Markets are like the ocean. Calm waters feel safe, but storms are inevitable. Investing in the markets over the past year may feel like rough waters, testing patience and shaking confidence. Yet history shows that navigating through these temporary storms often positions investors for smoother sailing ahead.

Negative Returns = Future Potential

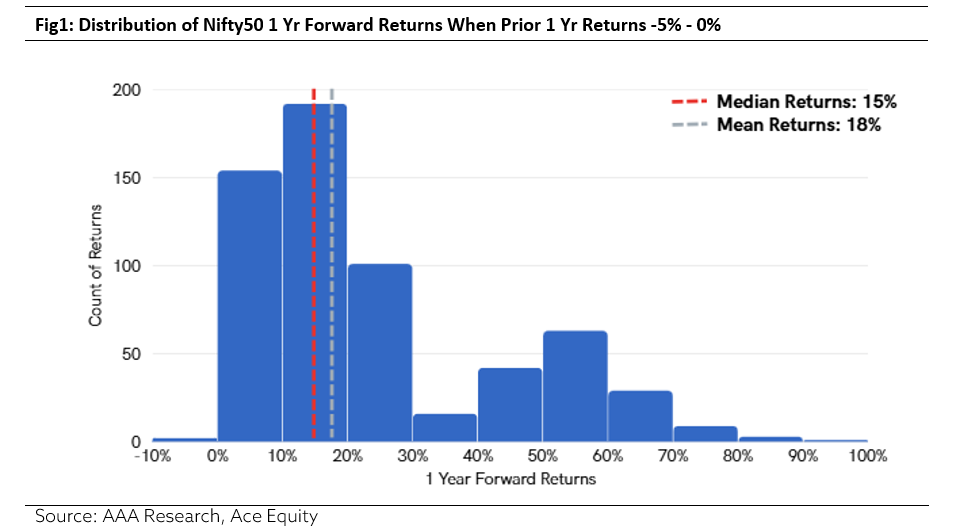

At first glance, short-term losses can be unsettling. However, Nifty50 rolling returns data from the past 15 years (30th September 2010 to 30th September 2025) reveals a consistent trend: periods of negative one-year returns (between -5% and 0%) have been followed by strong recoveries in the subsequent year.

As of 30th September 2025, the Nifty50 has declined by 3.45% over the past year. Historically, similar phases of weakness have been followed by broad-based recoveries, with median one-year forward returns of about 15% and an average return of 18% (Refer to Fig1). 99.52% of periods following such one-year declines have delivered positive one-year forward returns.

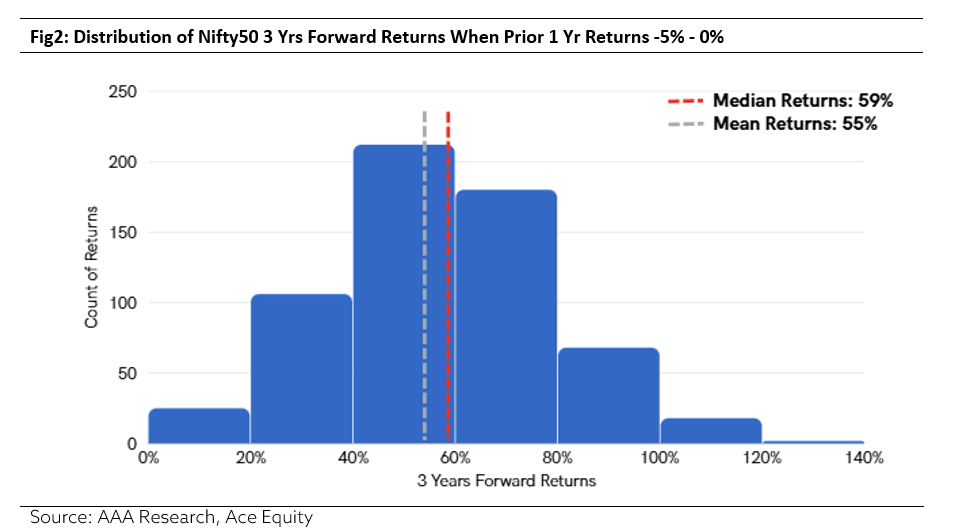

Periods that appear discouraging in the short term have consistently proven to be strong entry points for long-term investors.

Extending the horizon to three years further strengthens the case for staying invested. Historically, one-year declines of around 3.45% have been followed by median three-year forward returns of 59% and average returns of 55%, with 100% of such periods turning positive over the next three years (Refer to Fig2).

