When bear markets occur and the investment mistakes of the prior cycle are revealed, bearish investment commentary tends to intensify. There is a confessional, self-flagellating quality to some of this research, as if its authors are trying to atone for having missed the signals and risks during the prior boom. Our team has read a lot of research and met quite a few companies, and the consistent perception now is a litany of gloom on valuations, earnings, the surge in the USA Dollar, trade policy uncertainty etc. While we acknowledge some of these concerns, we are trying to highlight how the sentiment gets extended due to the nature of the markets. However, one important observation for investors is that there is a remarkable consistency to the patterns shown below: equities tend to bottom several months (at least) before the rest of the victims of a slowdown.

We don’t know if the current decline will fit into the pantheon of bear markets past. However, what we do know is that every bear period has eventually ended, and the market started back up again.

A Step Back – Assessing Drawdowns

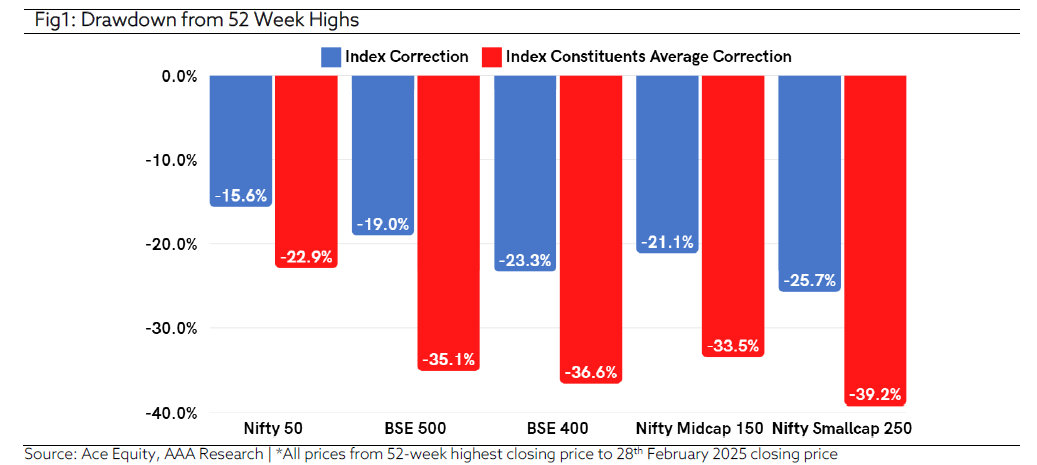

Indian equity markets witnessed sharp declines during the last five months. The range of correction for different indices has been 15% to 26%, while the average fall in the stocks is much higher ~21-39% (Refer the figure below).

While multiple reasons are being attributed to the recent correction, the key reasons are:

- Higher than average valuations

- Slowdown in the economic growth due to monetary tightening and lower credit growth

- Growth not being in line with valuations (H1FY25 Nifty EPS growth was in single digits)

- Tariffs related global uncertainties

Where do we go from here?

For equity markets to do well, growth needs to come back. Thankfully, both the government and RBI are actively working to revive growth. The union budget decision of a Rs. 1 lakh crore tax reduction will directly benefit domestic households, thereby improving prospects for higher consumption which was hit hard in last 2 years. Additionally, RBI has taken several steps to improve the liquidity measures. Inflation cooling down is a cherry on the top, as it led to RBI doing its first rate cut in the last 5 years. It is plausible that RBI could implement one more rate cut this year. D Street assumes 12-14% EPS growth for Nifty for FY26. This seems achievable given the low base and the expected pushback in consumption.

