Global:

- Economic re-openings are leading to fears of a second wave of COVID-19 infections as several states in the U.S. are reporting rising.

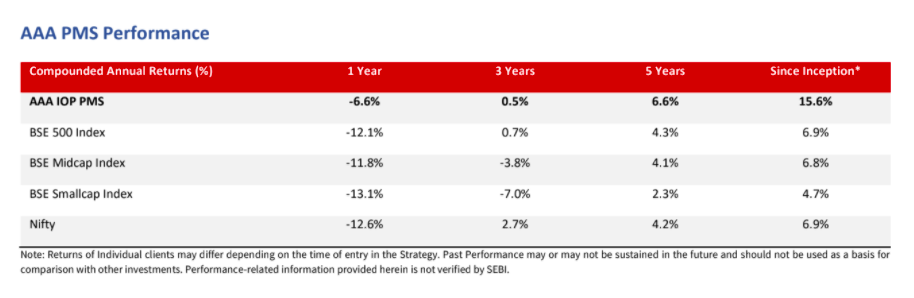

- However, on the other hand, policy support remains enormous and is likely to increase further – The White House is considering additional fiscal stimulus with a $1 trillion infrastructure program.

- Meanwhile, the pandemic is well under control in China, East Asia and Europe.

- There is evidence of improving business conditions in China as both PMI manufacturing and PMI nonmanufacturing are at pre Covid-19 levels (Exhibit 1). Even EUROZONE manufacturing PMI improved from low of 33.4 to 47.4 (almost near to Jan20 levels) (Exhibit 1).

Earnings Outlook:

Post wash out April, India is slowly witnessing recovery as per high frequency data indicators.

o Electricity consumption gap narrowed from 22% to 6% over the week ending 24 June.

o Railways – daily avg. of freight loaded in Jun20 was close to 90% of FY19 average and 92% of Jun19 level o Google mobility data shows that time at grocery stores is back to pre-Covid level.

o Daily payment data showed that daily average UPI transaction value in Jun at an all-time high; o Daily average number of e-waybills generated between Jun 8-14 was 82% of daily average for FY20. o Property registration numbers in Maharashtra for Jun are ~75% of FY20 average.

o Domestic flights were 24% of pre Covid levels in terms of no. of flights & 17% in terms of passenger carried .

o Unemployment level as estimated by CMIE survey has dropped from a peak of 27% to 11%.

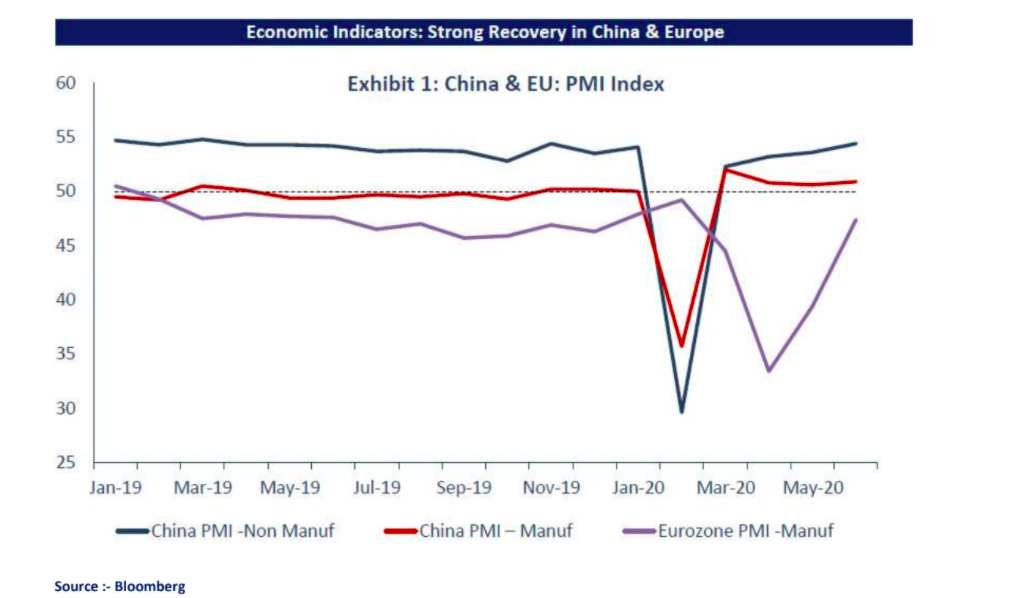

Portfolio Positioning: The commentary by most corporate suggest that corporate India will come back to normalcy by 3Q/4QFY21 depending upon its sector. While healthcare, consumer, agri-input, chemical and 2wheeler companies are expected to recover fast, cyclical sectors like CV, cement, engineering are expected to recover little later. We expect market share of leaders with strong balance sheet to improve further as players with weak balance sheet find extremely difficult to survive. Industries like retail, pipes, airlines are already witnessing such trends. In our portfolio, we hold companies which enjoys undisputed leadership with superior ROCE and zero/low leverage compared to its industry average. We have given few examples in Exhibit 2.

