During the last nine months, most investors’ concerns are centered around the impact of rising inflation and surging interest rates on the equity market. As inflation spiked from 1% to 8.5% in the USA, central banks’ singular focus to curb inflation resulted in Fed raising interest rates from 1% to 4.0%. Markets are grappling with the worsening trade-off policymakers face between growth and inflation Consequently, we come across a litany of gloom on GDP, earnings, valuations, employment, etc. While they are important data points for the economy, the crucial question for equity investors is how to interpret these numbers and what action should one take. Should one wait for a better GDP growth print? That dilemma of investing today vs investing tomorrow is the most discussed topic we experienced from our investors despite India facing lesser issues and being reasonably resilient in the current global macro sell-off.

Stock Market is not equal to Economy

To find an answer, we studied the market behaviour of United States equity market (we selected the US as that is the most developed market with tons of data published on a daily/weekly basis).

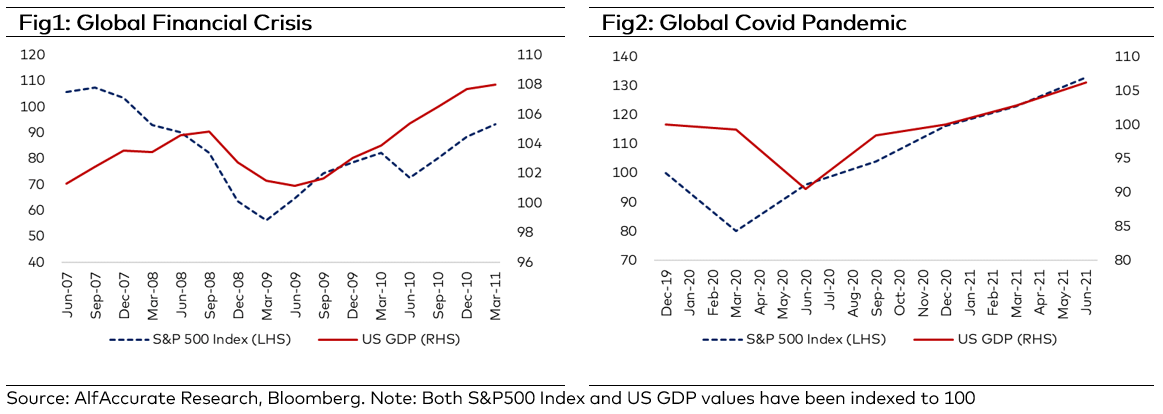

During the 2009 Global financial crisis, the worst GDP print of -3.3% came in Jun 2009 but S&P 500 Index made a bottom in March 2009 – nearly 3 months ahead of the worst economic print. You will observe the same pattern during the recent pandemic crisis when the US GDP registered a decline of 7.7% in Jun 2020 and S&P 500 Index made a bottom in March 2020 – again ahead of the economy. If one analyses the 40 years of data, we would get many similar patterns.

The reason for such pattern is that the stock market is forward looking. The price you are willing to pay for a stock today is based on how well you and other investors expect the company to do in the future. By contrast, economic data looks at what has already happened. Because of this, when the initial signs of economic slowdown begin, worry pushes investors to selling as they look to exit at a good price rather than ride out the bottom. Subsequently, as economic indicators start to worsen, market tends to fall more and continues to remain volatile. At some point in this period, stock market recovery begins while economy is still in recession and media headlines are negative. During this period, many investors hesitate to invest even as market begins to recover while continuing to look at lagging bad economic data. They thus miss out investing at favourable valuations.

The conclusion is: Equities generally bottom ahead of Fundamentals economies and investors should patiently keep investing during the volatile period to take advantage of opportunities.

