India is entering a new era of economic optimism. A rare alignment of macro tailwinds—softening inflation, decisive monetary policy, and bold fiscal support—has now been amplified by the government’s landmark GST 2.0 reforms. Together, these forces position India as one of the world’s most compelling investment opportunities, setting the stage for broad-based economic revival and sustained wealth creation.

Building on this foundation, the Finance Minister’s recent announcement of GST 2.0 reforms marks a true master stroke. With the GST structure now rationalized into two principal slabs—5% for essentials and 18% for standard goods and services—the missing piece in India’s growth puzzle is finally in place.

This move will make essential goods, electronics, automobiles, and consumer durables significantly more affordable, with the impact rippling outward to benefit households, businesses, and the broader consumption ecosystem. Economists anticipate that GST 2.0 could reduce headline inflation by over one percentage point while catalysing robust demand across categories.

Lower direct taxes further fuel this consumption engine; as income tax rates recede, households across the income spectrum will enjoy higher disposable incomes, empowering them to upgrade lifestyles and increase discretionary purchases. Daily essentials, FMCG, autos, electronics, and home improvement sectors are set to see better volume growth, translating into steady improvement in corporate earnings from 2QFY26 onward.

Crucially, India’s domestic-driven economy remains largely insulated from external shocks such as recent US tariffs, and its investment momentum continues to support near-term and long-term growth.

1QFY26 Report Card

As we step into the new financial year, India’s enterprise economy continues to show resilience. The Nifty500 delivered a good start to FY26, with aggregate sales rising 5%, EBITDA growing by 11%, and bottom-line earnings expanding 10% year-on-year. Operating profit margins for Nifty500 (ex-BFSI) strengthened to 17.1%, reflecting broad-based discipline. Oil & Gas, Cement, NBFCs, Telecom, and Capital Goods led the charge, while 42% of Nifty500 firms achieved profit growth above 15%, highlighting a market environment rich with leadership and quality.

AlfAccurate Outperformance

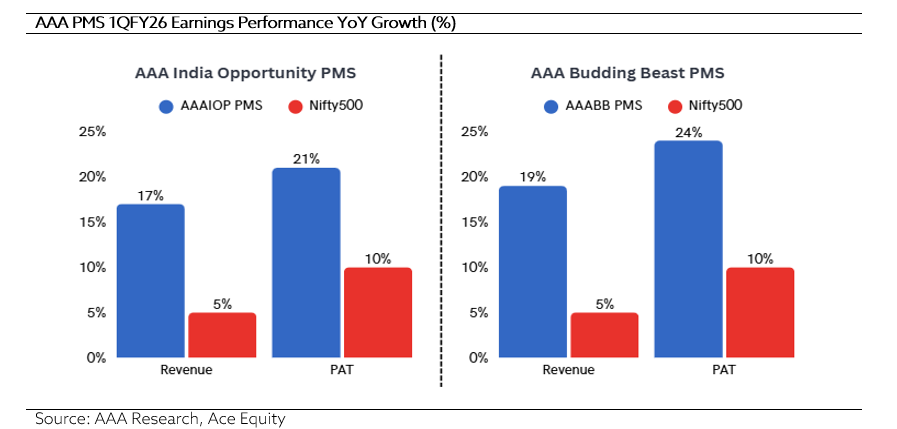

In this environment, AlfAccurate’s strategies once again highlighted the power of disciplined investing. The AAA IOP portfolio delivered a remarkable 17% revenue growth and 21% profit growth on a year-on-year basis, outpacing BSE500 and underlining our adeptness in identifying and capturing sectoral momentum. Dominant positions in auto ancillaries, specialty chemicals, housing finance, capital goods, retail, CDMO, and hospitals fuelled this outperformance, with each segment chosen for its structural growth prospects and robust business moats.

The AAA Budding Beasts strategy strengthened further, posting 19% revenue growth and 24% profit growth over the same period. Through disciplined risk management and a rigorous focus on emerging enterprise leaders, the Budding Beasts approach continues to deliver resilience and strong risk-adjusted returns, reinforcing our commitment to long-term wealth creation for clients.

This approach continues to reinforce AlfAccurate’s commitment to long-term wealth creation for clients. The season’s results reflect careful stewardship of investor capital and the execution of our distinctive strategy blueprint. As the breadth of market earnings improves and clear winners emerge from AAA’s process, our sights remain set on superior results and enduring investor confidence.

Valuations & Outlook

On valuations, the Nifty currently trades at a PE of 22.5x for FY26, perfectly aligned with its 10-year average of 21x. As growth prospects brighten, we expect Indian equities to deliver healthy returns over the next three to five years. In times like these, it is essential to stay invested and avoid market noise as the next leg of growth unfolds.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.