During the last 3 years, we often got a question from the investors “Which Market cap category is expected to outperform? Large or Mid or Small?” Market-cap based allocation is commonly used by many participants as most of the stock market indices are market-cap based. We at AlfAccurate, strongly believe that investment solely based on the market cap is not the correct approach and instead one should focus on absolute net profit and net profit growth [Net Profit Size x (1+ growth)] as the investment criteria because it is the net profit growth which drives market cap and not the other way round.

Why focus on market cap is not rewarding?

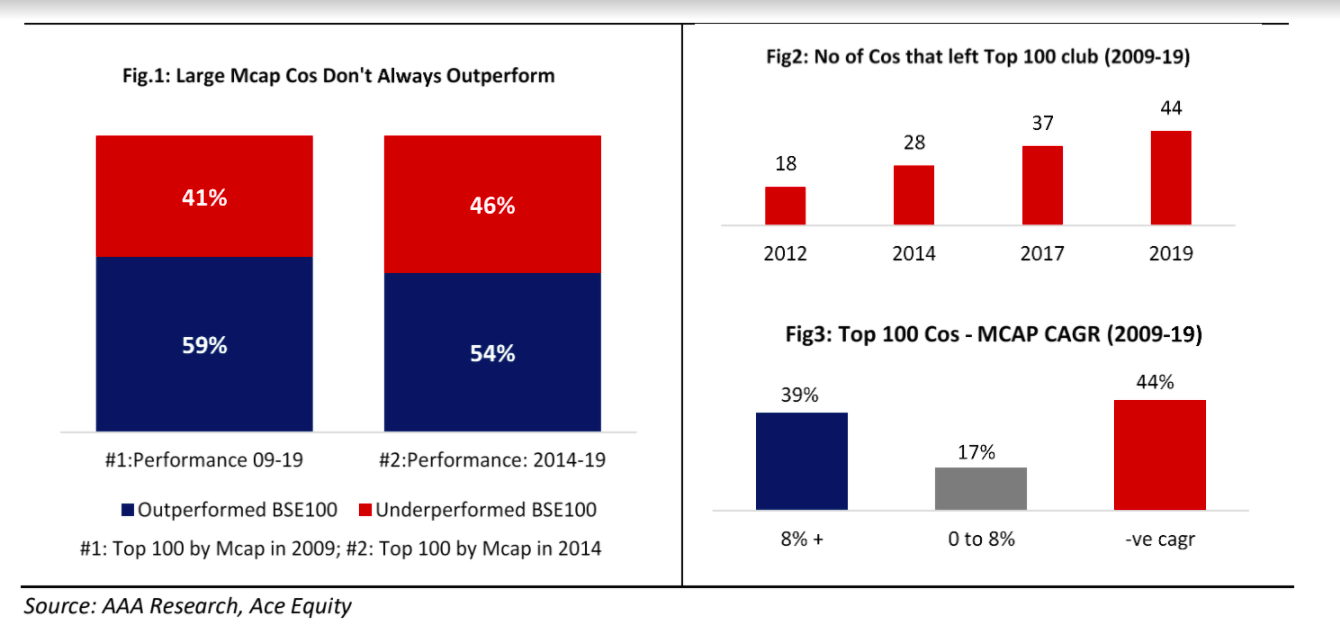

It is a common perception that the best way to reduce risk is to invest in large companies. However, in reality, 41% and 46% of the Top-100 companies by Market-cap underperformed the BSE100 index CAGR return over 10 year (2009-19) and 5 year (2014-19) period respectively (Fig1). (Since Mar20 was impacted severely due to pandemic, we selected Mar19 for our analysis).

Importantly, market cap leadership also kept on changing, as many leaders becomes laggards in the long term. During last 10-year period, out of top 100 companies by market-cap in the year 2009, whopping 44% companies were not part of Top 100 club in 2019 (Fig2).

Ironically, 40 out of 95 companies i.e. 44% of companies registered negative returns despite 10 year holding period (Fig3) – this is eye opener and further confirms that investment solely based on market cap criteria is not rewarding.

Moreover, market cap of firm tends to get skewed depending upon its up/down business cycle which results into expansion/contraction in its valuations. For instance, Infosys PE contracted from peak of 221x in Mar00 to 32x in Mar05 and further to 20x in Mar19. Similarly, during infra boom, L&T PE expanded from 6x (Mar03) to 36x in (Mar08) and then contracted to 23x in Mar19. Hence investor who would have selected stock based on market cap criteria would have lost significantly despite selecting one the highest market cap company.

