“After hard work, the biggest determinant is being in the right place at the right time”, says Michael Bloomberg. In hindsight, it does seem like the perfect determinant for superior investment returns. For instance, if you stuck with Silicon Valley Bank’s stock in the previous quarter, I’m sure that you would not have been very pleased. Hence, when it comes to investments, where an investor’s emotions take over an investor’s rational mindset, it is not very easy to be in the right place at the right time. We believe in two factors that can position an investor’s portfolio well to avoid such regrets – Quality and Agility, which we coined together – “QuAgility”. In such fast-paced market environments, QuAgility is the need of the hour, which not only focuses on the ship (portfolio) sailing in the right direction but also tries to maximise safety from the choppy waters (risk management).

AAA’s Quality: Quantified

Amid the value vs growth debate, we believe that the quality of companies and subsequently, the portfolio, is of paramount importance in such a volatile business environment. After all, it is only the long-term survivors who get a chance to thrive.

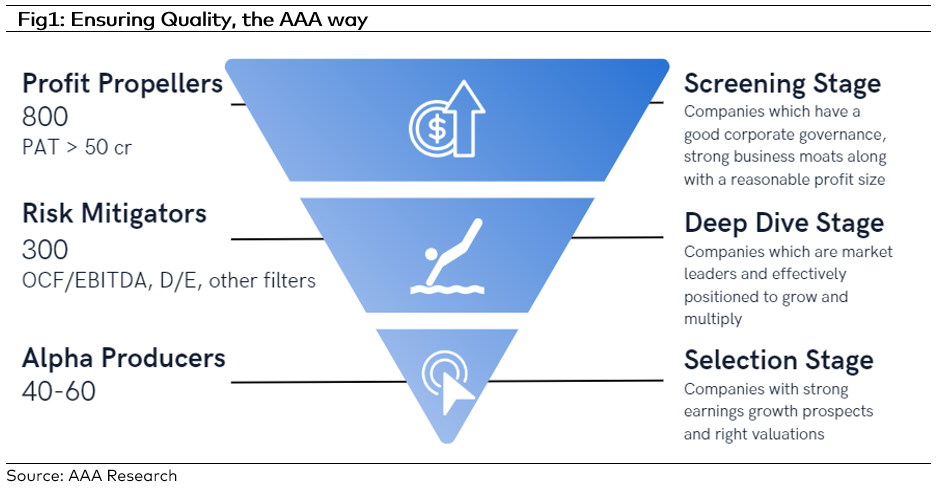

At AAA, on top of our 3M (Market Size, Market Share, Margin of Safety) Investment framework for stock selection, we use a three-step method to narrow down the pool of quality companies that are investable, ensuring a high likelihood of winners in the portfolio. As a part of our primary screening, companies that can generate a respectable profit of Rs. 50 crores and above are listed out. Only 800 of India’s over 5000 listed companies make it to that mark. These businesses are better able to withstand the ups and downs of the business cycle. These “profit propellers,” as we like to refer to them, are then subjected to risk mitigation filters of cash flow generation capability and balance sheet strength which further narrows down the universe to ~300 companies. Companies that are anticipated to show significant earnings growth and are available at the right valuations are then further put through forensic and longevity assessment to get to a portfolio of AAA Alpha Producers.

This meticulous approach ensures that the final AAA Portfolio has a strong balance sheet, the capacity to continue generating profits and cashflows, and a lower risk of unexpected surprises. For instance, 93% of the AAA IOP Portfolio has above Rs. 100 crores in PAT and 95% of the Portfolio has a debt-to-equity ratio of less than 1x. In FY22, the total portfolio generated 17% ROE, compared to 14% for the Nifty50 index, and it delivered a strong 35.6% earnings per share growth. Thus, such quality of investments resulted in exceptional performance during market dislocations.