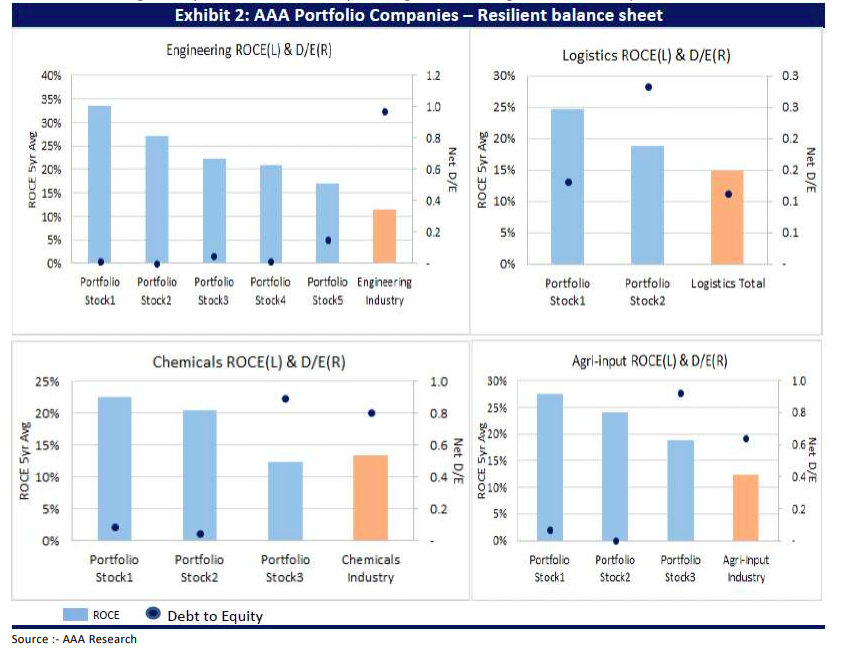

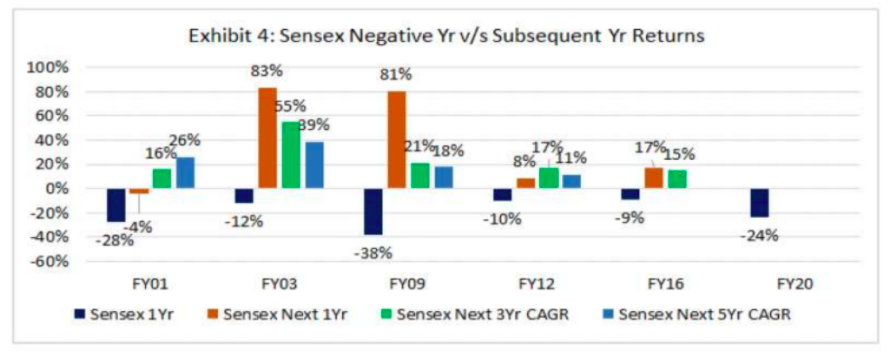

Further, our portfolio companies are preferred choice for global customers to capture India sourcing movement (vs China) – in sectors like pharma, electronics, agro chemical and speciality chemical. These companies have proven competence, did significant capex during last few years and has also strong cash flows for further expansion. As that capex comes on stream, market share and ROCE of companies will improve further from current levels. Hence, our portfolio companies are at an advantageous position to deliver superior earnings growth over next 3-5 years compared to the industry. During last 20 years, Sensex gave negative returns in 6 times on 1 year basis. Sharp fall in one particular year makes 3/5 year CAGR returns negative (Exhibit 3). However, However, if one invests during such time then subsequent 3/5 year CAGR returns can be very strong (Exhibit 4). Hence, such decline should be used as an opportunity.

Risk factors: USA presidential election, Second wave of Covid-19