In FY22, India hit a major milestone of merchandise exports of over USD400bn for the first time. This is a strong 44% higher than FY21 and a full 27% higher than the pre-pandemic year of FY19. In our Oct 2021 Insights (link), we highlighted that the growing trend of China+1 and PLI will improve the manufacturing opportunity for India. We believe the recent export performance is the first sign of India’s increasing role in world trade. Corporate India’s exports are at an inflection point and incrementally from here, PLI incentive will further drive the growth and establish India’s dominance in global trade.

Exports: How do the numbers stack up

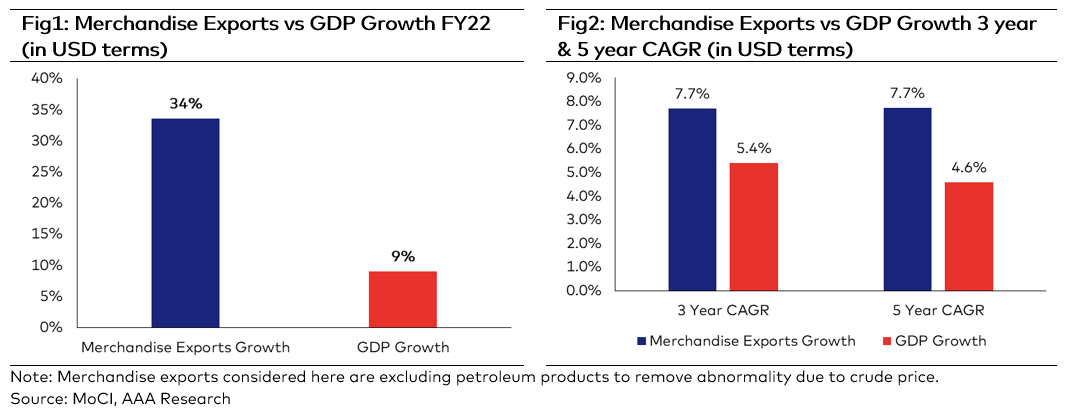

Merchandise exports (excluding petroleum) outgrew GDP growth significantly over last year (34% vs 9%). Even on a 3-year and 5-year CAGR basis, exports have done better than GDP growth during the same period (refer to Figure 1 & 2). The sharp rise in exports in FY22 was led by Engineering goods (46.5%), Electronics (42%), Ready-made garments (31%), and Chemicals (20%). All in all, the quality of exports is improving with more share of exports from high value additive segments.

Changing World Order:

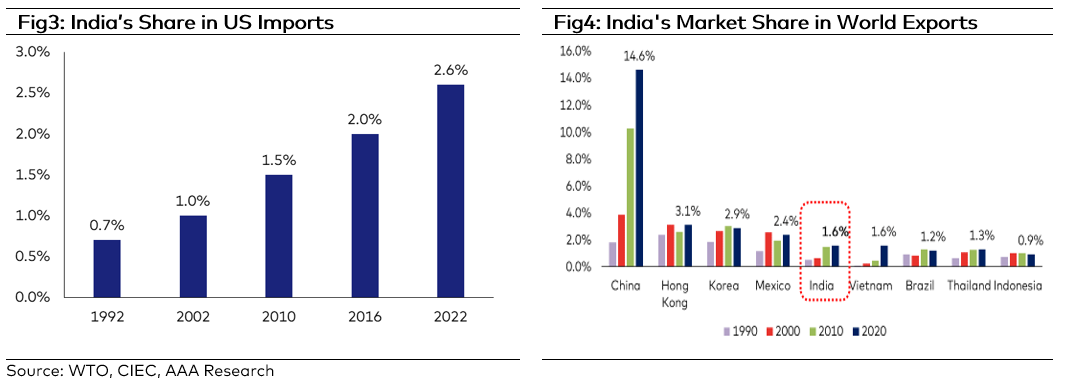

The world is shifting its global procurement preferences to diversify its dependence on China following the outbreak of the COVID-19 virus. India is rising to the occasion to take a higher incremental share. The US is India’s biggest trade partner since 1991. India’s share of total US imports has more than doubled to 2.6% in FY22 from 1% in 2002 (Refer Fig3). Shipments to the U.S. are up 49% in FY22. Australia, which is in the midst of a shrill trade battle with China, has made way for India, taking exports up 106% so far this year.