Why Agility

Corporate profitability cycles are getting more dynamic as the corporate world is transforming quickly at an unprecedented pace. According to a study conducted by McKinsey, the average longevity of a firm listed on the S&P 500 has decreased from 90 years in 1935 to just over 18 years today. This proves one thing – the only constant is change.

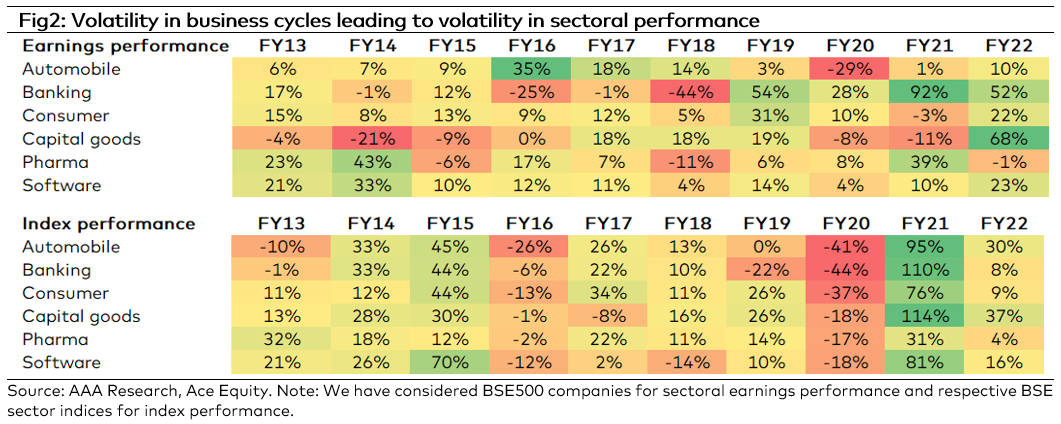

As one can see below, every business goes through a cycle. In fact, during the last ten years, there is not a single sector which reported 10%+ earnings growth every year. Even sectors like consumer and pharma reported subpar earnings growth of 10% during 40% and 60% of the time in the last decade, respectively. The volatility in business cycles has resulted in distinctive performance for different sectors over different periods of time. For instance, Automobile’s poor earnings performance of -29% during the pandemic resulted in a massive correction in the Automobile index, as it was down 41% over a year. The IL & FS banking crisis hit the banking sector’s profits hard, and investors were quick to send the index tumbling by 22% in FY19. Thus, it is important to be vigilant and agile in order to create wealth during the upturn of the cycle and protect capital during the downturn of the sector. Therefore, at AAA, we try our best to be agile and never let our guard down.

AAA’s Agility: Quantified

Amidst the series of unprecedented events in the last three years, we have navigated investor portfolios by remaining agile and taking portfolio actions swiftly whenever necessary. We follow a defined exit strategy to keep aligning ourselves with changing business scenarios. Companies that no longer meet our investment criteria, valuation metrices, or earnings expectations are immediately subjected to a formal review and action. The problem areas are thus identified and the course is corrected within no time.