Earnings growth more reliable indicator

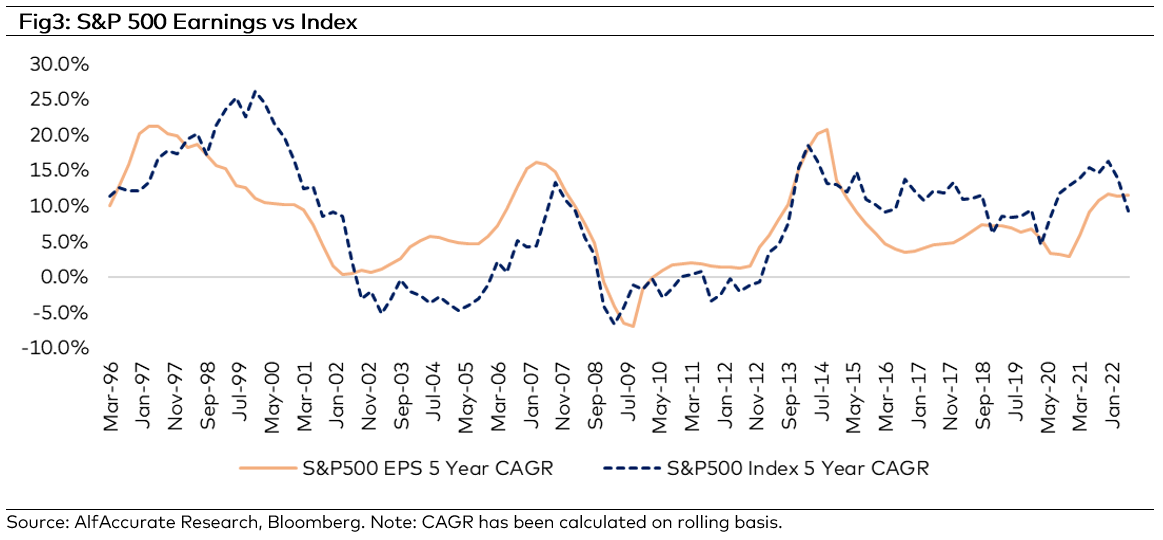

Instead of economic metrics, it is the long-term earnings growth which determines market returns and, importantly, portfolio returns. If one studies, S&P 500 Index, during the last 30 years, S&P 500 Index earnings grew at a CAGR of 8.8% and S&P 500 Index also delivered similar 8.5% CAGR returns (refer Fig3) with a strong correlation of 94%.

AAA PMS Strategy – strong focus on high quality earnings growth

At AlfAccurate, our equity team believes that the best way to preserve and grow client assets is by investing in competitively-advantaged companies that have the potential to deliver continuous and robust earnings growth under any economic environment. In challenging periods like these, we believe the strong get stronger. In other words, we believe that businesses with robust balance sheets that can self-fund growth are poised to withstand a potential recession, maintain resilience and gain market share while their competitors retreat. Our portfolio companies’ characteristics of the market dominance, under-leveraged balance sheets, and 18%+ earnings growth truly reflect our robust stock selection process.

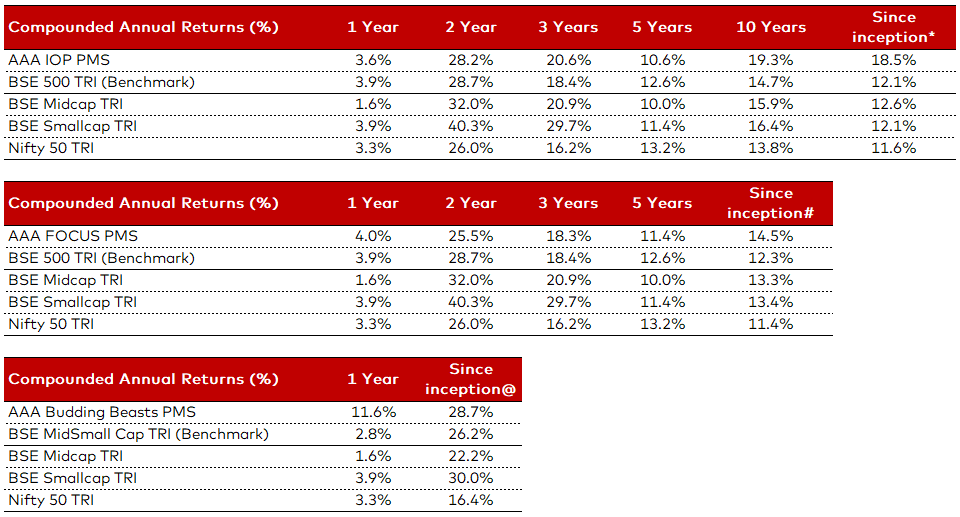

AAA PMS Performance