Inflation, higher interest rates and recession fears continue on D-street. However, every cloud has a silver lining. The famous investor, Howard Marks says “The consensus opinion of market participants is baked into (current) market price. If you want to be above average, you have to depart from consensus behaviour. You have to do something different.” We think it is time to look beyond the clouds. While the Indian market volatility may continue, we believe that when pessimism permeates markets, positive surprises can be more powerful. We, at AAA, have identified five reasons that contribute to our upbeat perspective in this situation.

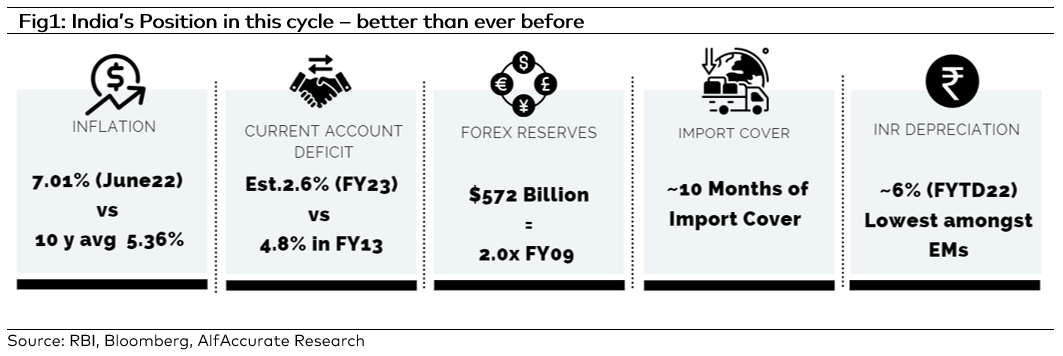

1) Resilient Macros

Compared to previous economic cycles, India is better placed in the current environment. The current account deficit estimate for 2022-23 (estimated at 2.6%) is about half of what it was in 2012-13 (4.8%). India’s forex reserves at USD 572 bn are almost 2.0x as compared to FY09. Forex reserves have more than doubled from the levels of 2008 to 2014 and the import cover is higher than that during 2012-19. Short term external debt remains manageable at 19% of forex reserves (32% during 2013-14). The result of these factors is the outstanding performance of INR compared to other emerging market currencies (only 5.5% depreciation against USD on FYTD22 basis). Indian macros are thus more resilient than ever before.

2) Reducing Inflationary Pressures

Upside risks to India’s inflation seem to be easing as global commodity prices have corrected amid concerns of a global slowdown and as domestic food price increases have began to moderate amid a global correction in edible oils and better domestic supply. With the recent inflation release of 7%, Q1FY23 CPI inflation undershot the RBI’s projection of 7.5% by 22bp. Easing supply-side pressures and cooling-off of global commodity prices may provide RBI with the necessary policy space to balance the growth-inflation trade-off better.

3) Strong Earnings Growth

Fast frequency data indicators reflect that the Indian economy is on a strong growth path. GST collections rose 28% YoY to nearly Rs 1.49 trillion in July – the second-highest mop-up since the rollout of the regime. In July, the Manufacturing PMI rose to 56.4 from 53.9 last month, thereby indicating significant gains in new business and output. Non-food credit grew 13.7% YoY in June 2022 indicating a revival in industrial credit. Government impetus to manufacturing, a leaner corporate India balance sheet, a cleaner bank balance sheet and revival of capex will bring strong earnings growth for corporate India. Nifty companies are estimated to grow earnings by ~15% CAGR over FY22-24 compared to 8.7% over FY08-22.

4) Discounted Valuations

Nifty currently trades at a 1 year forward PER of 18.9x which is 11%/3% lower than 5years/10years average. Nifty Valuations have corrected by nearly 15% from the peak PE of 22.2x in Sept2021. The major part of the correction is driven by a contraction in valuations rather than earnings. That provides an opportunity to investors to invest at lower valuations compared to the historical average.

5) Liquidity factor – Increasing Retail Participation

Indian households invest ~7% of financial assets in equities versus an average of ~30% for other major emerging markets. However, retail participation in equity is increasing at a fast pace. During the last 12 months, although the FIIs cumulatively sold US$53bn, strong inflow by retail investors led to domestic institutions buying USD$42.5bn. The growing importance of financial savings among Indian households, increase in financial literacy, awareness and education, strong distribution platforms, ease of transactions through digitisation and popularity of instruments like SIPs are expected to drive higher participation of domestic retail investors.

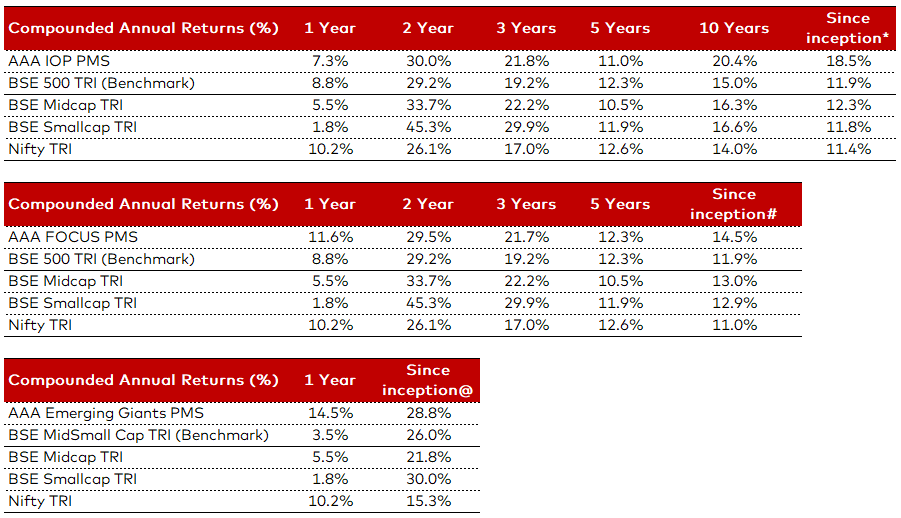

AAA PMS Performance