Selecting/Exiting stocks based on election assumptions? Just a one-word answer – “Don’t”.

Benjamin Graham, the father of value investing, famously noted that “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” It is essential to keep this quote in mind as we approach the national elections in the coming months.

Investing during an election year can be tough on the nerves, and 2024 seems to be no different. This is the biggest election year in world history. Seventy-six countries — home to roughly 4.4 billion people — will hold political contests in 2024. The political order can have sweeping impacts on policy and society. Given the intensity of feelings on different sides of the aisle, politics usually bring out strong emotions and biases. Consequently, it’s natural for investors to assume that the outcome could have a major impact on sentiment and prices in financial markets, but investors should be wise to ignore these senses when making investment decisions. In other words, it would be wise to follow Graham’s advice and have a “I don’t care” approach in the short-term, not making major changes in your portfolio solely because of the elections. Let us have a look at how the election outcomes have influenced the markets in the past.

Markets are indifferent

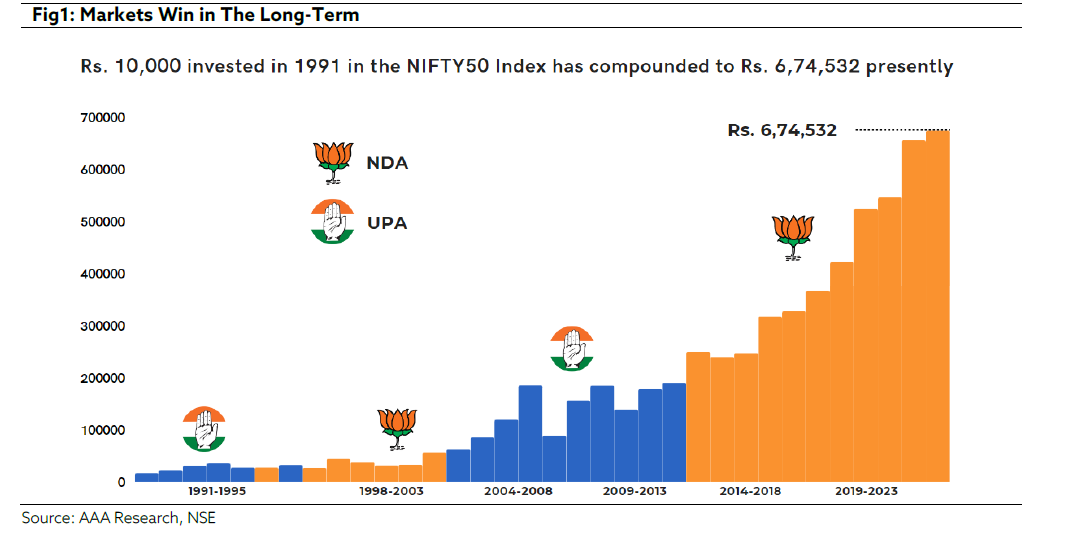

Although the broader consensus sometimes suggests that one party or the other is “better” for the stock markets, the historical data suggests that the actual outcome has no significance whatsoever on the long-term returns, i.e., markets are indifferent to the party in office. There might be market swings in the short-term, but in the longer-term, investors exhibiting patience always win. As seen in Fig1, Rs. 10,000 invested in Nifty50 in 1991 has grown to a staggering Rs. 6,74,532, implying an annualized return of 13.47%. Thus, not doing anything would have created substantial wealth, regardless of the political party in rule. Hence, rather than letting your emotional instincts get the better of you, it is imperative to stay invested in the markets.