Impact of Tariff

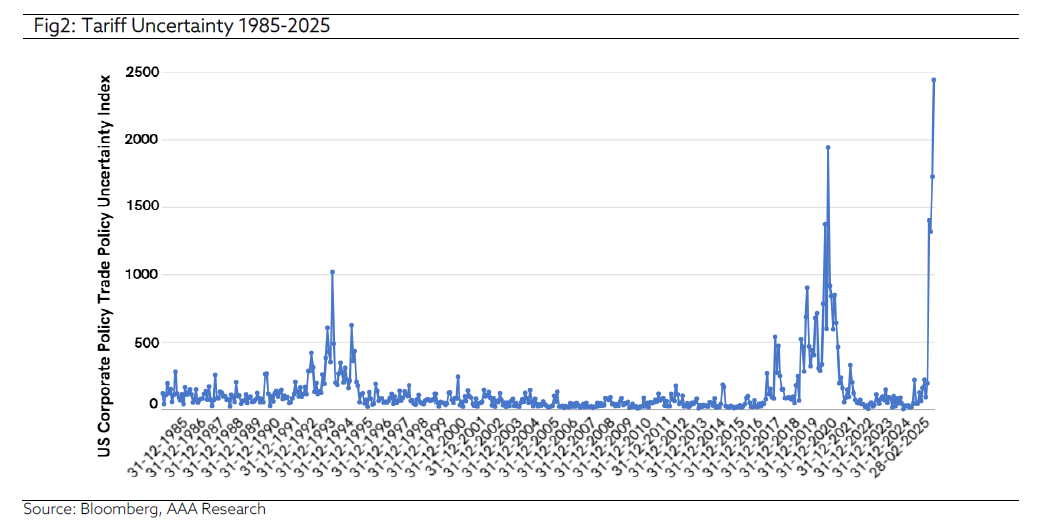

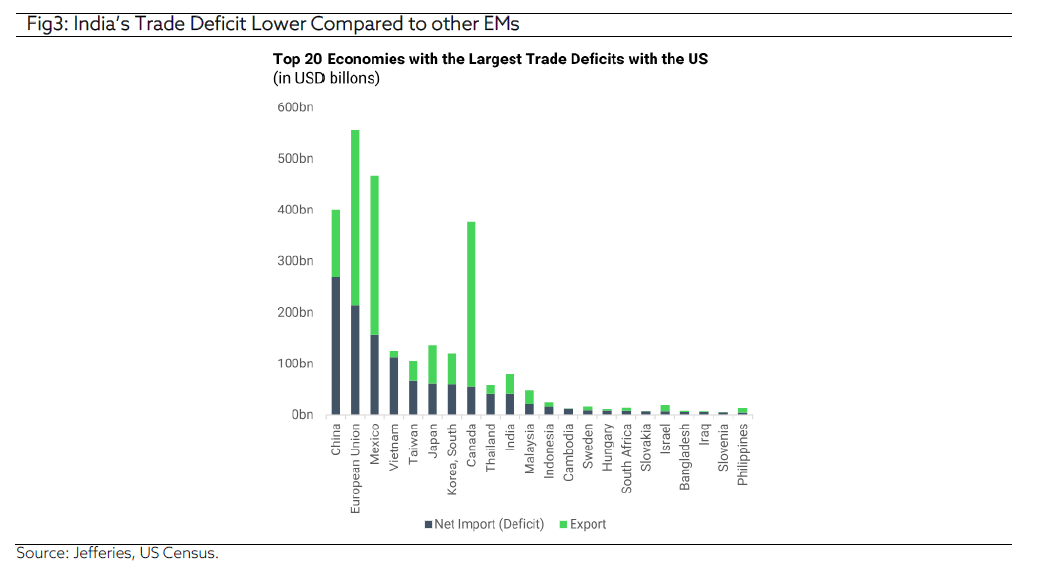

Trade policy uncertainty has soared to its highest in at least 39 years, reflecting U.S. tariff headlines. See the chart above. While it is difficult to predict the impact of tariff, we believe at worst, the impact would be marginally negative. This is because on a relative basis, India is better off than other countries (see below), given the lower tariffs.