Focus on Net profit + Growth

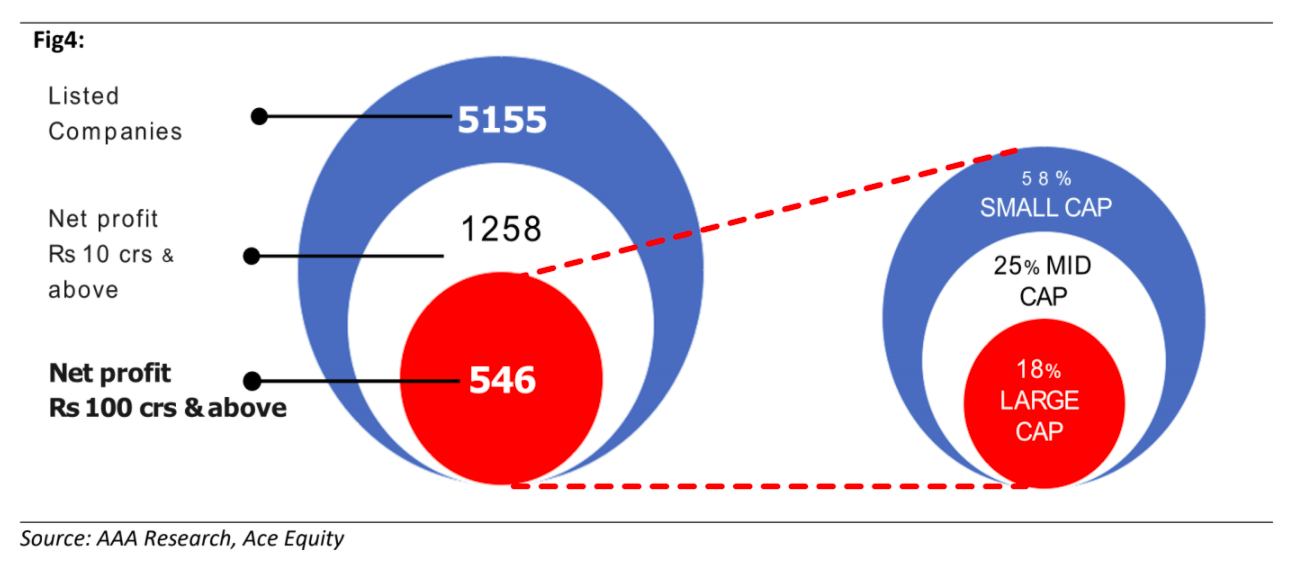

We strongly believe that true measure of size of company is its Net profit size rather than market cap as the objective is to own a slice of firm’s profits. Out of the 5155 total listed companies in India, only 546 companies have net profit of more than Rs 100crs i.e. ~10% of the universe. We believe that a Rs 100 crs net profit is good milestone to measure the success of any firm as companies with large net profit size can better navigate the business cycles. Although large in size, 83% of these companies falls in mid and small cap categorisation (as per new market cap categorisation regulations) as reflected in Fig4. However, this categorisation does not make the company risky investment as many of these names have become multi-baggers during last 10 years.

