We are living through an unprecedented time in history, marked by geopolitical tensions, high inflation, fear of stagflation, highly volatile and unpredictable financial markets, and the end of a 40-year period of declining interest rates in the United States. Despite these challenges, our team remains optimistic about the investing environment for several reasons. First, India’s corporate earnings growth is expected to remain strong over the next two to three years. Second, earnings growth is expected to be the driving force of equity markets, as opposed to the expansion of multiples – a welcome return to fundamentals. Third, despite the USA nearing a recession, India is in much better shape and well-positioned. We believe that the correction in the market is necessary and healthy. What does this mean for investors? Maintaining a diversified equity portfolio makes sense in any environment, but particularly this one. Earlier this year, we cautioned investors to prepare for volatility and advised them to remain focused on the quality of the portfolio. Market volatility has returned, but that’s not a reason to be discouraged. We continue to believe that a diversified portfolio with the right stock selection is the best recipe to navigate the rough waters and will reward investors in the long term.

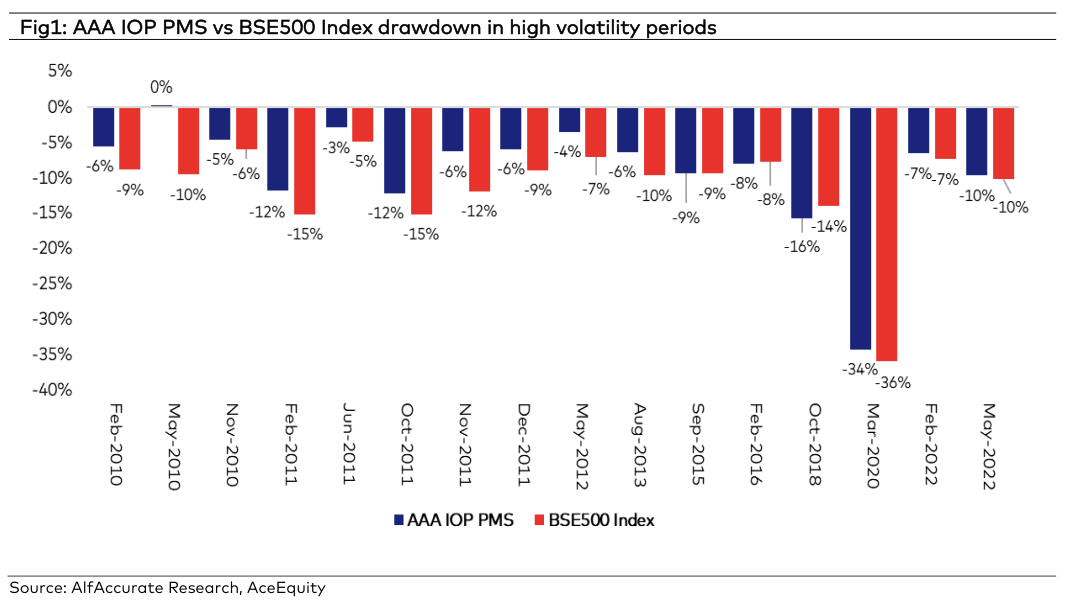

AAA IOP wins over the volatility in the past periods

Back in 2009, we launched the AAA IOP PMS plan, a multi-cap PMS plan which invests in about 50 companies carefully selected by applying our resilient 3M Investment approach. During the last 12 years, there were 19 episodes when volatility in the market, as measured by the VIX index registered sharp increases (above 20). Correspondingly, the market registered declines in the range of -5% to -35% during a staggering 16 times out of 19. However, due to the right stock selection and diversified investment approach, our flagship AAA IOP PMS plan did better than the market 14 out of the 16 times. On a median basis, AAA IOP PMS outperformed the BSE500 Index by 2.5% during such volatile periods. This time too, our team continues to persevere to insulate your portfolio.

