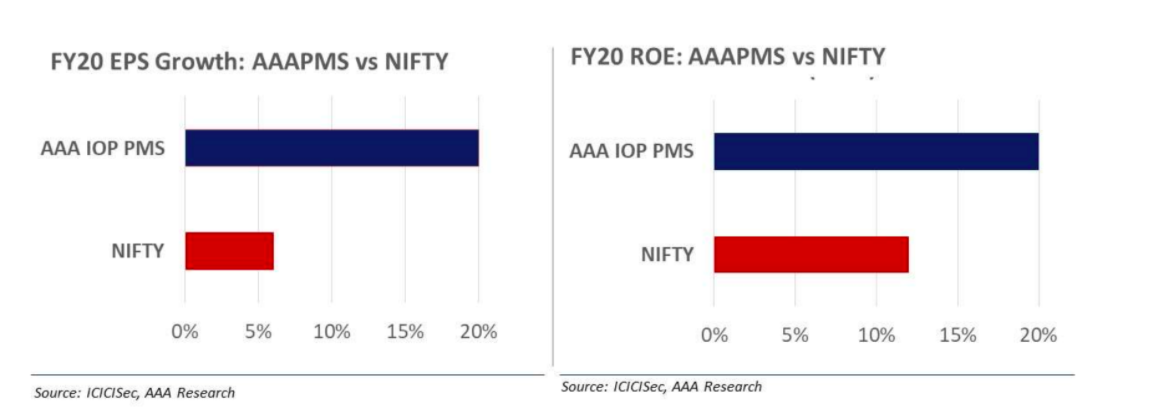

FY20 was a challenging year for corporate India as pandemic hit the country in March. This usually being one of the best month resulted in a significant dent in corporate India earnings. In 4QFY20, Nifty reported revenue de-growth of 5% and profit de-growth of ~20%. For full financial year (FY20), Nifty reported flat revenue & Operating profit and PBT de-growth of 9%. Lower income tax rate resulted in PAT growth of ~6%. Under those circumstances, AAAPMS companies reported strong revenue/EBITDA/PBT growth of 9%/15%/12%. Our portfolio reported PAT growth of 20% – significantly better than the aggregate corporate India. Importantly, AAAPMS reported ROE of 20% compared to NIFTY ROE of ~12% – validating our thesis of 3M Investment stock selection approach.

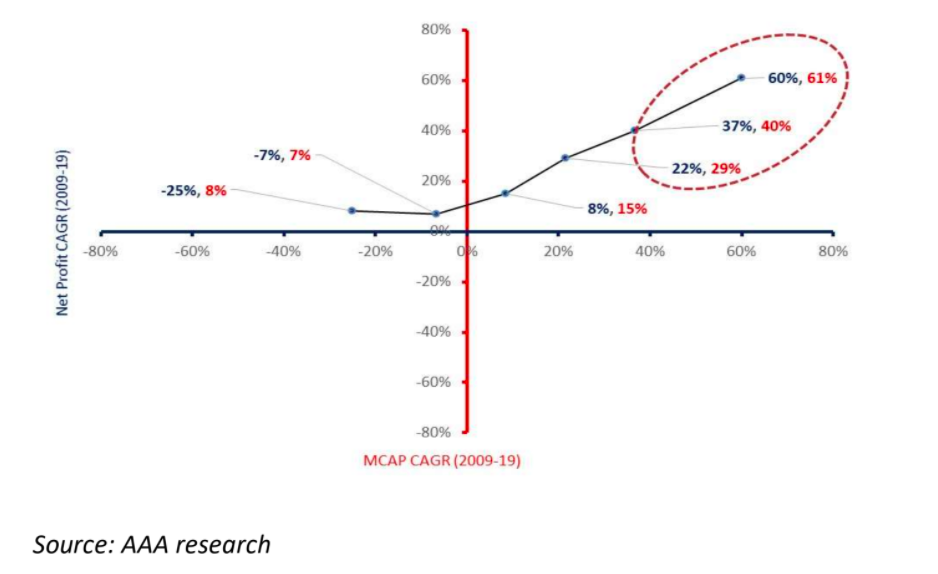

Market Cap Growth Mirrors Earnings Growth in long term

Earnings growth is a critical factor for stock price returns as in the long term market is a mirror of earnings growth. During FY09-19, companies that reported 22%/37%/60% net profit CAGR reported 29%/40%/61% CAGR in its market cap and companies which reported negative earnings CAGR reported lower market cap CAGR (see chart below).

Leadership character differentiates Men vs Boys

Nifty has moved up sharply from low of 7600 to ~11000 levels +48% in just 120 days. There is a common question by investors – why equity market is doing well when underlying economy is still going through slowdown? The answer is – equity market is always forward looking. Importantly, while we agree that economy is expected to take few quarters before it reaches normalcy, Economic Power of sectoral Leaders is increasingly moving up. The classic example is – Britannia Industries (our portfolio holding) -“the largest player in biscuit industry has reported 26% revenue growth and 100% profit growth. Similarly, HDFC Bank reported industry leading 20%+ loan growth. Story is same across our portfolio holdings in various sectors like telecom, consumer, cement, auto, etc. We expect the formalisation process which started from demonetisation has accelerated further with GST and ILFS credit crisis but with Covid19 crisis, even organised players with heavy debt on balance sheet will find it extremely difficult to survive/expand.

Our investment approach of investing in companies which are Market Leaders with Strong Balance sheet will not only enable the companies to navigate the downturn but will also help it to capitalise on upturn when economy revives. Our portfolio companies have Zero/low leverage and strong cash flows. Many of our portfolio companies in manufacturing segment have done significant capital expenditure during last three years and will continue to invest to capture the future growth. For instance, our chemical and healthcare companies have spent ~70% and ~74% of their operating cash flows in last 3 years. They are rightly positioned in China+1 strategy to attract the global customers as they have competence and proven track record of execution.

Market outlook

EU lawmakers approved a 750 billion-euro ($870 billion) fund to combat the devastating economic effects of the pandemic. It’s also laden with hopes for the birth of a new, fiscally-integrated bloc As a result, Italian yields rallied, taking the 10-year back below 1% and narrowing the gap to their German peers to pre-crisis levels. The US Federal Reserve (FED) kept interest rates near zero and policymaking committee noted that economic activity and employment have “picked up somewhat” but added that conditions were still considerably worse than before the pandemic which implies continued support from both monetary and fiscal policy.

In recent 1QFY21, corporate India has positively surprised the street by showing significantly better operating margins compared to the street estimate. Reduction in travel, advertisement, sales and rental expense are the major heads where corporate India reduced the spend. Most corporates mentioned demand revival in Jun and expect normalcy over coming quarters. While we remain positive on market, we do not rule out short term correction – indeed, correction would be healthy for the market and we will use such opportunity to deploy cash.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.