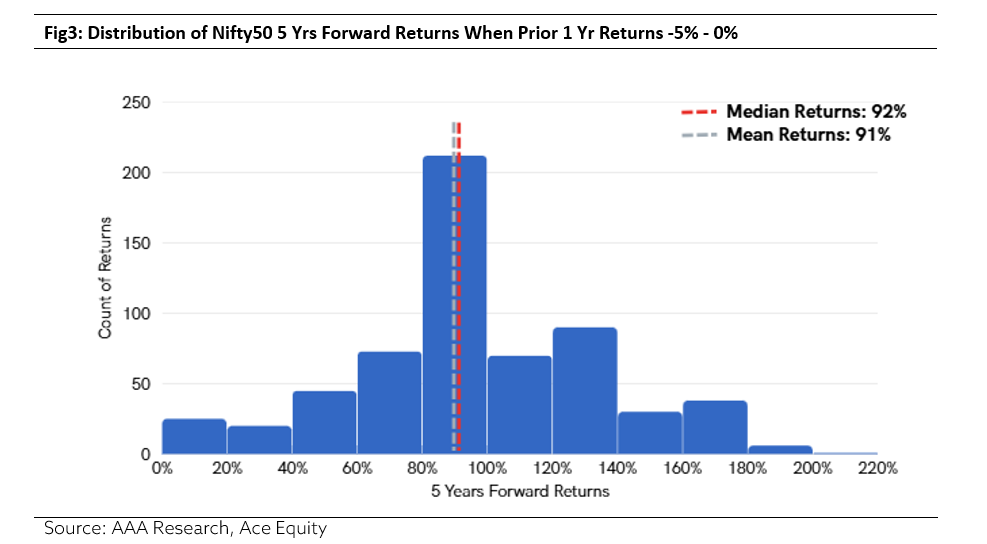

The story becomes even more compelling over a five-year horizon. Historically, one-year declines of around 3.45% have been followed by strong five-year recoveries, with median forward returns of 92% and average returns of 91% (Refer to Fig3). Moreover, all such periods have gone on to deliver positive five-year returns, reflecting a 100% success rate.

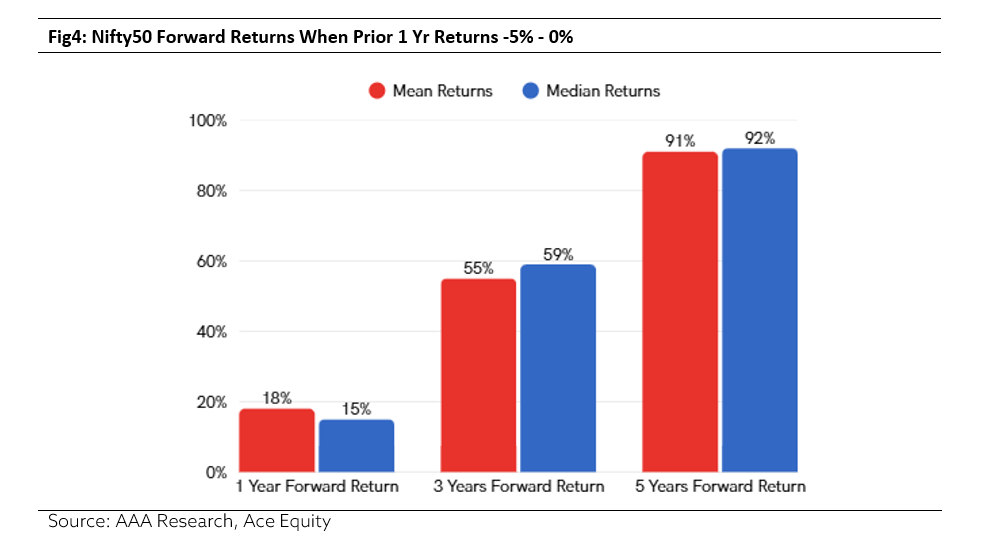

To sum it up, evidence shows that negative returns are usually just short-term blips. Maintaining a long-term perspective increases the likelihood of higher, positive returns, as extended holding periods historically smooth out short-term volatility and amplify gains (Refer to Fig4).

These patterns highlight a simple truth—temporary setbacks rarely derail long-term progress. What drives these recoveries is not luck, but the underlying mechanics of how markets function.

Why Markets Bounce Back

- Valuations realign: When prices fall, stocks often become undervalued relative to their earnings potential, creating attractive opportunities for disciplined investors.

- Mean reversion at work: Markets tend to correct extreme movements over time. Large declines are often followed by proportionally strong recoveries.

- Behavioural dynamics: Fear drives many investors to sell during downturns and return too late, missing the rebound. Those who stay invested—or continue adding systematically—position themselves to benefit fully when markets recover.

How Investors Can Benefit

- Turn dips into opportunities: As Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.” Market corrections can be the perfect time to invest in strong businesses at more reasonable prices. Short-term losses often create long-term potential.

- Explore overlooked opportunities: Market downturns can shine a spotlight on sectors or companies that get ignored during boom periods. Investors who do their homework now can position themselves to capture outsized gains when the recovery begins.

- Prioritize quality over chasing trends: In volatile markets, short-term fads can be tempting—but lasting growth comes from companies with solid balance sheets, resilient earnings, and clear competitive advantages. Focusing on quality positions your portfolio to withstand downturns and benefit from eventual recoveries.

- Stay invested, don’t try to predict the bottom: As the legendary investor Peter Lynch once said, “Far more money has been lost by investors trying to anticipate corrections, than has been lost in the corrections themselves.” Trying to time the market often backfires—remaining invested matters far more.

The Bottom Line

Periods of negative returns are not a reason to panic. They are a reminder that patience and discipline drive long-term wealth creation. History is consistent: negative phases are typically followed by strong recoveries.

The question isn’t “Should I exit?” but “Am I positioned to benefit from the rebound ahead?” Like a storm at sea, downturns are temporary. Investors who remain steady and disciplined are the ones who enjoy the smooth waters that follow.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.