To say the past few months have been a whirlwind for markets doesn’t begin to describe it. Ever since commodities’ November sell-off, commodities have been caught in a tug of war between macro and micro forces. On the macro side, China’s lockdowns, tightening monetary policy, and Europe’s energy crisis have contributed to risk aversion in the economy and markets. On the micro side, however, the same risk aversion has led participants in the physical markets — such as manufacturers, power utilities and food businesses — to destock inventories and refrain from buying new supplies, in some cases leaving stocks critically short. The operative question which we are supposed to assess is: Are the flashpoints we are seeing across sectors idiosyncratic or systemic? We believe it’s both. In this newsletter, we dive into some critical changes which we have witnessed over the past couple of years.

Persistent Volatility

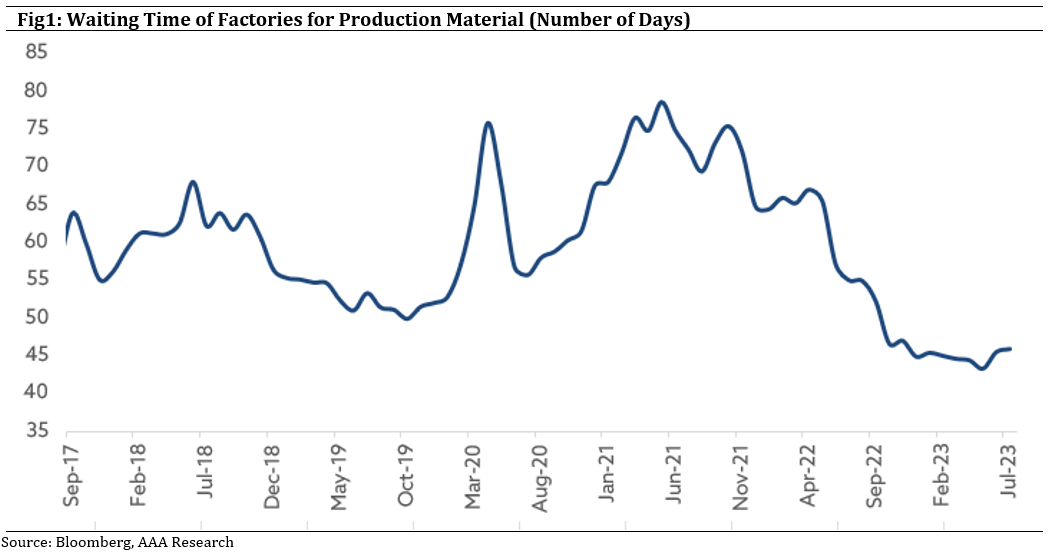

Flashback to May 2021 – just two years ago – when global commodity prices were rising, waiting time for production material was almost near all-time highs, and we discussed about the key to the lock called “Inflation”. Restocking in the face of a global pandemic had been the global inventory management policy in Covid-19 years.

Now, on the flip side, commodity prices are declining, amidst increasing economic concerns of China, and declining inflation in the United States. Micro catalysts such as ongoing OPEC cuts, declining U.S. shale production and an end to emergency oil stock releases have been keeping inventories of energy commodities and agricultural biofuels tight. It’s almost as if the inventory management policy has changed from restocking to destocking. An unanticipated spike and decline in demand, along with globally dynamic forces has resulted in rapidly changing business cycles. This is reflected in the significant reduction in waiting time of factories for production material (refer Fig1) by 41% to 46 days – the lowest number since 2010.

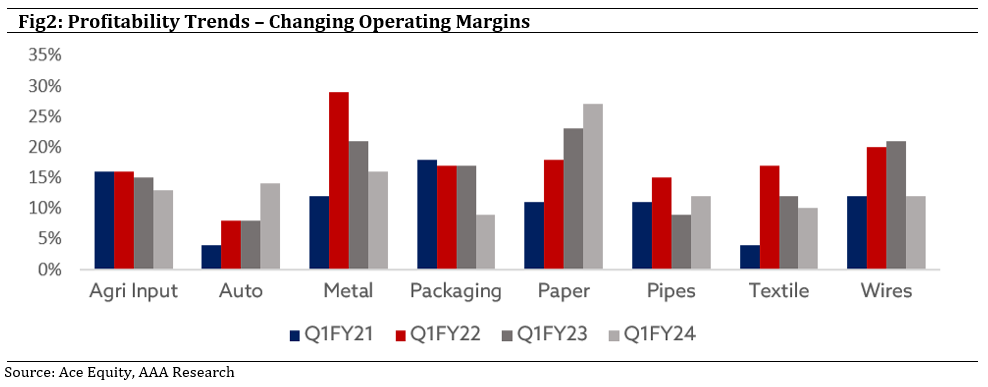

The outcome – increasing volatility in business cycles, resulting in increased volatility of the company’s earnings in the recent times. A closer look at the sectoral margins trend for the last four years depicts how the operating environment is changing for businesses (Refer Fig2). Such swings in the profitability trend leads to sharper swings in earnings expectations and ultimately its stock prices. Going forward, we expect the pace at which business cycles are changing to continue, given the increasing geo-political and global influences. As always, our QuAgile approach will prove to be beneficial for investors and result in sustainable wealth creation over the long-term.