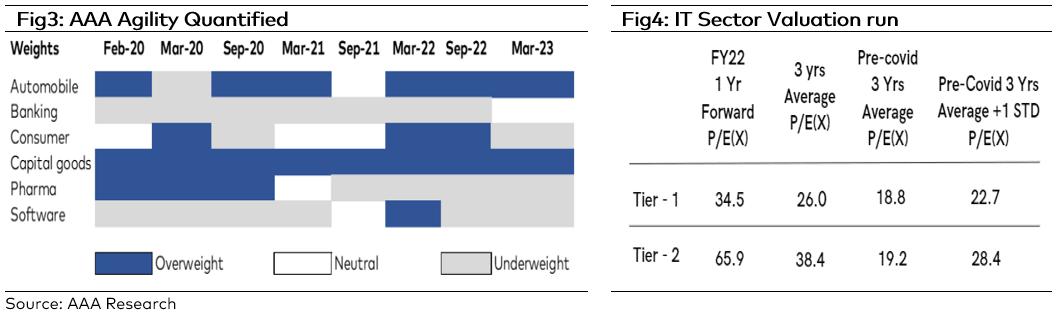

During the covid period of locking and unlocking, corporates were forced to accelerate spending on digital to ensure business continuity. This resulted in a flurry of orders for cloud migration, system upgradation, and website development among others. What followed was a record year for Indian IT with over 80% IT index return. While profit growth was healthy at 23%, majority of returns came from valuation re-rating which pushed multiples to record highs. Identifying this worrying trend, we avoided over-exposing ourselves to this sector and were thus saved from the massive drawdown that followed. Additionally, we were alert and quick enough to identify pharma sector’s growth prospects, right before the onset of Covid-19, due to our holistic analytical approach of the global economy. Thus, as seen in figure 3, we were overweight in the pharma sector from Feb’ 20 to Sep’ 20. Upon identifying certain signs indicating future growth concerns, we gradually reduced our exposure to pharma over time. This proved to be fruitful for our investors, as the Pharma sector underwent a massive correction. More importantly, we remained invested in companies which we believed were of high investment quality, and thus, refrained from taking part in the broader momentum-based pharma rally, which helped us in managing event risk in a systematic manner.

Our QuAgility has brought us many success stories over the course of our journey in the last 13 years. True to our investment philosophy of “Protect Capital, Create Wealth”, we were able to capture the upside while avoiding drawdowns and protecting investor returns when the cycles turned. Notable success stories for us over the past decade have been Motherson Sumi (6x return), Dixon Technologies (3.8x return), Honeywell Automation (7.4x), and several others.

Market Outlook

The 4QFY23 earnings season has started on a mixed note, with the banking sector reporting solid results driven by improvement in credit growth and low credit cost while IT companies reporting disappointing results resulting in downgrades. Auto and cement sectors reported better margins due to softening in commodity prices.

We remain positive on the markets as the macro environment is supportive – normal monsoon, benign commodity prices, and a revival in capex. Moreover, on valuations, Indian equities are trading below mean levels relative to long-term averages, providing comfort. We remain focused on owning companies with competitive advantages and are on a constant lookout for quality bottom-up opportunities.

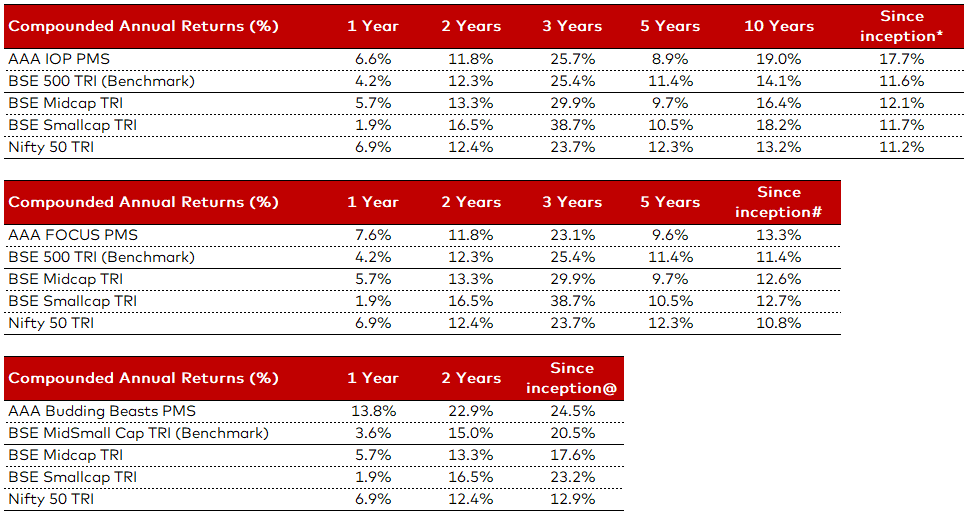

AAA PMS Performance