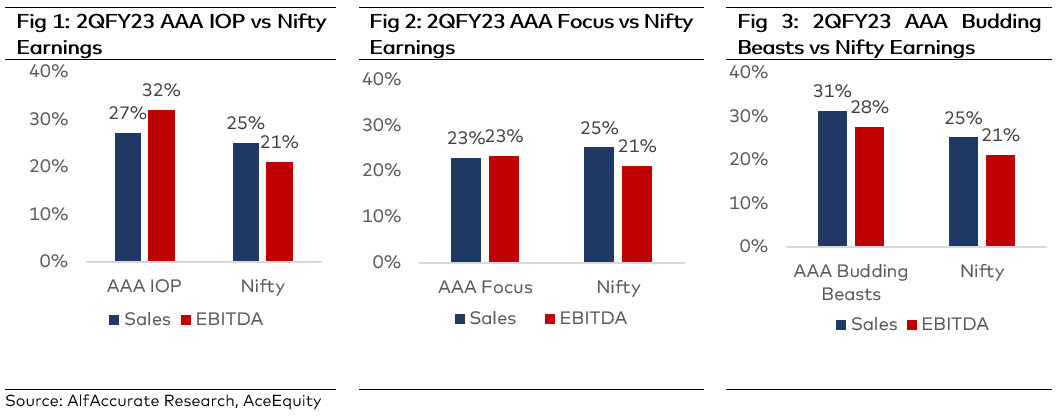

The AAA portfolio delivered robust sales and EBITDA growth during 2QFY23. The strong performance was due to a combination of factors – the right sectoral allocation as well as the right stock selection within the sectors. We were early in identifying three sectors – capital goods, automobile, and specialty chemicals. In capital goods, the AAA portfolio not only registered revenue and EBITDA growth but also witnessed order-inflow growth of more than 20%, marking the third consecutive quarter of strong performance. This not only offers future revenue visibility but also reflects the underlying trends in the economy. In the automobile sector, our preference to play the sector through passenger vehicle (PV), commercial vehicle (CV), and auto ancillaries and avoiding direct exposure to two-wheelers (2W) OEM segment worked well. The difference was stark as PV and CV registered volume growth of 38% and 36% as against 2W volume growth of 7%. In the specialty chemical space, despite headwinds on inventory losses, AAA portfolio companies registered stellar performance and companies have announced new capex for future growth. The Banking sector reported a solid quarter led by healthy loan growth, margin expansion, and continued moderation in provisions. Loan growth was led by sustained traction in Retail and SME segments, along with a sharp revival in corporate loan.

Market Outlook

India is a bright spot in a troubled world economy. High-frequency indicators like GST collection, peak power demand, recovery in air travel, sales of apparel, QSR, auto, housing, capital goods, and improving capacity utilisation are positive. Rural India was adversely impacted in first half but we expect that to improve with a decline in inflation and a strong rabi crop. India nearing a new capex super cycle, in our view, with private spending likely coinciding with ongoing public outlay. Private capex stimulus to stem from decarbonisation, PLI, and China+1, implying fresh investments. On profitability front, corporate India was adversely impacted during the last two quarters due to the higher raw material prices resulting in a decline in gross margins. However, as commodity prices have declined in recent times, we expect gross margins to improve from current levels. Hence, we believe that multiple factors will support the corporate earnings growth momentum and will cushion the downside impact in a scenario where the world enters into a slow growth lane in 2023.

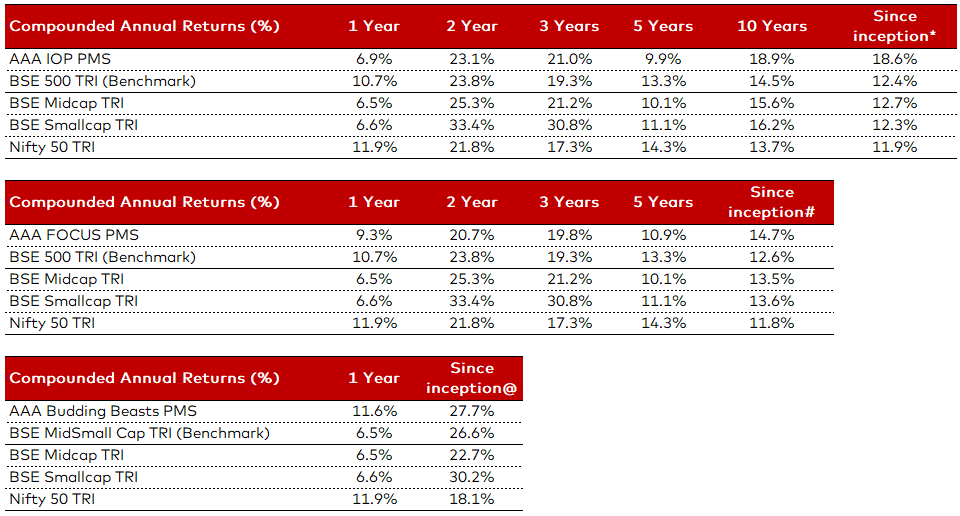

AAA PMS Performance