History as a Guide

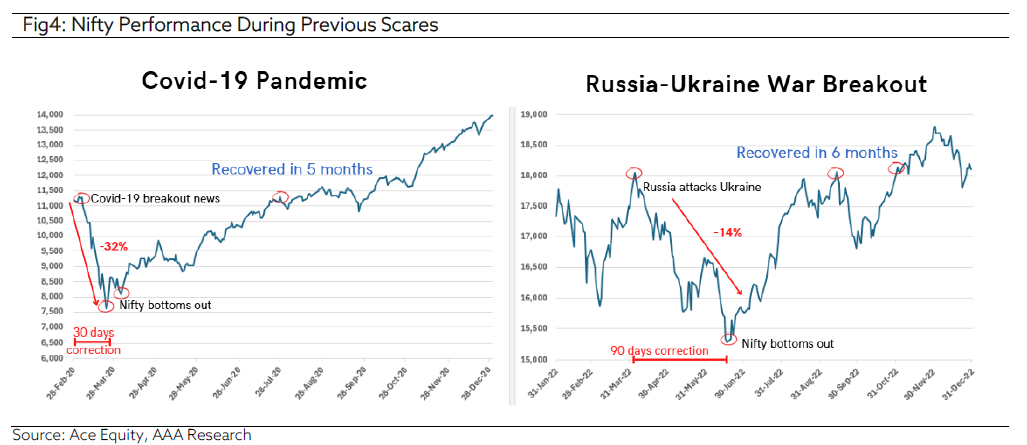

Interestingly, if one takes history as a guide, such events are usually discounted in the market within 100 days (refer Figure 4). As days pass by, markets shift their attention to resolution, capping the downside limit. Since being elected, President Trump started talking about using tariffs as a tool. It has already been 60 days and considering that Nifty has already corrected 15%, it is possible that the bulk of the noise is over.

Today, there are thoughtful, experienced economists and professional investors who can give you well-reasoned arguments why this bear market is different, why the economic problems are different and why this time things may get worse. While some might say, “This time is different,” our message to you is, “We’ve seen this before.”

Over time, the financial markets have demonstrated a remarkable ability to anticipate a better tomorrow even when today’s news feels so bad. While no one can predict the future and no two market declines are the same, we have been here before, and we’ve learned how to survive and prosper when markets begin to recover.

Valuations

On the valuation front, Nifty traded at 18.8x P/E FY26 as on 28th February’s close. This is 11% lesser than the last 10-year average 1 year forward P/E of 21.2x. This implies a good entry point for investors. Recent history suggests that whenever investors enter below 10-year average valuations, the chances of double-digit returns over a 3-to-5-year period are quite bright. However, we continue to believe that being selective would prove to be rewarding this year.

The AAA way

At stock selection level, time and again, our 3M investment approach (Market Size, Market Share, Margin of Safety) has helped us to deliver higher alpha, while witnessing lesser drawdowns during the bad times of market. This time too, all our portfolio holdings enjoy large profits, have under leveraged balance sheets and have delivered high ROE, thereby protecting your capital.

At AAA, we strongly believe that business cycles are getting shorter. This implies rapid swings in earnings growth as well as valuations. Markets will demand more Agility and that means disciplined exits where growth prospects are bleak, or valuations are significantly extended.

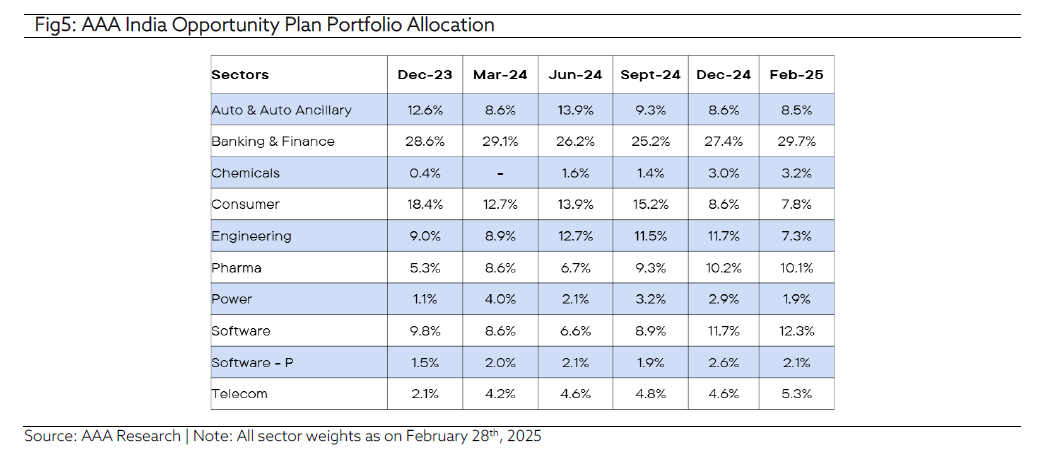

As seen in the chart above, we have increased our allocation to healthcare, speciality chemicals and the IT sectors over the past three quarters. We have trimmed our exposure in certain pockets of the consumer sector due to bleak growth prospects and reduced our weightage in the Capital Goods sector where valuations are a little bloated.