Diversification helps to manage the unsystematic risk

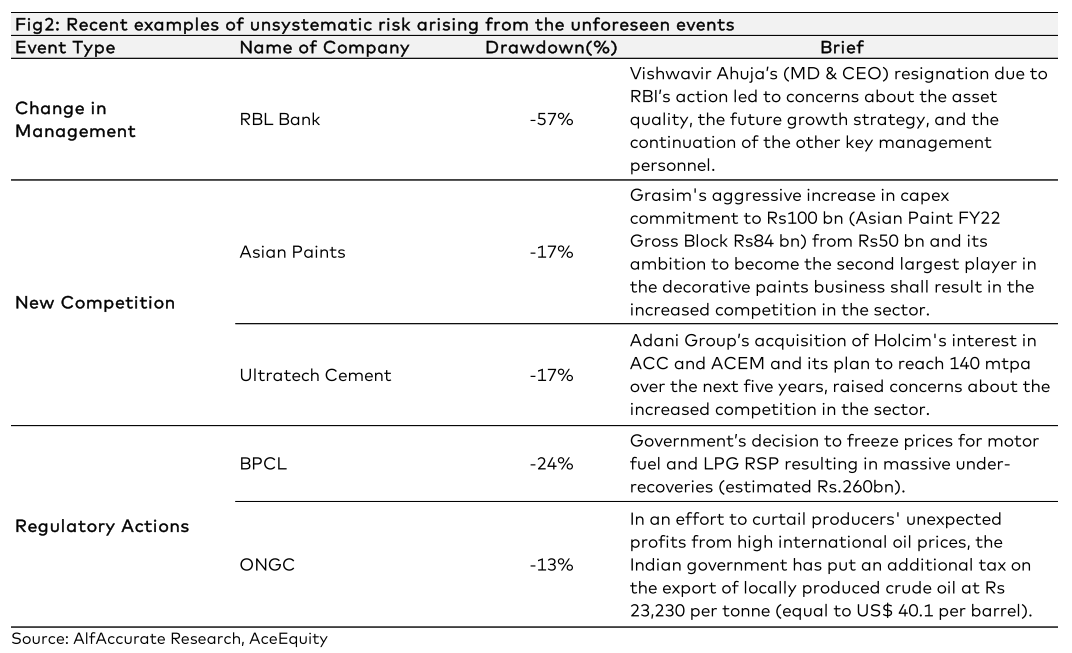

There is no secret sauce to manage risks and navigate volatility. Investors are often so enthralled in the macros, that the basics are overlooked at times. Our approach at AAA is simple. To manage volatility, one needs to reduce the unsystematic risk and diversification is an important tool we can use to do it. During the last 12 months, there are many incidents experienced by corporate India which unfolded the risks of concentration in the portfolio. For instance, supply chain shortages resulted in a significant cost push in the automobile industry. Similarly, rising energy costs adversely impacted the cement sector significantly. High concentration and investment holdings in one particular sector would have meant significant damage to overall portfolio returns. However, our sectoral cap on exposure resulted in a much lesser impact on the performance and thus, a lesser turbulent investment journey for our clients.

The greatest risk to any portfolio is the risk of the unknown – the risk which can emanate from unforeseen events like sudden changes in management or risks posed by regulatory changes, the risks of the ever-changing industry dynamics. We have highlighted below the important events faced by corporate India during recent times. In each of the examples below, the stocks have witnessed sharp falls (refer to Fig2) resulting in significant damage to investor wealth. At AAA, our diversified portfolio across 50 companies limits the damage to the portfolio returns ensuring resilient risk management, which leads to superior risk-adjusted returns.

Note: AAA IOP PMS has no exposure to these names, except ~2% exposure in Asian Paints.

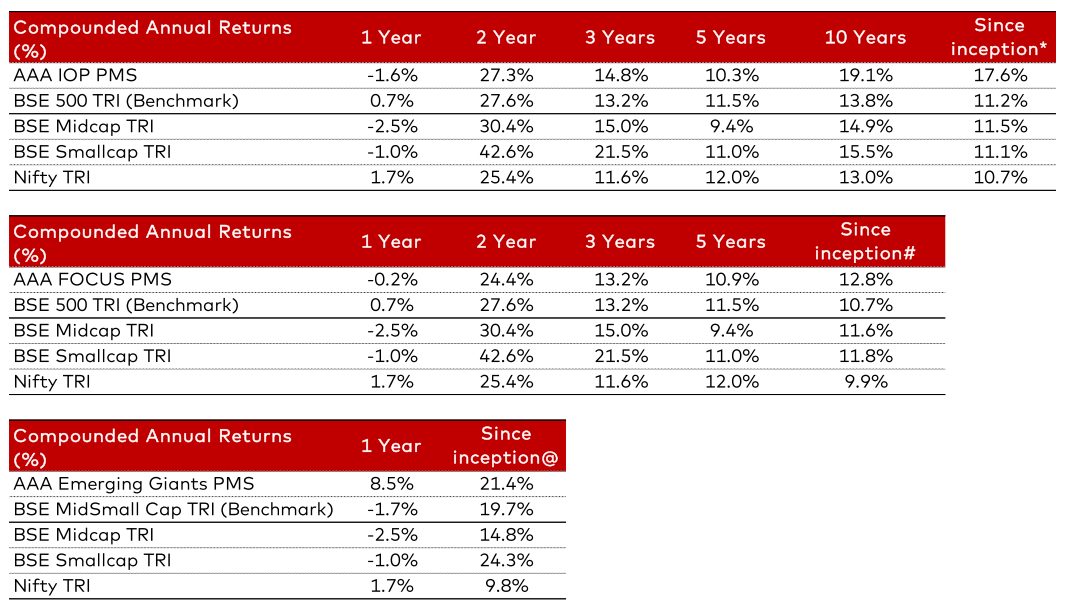

AAA PMS Performance