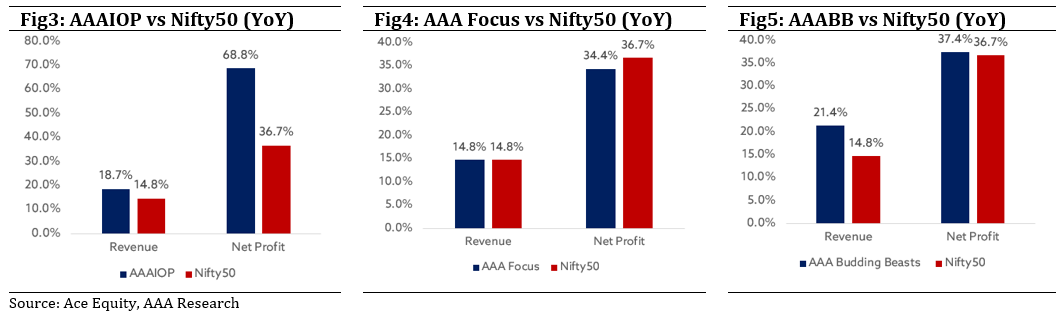

Earnings Front: Q1FY24

On the earnings front, AAA companies delivered strong results. The decline in commodity prices resulted in an improvement in gross margins for most of the sectors. On sectoral trends, auto companies witnessed healthy demand sentiment driven by new product launches. The banking sector reported strong loan book growth but with some pressure on net interest margins due to rising funding costs. Order book remains robust for most engineering companies and pick up in the execution cycle will accelerate growth for the sector. The consumer companies are still reeling under pressure and waiting for rural India’s recovery. IT sector, as expected, reported weak numbers and sounded cautious on their guidance for FY24. All in all, the portfolios are on track, and we are robustly monitoring and evaluating investments to ensure capital protection and wealth creation.

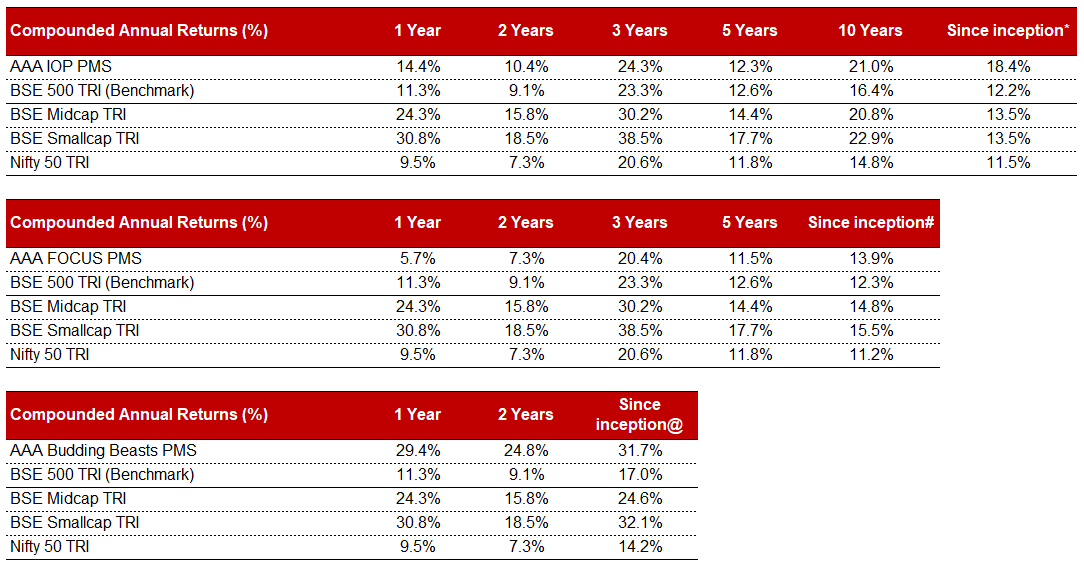

AAA PMS Performance