The year 2022 has had a rocky start. Equity markets globally witnessed sharp sell-off. India also witnessed similar trends. The BSE-30 and Nifty-50 rose around 5% by January 17, only to give it all back. While for the month, the market ended with a flat note, the decline was sharper underneath the indices. BSE IT, healthcare, and consumer durables indices fell 8%, 8% and 6% respectively.

What caused the sell-off in global markets?

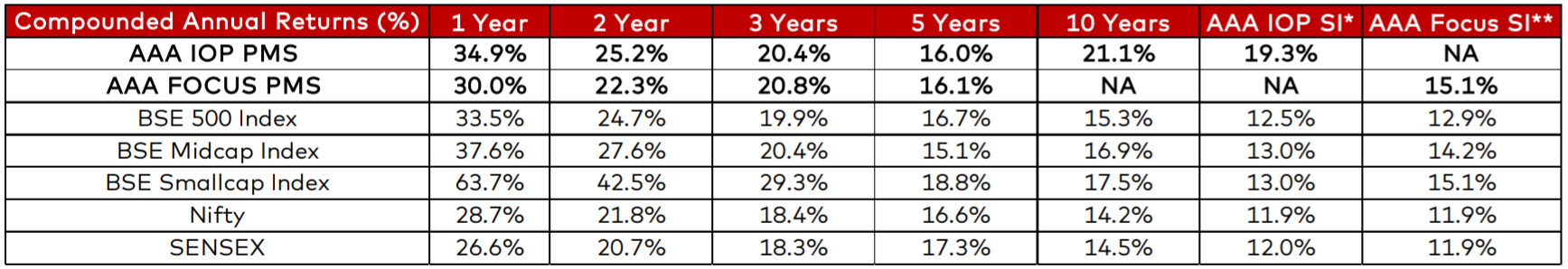

Understanding the reasons of the sell-off can help investors decide it is a “normal” correction or whether it is a sign of the harbinger of a bear market. We believe primary reasons for sell-off were faster-than-expected rate hikes signals by the US Fed and rising bond yields. As shown in Fig1, US Treasury yield (2year tenure) saw a sharp spike from 0.73% to 1.18% in last 30 days.

Is rising yield negative for equities?

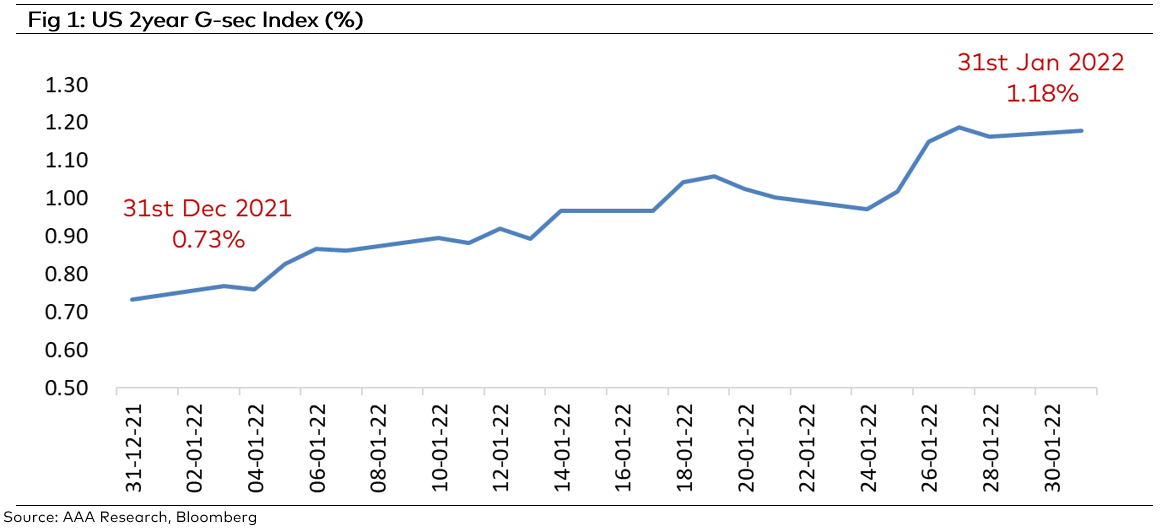

In the initial period of rate hike expectations, the equity market does witness volatility but they tend to find their footing after adjusting to higher policy rates because hikes tend to happen when the economy is strong. Empirically ‘normalisation’ of interest rates in an environment of rising investment and profit cycle has not negatively impacted stocks. We don’t see a compelling reason why this time would be different. This is further collaborated during previous rate hike cycles as explained in Fig3 and Fig4. During both the previous rate hike cycles (2004-06 and 2016-18), Nifty delivered over 95% and 32% returns respectively (Fig 2 and Fig 4).