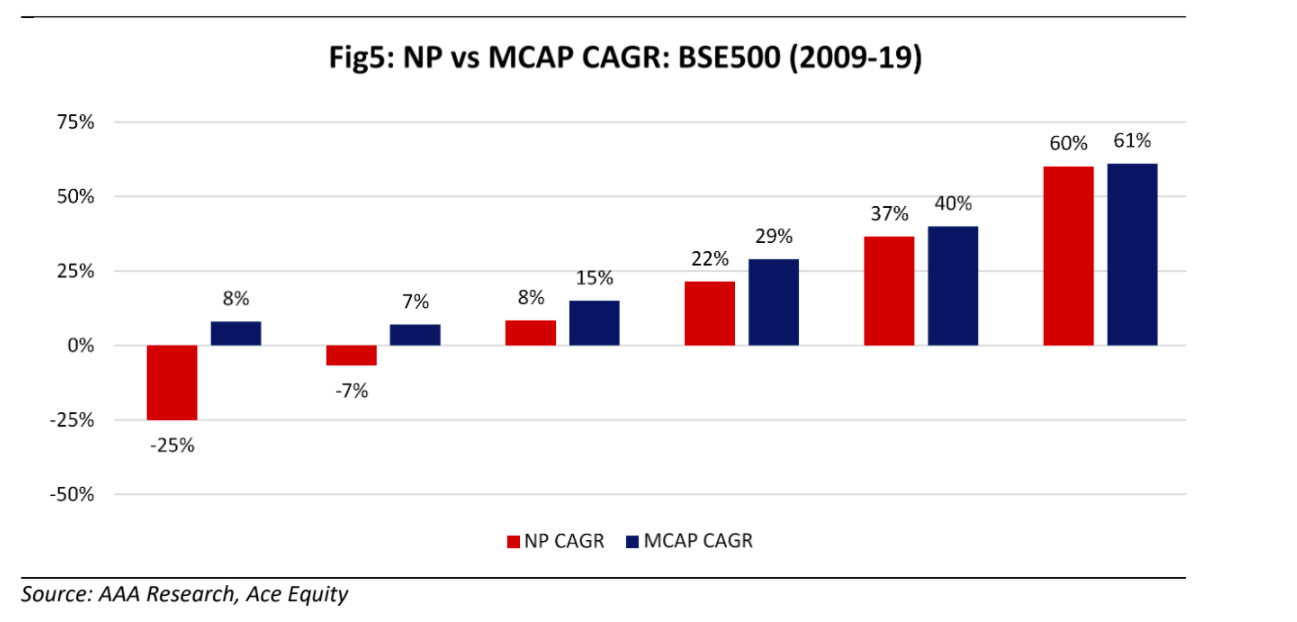

We emphasise on Net profit growth as important criteria as net profit growth drives market cap growth. As can been in Fig5, the companies which delivered strong profit growth also registered strong stock price returns. For instance, companies which reported 22% NP CAGR witnessed 29% CAGR in its market cap during FY09-19. Similarly, companies which witnessed poor earnings registered poor stock price returns as well.

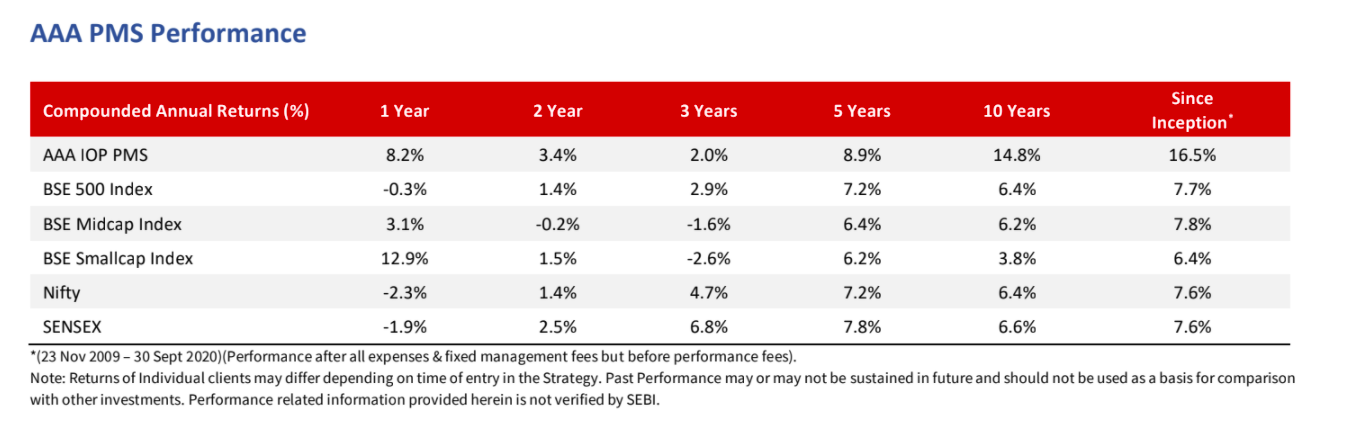

At AAA, we consider the entire 100cr+NP universe irrespective of its market cap worth evaluating as this bucket has potential to deliver outsized net profit growth as well as outsized stock price returns. Since last 10+ years, AAAIOP PMS remained True Multicap Plan with current exposure of ~51% in large cap and balance in mid/small cap. However, in terms of net profit, 92% of portfolio companies are large in size (Rs 100 crs+ net profit). These companies have strong business moat with market leadership, strong balance sheet and have demonstrated resilience during the tough period. In terms of earnings growth, AAAPMS registered earnings growth of 18% in FY20 compared to Sensex earnings growth of 6% and reported ROE of 18% vs Sensex ROE of 13.3%.

Market outlook

The Federal Reserve kept interest rates pinned near zero with a promise to keep them there until inflation is on track to “moderately exceed” the US central bank’s 2% inflation target “for some time.” The new guidance allows the economy to keep adding jobs for as long as possible. The Fed also used its policy statement to begin to pivot from stabilizing financial markets to stimulating the economy, saying that it would keep its current government bond-buying at least at the current pace of $120 billion per month, in part to ensure “accommodative” financial conditions in the future.

Indian economy is coming back to normalcy slowly – Electricity consumption, e-waybill generation, NETC FASTag transactions and railway freight volumes are back to pre-Covid level. However, indicators like petroleum product consumption, job postings, port volumes and civil aviation are still well below their pre-Covid level. Growth in GST collections to Rs 955 bn in Sep20 for the first time in 5 months is a positive surprise. We expect market to remain volatile as we enter the US Presidential election season over the next 5 weeks and recommend to take any decline as an opportunity to add to the equity asset class.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.