We have been careful while identifying winners and avoiding losers within each sector. We exited the FMCG space within consumer, while we continue to like select names in the discretionary space. Within healthcare, we like the CDMO space, hospitals, and domestic focused companies. In the banking sector, while the AAAIOP portfolio has 29.7% exposure, we have been prudent by avoiding the micro finance subsegment, one of the worst performers over the past five years. During the last 15+ years, we have been QuAgile in sector and stock allocation, to insulate the portfolio from shocks, while ensuring our quality guardrails are met.

Quarterly Snapshot – Q3FY25

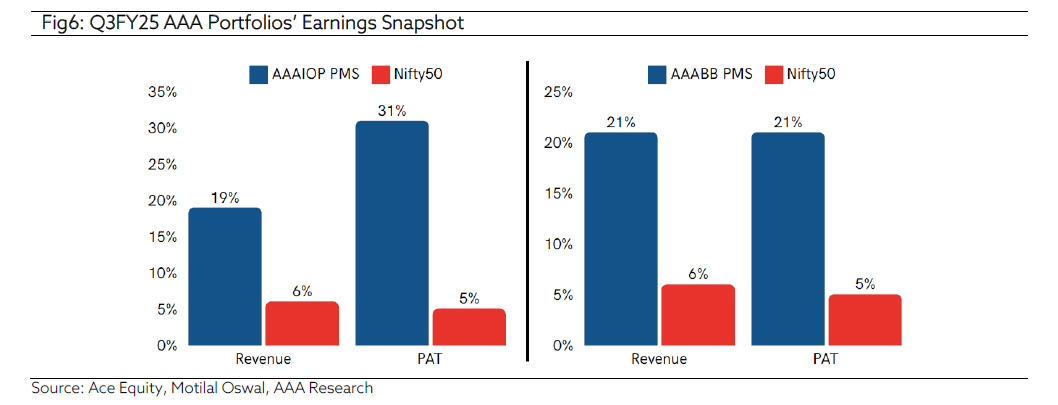

For 3QFY25, AAA portfolios continued to deliver strongly despite challenges in the macroeconomic environment. Both strategies delivered more than 20% PAT growth as compared to Nifty earnings growth of just 5%.

(AAA Emerging Giants PMS Plan has been renamed as AAA Budding Beasts PMS Plan)

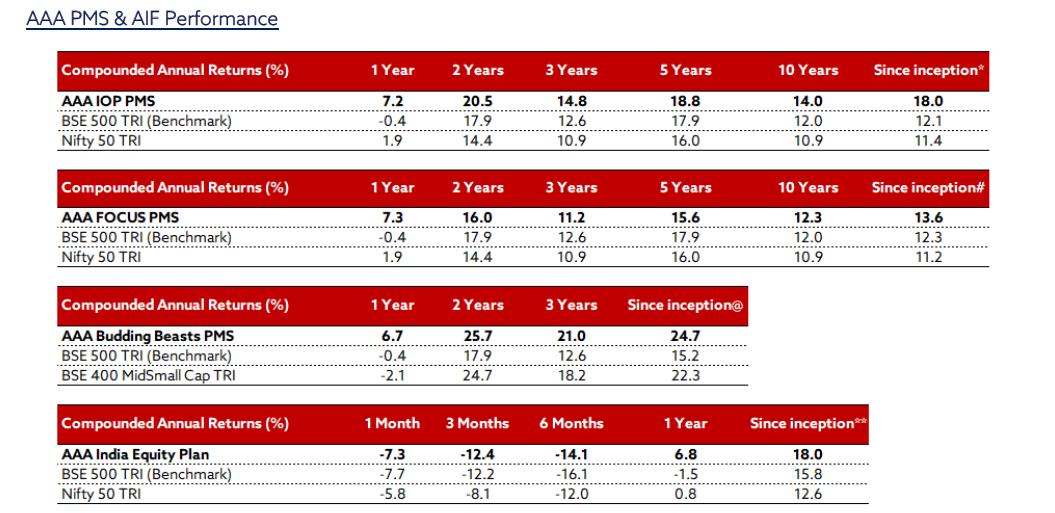

*(23 Nov 2009 – 28 Feb 2025); #(17 Nov 2014 – 28 Feb 2025); @(01 Jan 2021 – 28 Feb 2025); **(16 May 2023 – 28 Feb 2025)

Performance is after all expenses and fees from April 2018 onwards. Prior to April 2018, the performance is after all expenses and Fixed Management fees. Index performance is calculated using Total Return Indices, as per SEBI guidelines.

Note: Returns of Individual clients may differ depending on the time of entry in the strategy. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.