India is in an advantageous position amid global uncertainty. According to the Recession Probabilities Worldwide 2023 data, India has a 0% recession probability this year vs. 75% and 65% for UK and USA, respectively. Moreover, the political stability, rising public and private capex, focus on Make in India, and stable policy environment makes India a bright global market spot. Unlike the last twelve months, where macros were against the Indian economy characterized by higher commodity prices and volatility, the next twelve months are expected to be the opposite. Inflation is declining from its peak, and interest rates are most likely peaking in the current rate cycle. That makes the macro environment favorable, and we expect Corporate India to also benefit from it significantly. Our views get echoed in the recent J.P. Morgan 2023 India business leaders survey, where 94% of corporates anticipate an increase in capital spending, and 84% expect a profit rise in the year ahead.

Three C’s for FY24

Given the favourable macro situation for India, we identify three key themes that will drive earnings in the coming year:

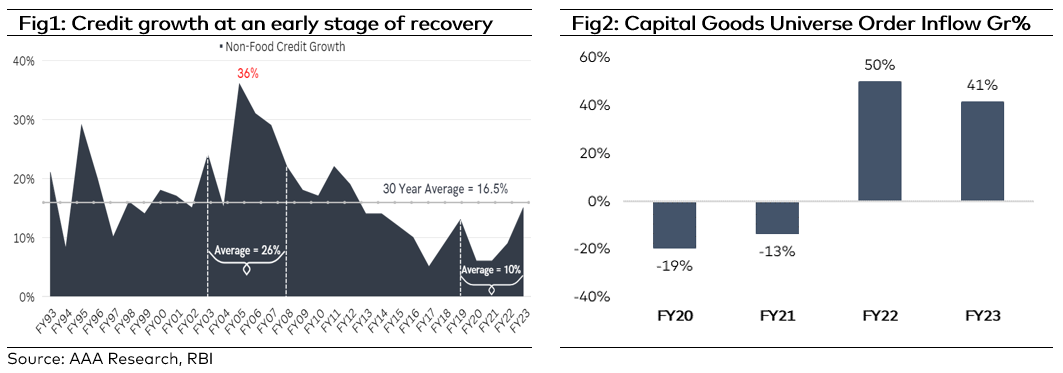

- Credit growth to remain strong

The Indian banking sector ended FY23 on a high note, led by robust traction in loan growth and a benign credit cost. Gross system credit growth improved to 15% (refer Fig 1) in FY23 – the highest in the last eleven years. Going into FY24, we expect continued momentum in loan growth led by improving rural demand, infra spending, and a general increase in corporate capital spending. SBI chairman Mr. Dinesh Khara in his latest results conference call echoes, “In the union budget for FY24, several steps have been announced to push up the capital investment in the country, which will actually boost the credit demand in the economy, and we expect the credit growth to continue in FY24 also, though with some moderation, which can perhaps happen. All in all, to paraphrase Mr. Uday Kotak, the Indian banking sector is in a state of Goldilocks. We are positive in the banking and finance sector and have exposure to companies with robust risk management and are rightly positioned to capture the growth opportunities in sub-segments of the industry.

- Capex to gather momentum

After a harsh winter of almost ten years, the Indian capital goods sector witnessed an acceleration in order inquiries in recent months. This is reflected in solid order intake growth for capital goods companies (Refer Fig 2). ABBs’ managing director’s recent comments on Indian capex cycles say it all: “We continue to see strong growth across most business areas in short-cycle business and that shows the width of business across Tier-1, Tier-2, Tier-3, and even Tier-4 cities. There is an overall growth in different market segments. Customers are investing in improving reliability, availability, maintainability, and serviceability of their assets. I think there the growth is quite robust and that really represents what’s happening in the country across because it is a secular growth, not coming from very large industries but it is coming across the cities, geographical distribution across the market segment, and also the category of the customers you have.” We continue to like this space and have built a portfolio of companies that are the biggest beneficiaries of new capex growth drivers like renewable energy, data centers, automation, and process efficiency.