High-frequency indicators are pointing to a continued uptick in economic activities. GST collection was robust at Rs.1.4tn in Jan2022 (15% YoY). Bank credit growth has picked up to 8.0% YoY as of Jan14 2022, from 5.2% in Mar 2021. Manufacturing PLI remains strong at 54.0 in Jan2022. Private sector investment is set to benefit from PLI scheme which can potentially generate Rs. 2.5-3.0 lakh crore of capex across 14 sectors between 2023-2025. The Omicron variant that embodied the third wave was relatively mild. Though highly contagious, it necessitated fewer curbs. More significantly, increasing vaccination coverage and the acquired ability to live with the virus, have lessened the severity of economic impact with each successive wave. Economic recovery thus continues unabated.

Quality stocks offer an opportunity

In the current market sell-off, good quality stocks have witnessed sharp correction which provides a good entry point for investment as they have a long runway of growth. During the inflationary environment, two important parameters which bring resilience to the corporate are 1. Profitability and 2. Low leverage. The companies which can pass through the increase in cost in the medium-term and the companies which are not required to raise capital (equity/debt) to meet growth targets are winners.

Across our portfolios, we own companies that are market leaders with strong pricing power and zero/low leverage. Hence our portfolio companies are uniquely positioned to further gain market share in a rising inflation environment. We also believe that as economic growth revives, it makes sense to own companies that are linked to the real economy – banking & finance, industrials, building material, and automobiles.

Union Budget 2022: Balancing between Growth and Fiscal Prudence

For yet another year, the Government steered clear from short-term consumption push to economy and focused on capital spending to make India ready for structural growth. The FY23 Union Budget promoted capital expenditure (up 10% YoY including IEBR) with a focus on supply side management. It has targeted the central fiscal deficit at 6.4% for FY23 and reiterated its target to get back to a 4.5% fiscal deficit number by FY26 which highlights fiscal prudence. The FM has budgeted a 10% growth in gross revenue for FY23 which is a credible number and can potentially surprise on the upside. No major changes on the taxation front thus maintaining stable taxation policies is also a positive.

Key Risks: Supply chain disruptions, faster than expected monetary tightening, a significant increase in crude oil prices, geopolitical risks.

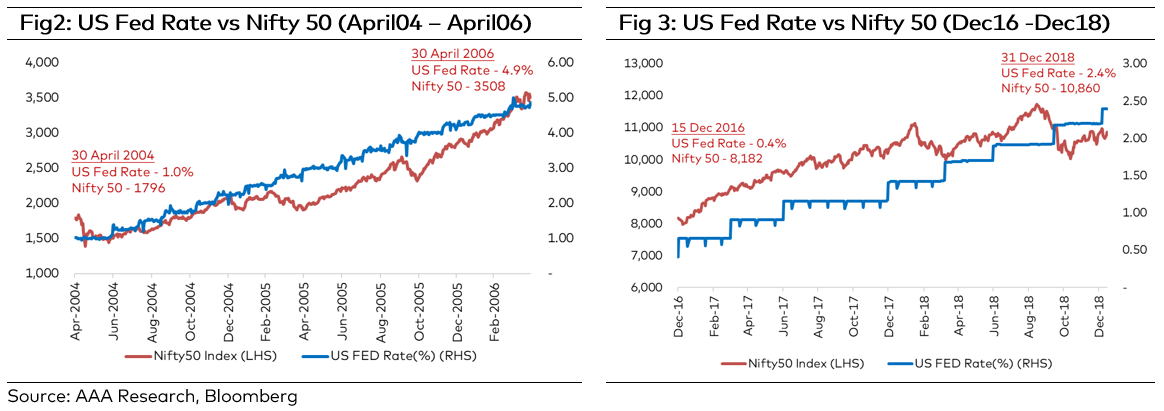

AAA PMS Performance