Further, India has inked landmark Free Trade Agreements (FTA) with Australia and UAE in the last 2 months. These FTAs allow 85% of goods exported to these countries at minimal duties. Additionally, negotiations with EU, UK, and Canada have also accelerated. Such agreements make access to large markets easier and give a big boost to exporting companies.

The Indian Government has thus taken the target of taking India’s merchandise exports to USD 1trillion by 2030 from USD 418bn in 2022 (11.5% CAGR). Several major and minor steps have been taken to incentivise and promote exports including trade agreements for favourable duties, PLI incentives to help be cost competitive, improving infrastructure (port, rail, road, electricity, industrial gas pipeline), tax incentives for new manufacturing set-ups, etc. These steps will help improve India’s market share in world exports which is currently significantly lower when compared with its Asian peers (refer Fig4).

AAA Portfolio Strategy: Capitalise on Export Opportunity

AAA portfolio companies are sectoral leaders in India with cost leadership, technical capability, long standing customer relationships, and proven reliability in cost and delivery. Many of them are truly the globally competitive and hence natural first choice for global OEMs looking for reliable sourcing partners. For instance, Navin Fluorine is a strong candidate for incremental orders from global majors in the ‘Plus One’ theme. In Feb2020 The company bagged a ₹2,900-crore multi-year export order from Honeywell Corporation and further similar size projects are at various stages of discussion. Schaeffler India has been selected as a manufacturing hub for certain products by its parent for exports to group entities across the world. KSB Pump has witnessed its 27% export growth in CY21 resulting in export contributing to 20% of revenue in CY21 vs 14% in CY14.

Thus, the rising export opportunities will enable our portfolio companies to expand the 2Ms (Market Size and Market Share) of our 3M Investment Approach and in the process, will further boost their earnings growth.

Market Outlook

Undoubtedly, high inflation and tightening monetary policy by US FED are causing volatility in the global markets. However, India is passing through an interesting phase. Record GST collection in April, strong growth in e-way bills, higher tax collection, PLI support by the government, and strong corporate balance sheet are important positive data points. While 4QFY22/1QFY23 results are likely to be under pressure due to rising inflation, we believe, Corporate India has improved its resilience significantly during the last few years. We continue to believe that market will remain volatile and advise investors to take volatility to their advantage.

Key Risks: Supply chain disruptions, faster than expected monetary tightening, geopolitical risks.

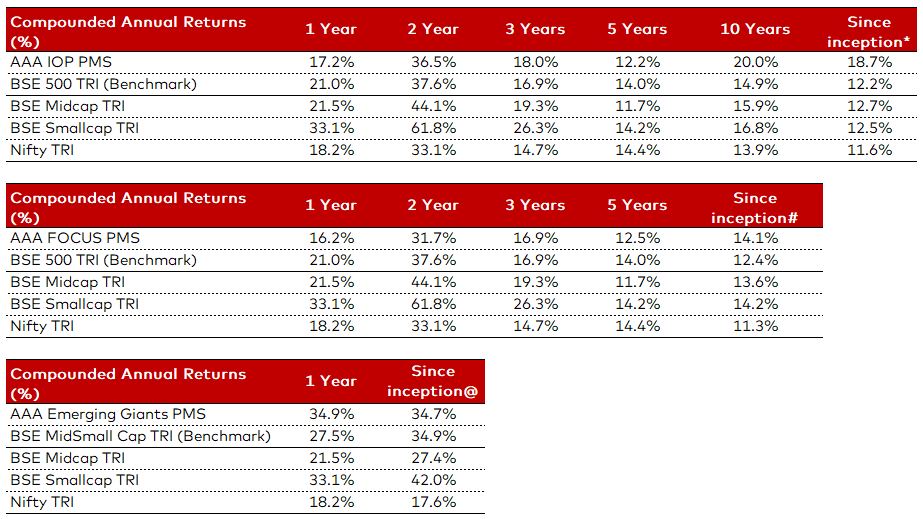

AAA PMS Performance