- Consumption to revive

Rural consumption was clearly impacted by sharp price hikes in the last two years. With WPI cooling down from 14% to 1.5%, rural demand is beginning to revive. Improvement in MSSP prices, agri wages, and increased government spending is also helping in uplifting demand. According to the CEO of a leading FMCG company, “Looking at FMCG volume trends in this period, we believe the prospects of a sustained recovery have strengthened. After five quarters of volume decline, the sector has posted volume growth. Urban consumption has been steady, while rural is also showing some convincing signs of having bottomed out.” We are incrementally adding to this theme as the sector will witness improvement in volume growth coupled with improvement in gross margins due to softening of commodity prices.

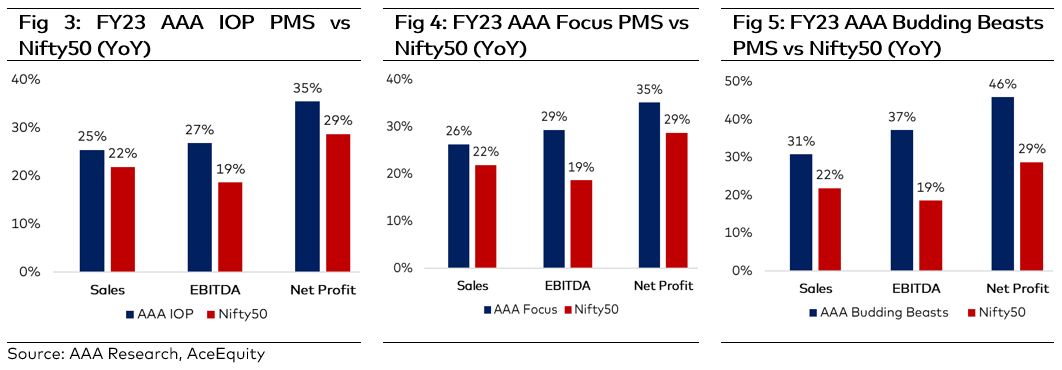

FY23 Results: AAA Portfolio Marching ahead

AAA Portfolio companies performed robustly in FY23, outperforming Nifty on all fronts (Refer Fig 3-5). Avoiding the noise on macro and focusing on bottom-up stock picking has been critical for such strong performance.

Market Outlook

Equity markets have now broadly recovered from the tumult in March. India’s resilience in the uncertain macro world is helping turn even global investor confidence leading to FII inflows. We remain constructive on Indian equity markets and expect Indian equity asset class to deliver strong returns over the long term. We continue to remain disciplined by focusing our attention squarely on only the most competitively advantaged growth companies that meet our guardrails. We will also remain agile to take advantage of short-term share price dislocations to capitalise on the opportunities.

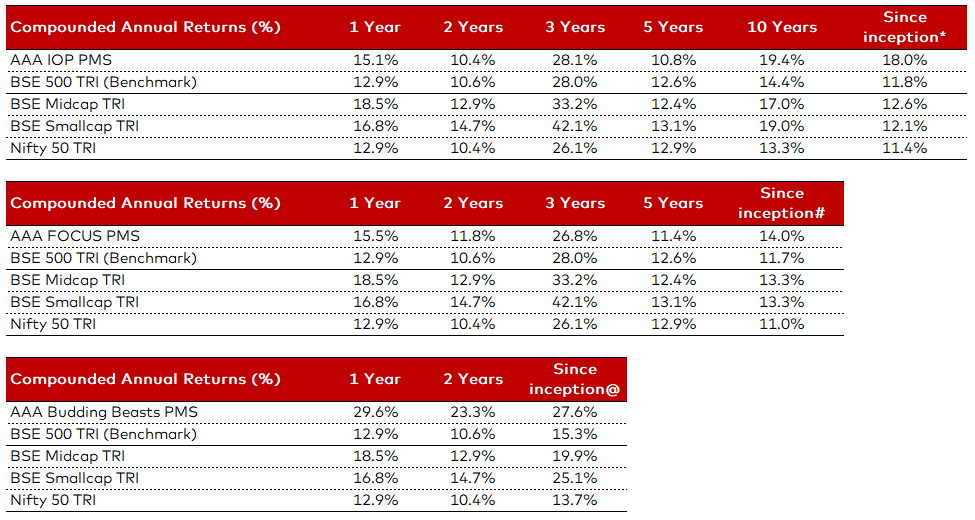

AAA PMS Performance