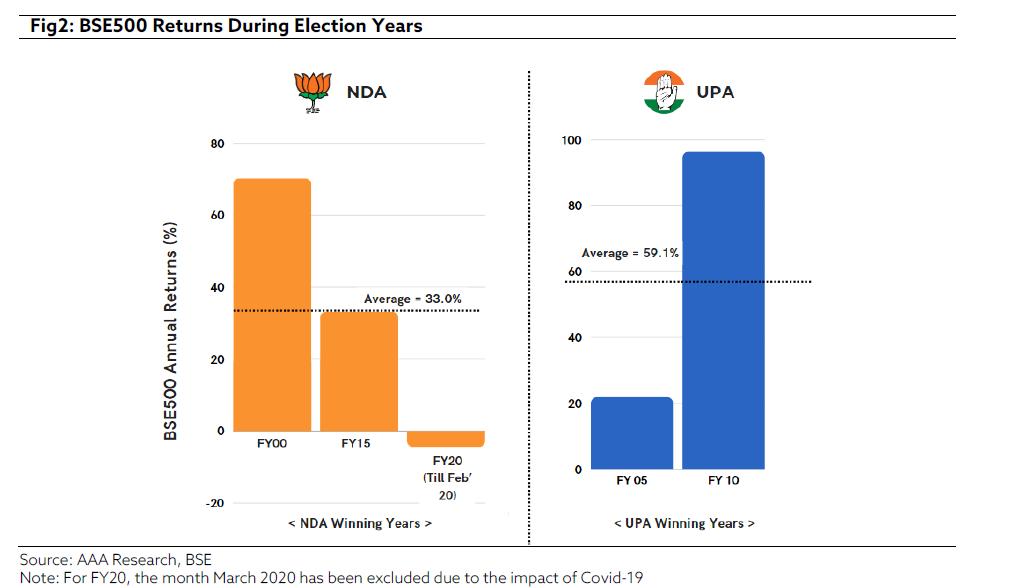

Taking a step further, looking at the market returns for the election years, the results are even more surprising. The annual market returns for all individual election years (except FY20 – onset of Covid19) – despite the election outcomes – have been positive. While volatility is a feature of investing in any year, election years tend to be more volatile, especially just before the vote. The uncertainty tends to make it more pronounced, resulting in some investors taking some risk off the table pre-elections, and then putting money back to work once there is more clarity on policy. However, after results are announced and the uncertainty dissipates, stocks have tended to rally. Looking at the last five election time periods, stocks have been higher, on average, one year later. Hence, despite the political uncertainty and varying election outcomes, markets have always delivered positively (refer Fig2), thereby highlighting the importance of not taking investment decisions based on election polls/assumptions.

Sectoral Performance During Election Years

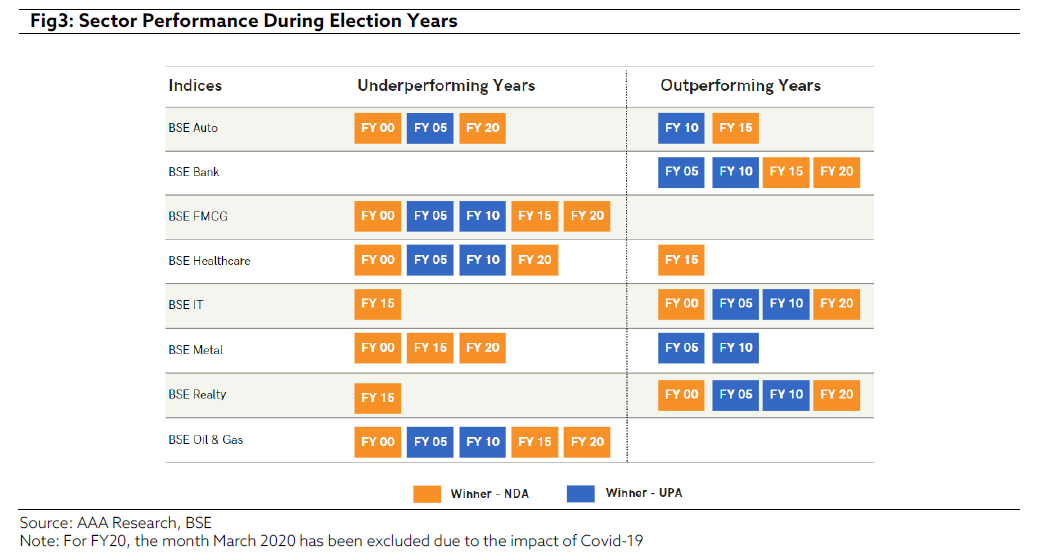

While it’s possible to anticipate the government’s potential policy impacts at a very broad level, the reality is that no one can predict with any certainty which party will win, let alone what sectors, or stocks may benefit from the next government’s policies.

This unpredictability is backed up by the historical data on sector performance. There are very few consistent patterns of relative sector returns in election years, which makes placing sector bets around election outcomes very risky, as evident from Fig3.

Bottomline

Election outcomes can be uncertain. Making investing decisions based on such uncertain factors would make the portfolio vulnerable to extrinsic factors. Rather, it is better to stay invested in quality companies with a long-term horizon, and let things take their natural course.

AAA PMS Performance

*(23 Nov 2009 – 31 Mar 2024); @(01 Jan 2021 – 31 Mar 2024); #(17 Nov 2014 – 31 Mar 2024

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.