.

AAA PMS Performance