“… favored business must have two characteristics: (1) an ability to increase prices rather easily without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business with only minor additional investment of capital… However, very few enterprises possess both characteristics.”

– Warren Buffet in 1981 shareholder letter

After spending months arguing that the surge in pandemic inflation was largely due to “transitory” forces, Fed Chair Jerome Powell told Congress on Tuesday that it’s “probably a good time to retire that word.” That implies that inflation is proving more powerful and persistent than expected. With the resurgence of the virus, supply chain bottlenecks also may persist longer than what one anticipated. In our Jun21 AAA Insights, we explained in detail why Resilience is key to tide over inflation. In this note, we analyse our portfolio companies’ performance and strategies to win against inflation.

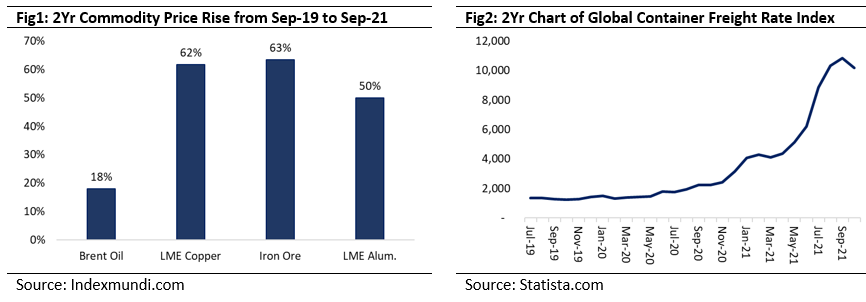

2QFY22 is an important quarter for corporate India, as it faced twin issues of heightened disruption in the supply chain and a high inflationary environment. Prices of important commodities went up sharply by 20-60% in Sept 2021 compared to Sept 19 (ref Fig1). In most commodities, the price hike was the steepest in the last 10 years. During the same period, freight rate moved up by ~9x an unprecedented hike unseen in the last ten years (Fig2).

While judging the company based on one quarter does not give a full picture as at times corporate pass on the input cost hike with a lag of 1-2 quarters, it does give insights into the company’s behaviour in such challenging times. We ran the test of strength on our portfolio companies, and we were happy to see that most companies passed the litmus test with flying colours (though not a surprise to us, as being true leaders, we expect them to deliver on those lines).

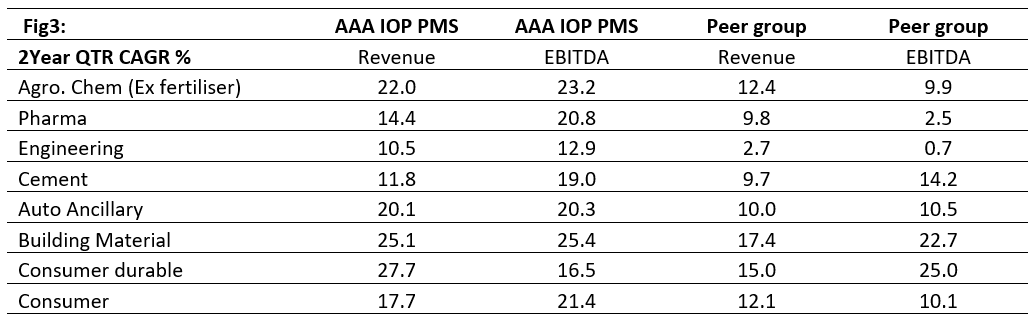

While few companies hiked the prices fully to their customers, some companies decided to change the raw material mix to ensure a lower cost burden for their customers. Some companies decided to do price hikes in a gradual phase as a price hike of 20-30% would have dampened the demand significantly. It is a combination of all, that helped many portfolio companies to report improvement in OPM – a commendable task in our view! Further, the majority of portfolio companies across sectors, outperformed their peer group by a wide margin (ref Fig3) in both revenue and profitability.

The reason for such strong outperformance is their Market Leadership – a common character of all our portfolio companies. The leadership has helped them to get raw material, that too at the right price, passing the inflation to end consumers and retain their margins. Rising inflation is a boon to their financials as it helped them to increase revenue and enjoy higher margins on higher revenue which translated into strong earnings growth. Thus, on 2 years CAGR basis, AAA IOP PMS delivered revenue, EBITDA, and NP CAGR of 11.8%, 16.5%, and 33.6%, respectively compared to Nifty 2 years the revenue/EBITDA/PAT CAGR of 9.2%/13.1%/26.1%. A higher inflation environment will further strengthen our portfolio companies as the companies with low pricing power and weak balance sheets will further lose market share to the sectoral leaders.

Equity Market Outlook

Fears of the spread of new Covid-19 variant (Omicron) and Fed tapering amid rising inflation resulted in a market correction during last month. While the index registered a decline of ~7.9% from its recent peak, 67% of the BSEMIDSMALL cap index registered a decline of more than 20% and ~27% of large-cap stocks also witnessed a decline of more than 20%. We continue to expect high volatility in the market but advise investors to use such volatility to add to equity assets to their advantage. We believe that the bottom-up approach will be more rewarding from current levels as the market has registered a 32.5% gain during the last 12 months.

Key Risks: Severe Covid third wave, significant increase in crude oil prices, geopolitical risks.

AAA PMS Performance

*(23 Nov 2009 – 30 Nov 2021) ^ (7 Dec 2014 – 30 Nov 2021)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.