As the year closes, 2025 is ending not with exhaustion, but with acceleration beneath the surface. The macro narrative that dominated much of the past twelve months is now giving way to a new and more constructive storyline. A powerful combination of lower inflation, policy clarity, liquidity support and strengthening fundamentals is quietly resetting the stage for 2026. For disciplined investors, this transition is not noise — it is the beginning of a new opportunity cycle. At AlfAccurate, our focus remains on identifying the structural winners that stand to benefit the most from this evolving environment.

India’s macroeconomic backdrop has strengthened considerably over the past few months, reinforcing the constructive outlook we shared in our April AAA Insights. What began as a rare alignment of fiscal and monetary forces has now evolved into a broad-based acceleration across liquidity, consumption, capex and credit. The result is an economic flywheel that is turning faster than at any point in the last several years, and in our view, this has the potential to create a positive surprise for markets in 2026.

Inflation remains low and comfortably within the target range, giving consumers and corporates much-needed relief. Combined with lower interest rates, this has created a supportive environment for both consumption and investment. The RBI’s ₹1.1 lakh crore liquidity infusion is one of the largest in recent years. It has further eased monetary conditions and strengthened the macro backdrop.

On the investment front, the Government’s sustained capex push continues to anchor growth. Over the past seven years, combined central and state capex has nearly tripled, keeping capacity utilisation steady at about 75% for eleven consecutive quarters. Private-sector capex, however, had remained subdued due to weak consumption and tighter financial conditions.

That equation is now changing. Policymakers have delivered meaningful consumption support through GST cuts and income-tax reductions, transferring nearly ₹3 trillion to households. Including the benefit of lower rates, the total boost approaches ₹4 trillion.

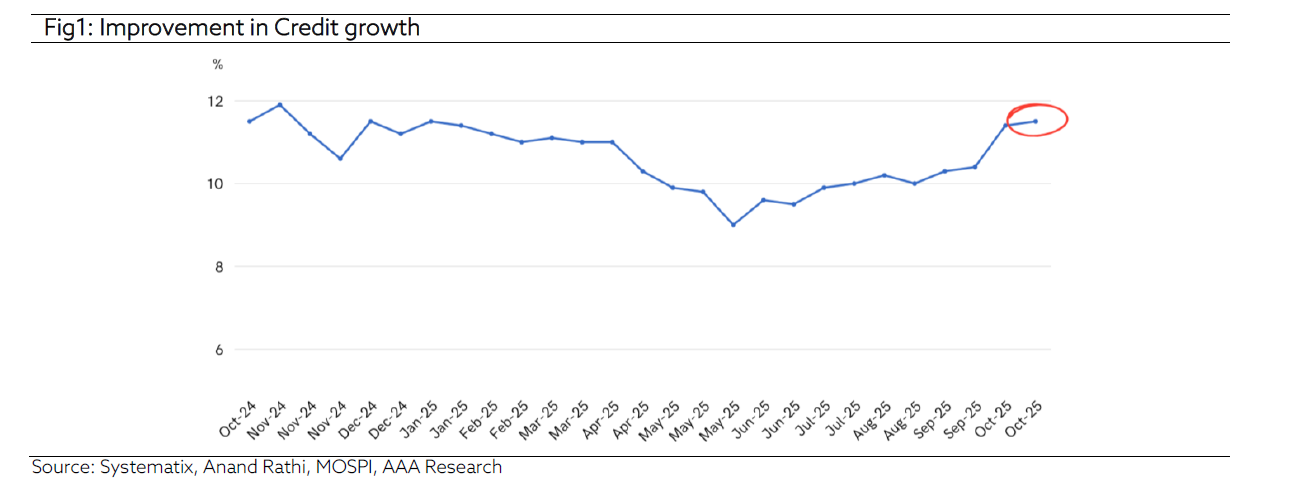

Early indicators reflect this turn. Credit growth has improved to ~11%, a sharp 250 bps jump (Fig1), and auto registrations have reached all-time highs – clear signs of a broad-based revival in discretionary demand.

Quarterly Snapshot – Q2FY26

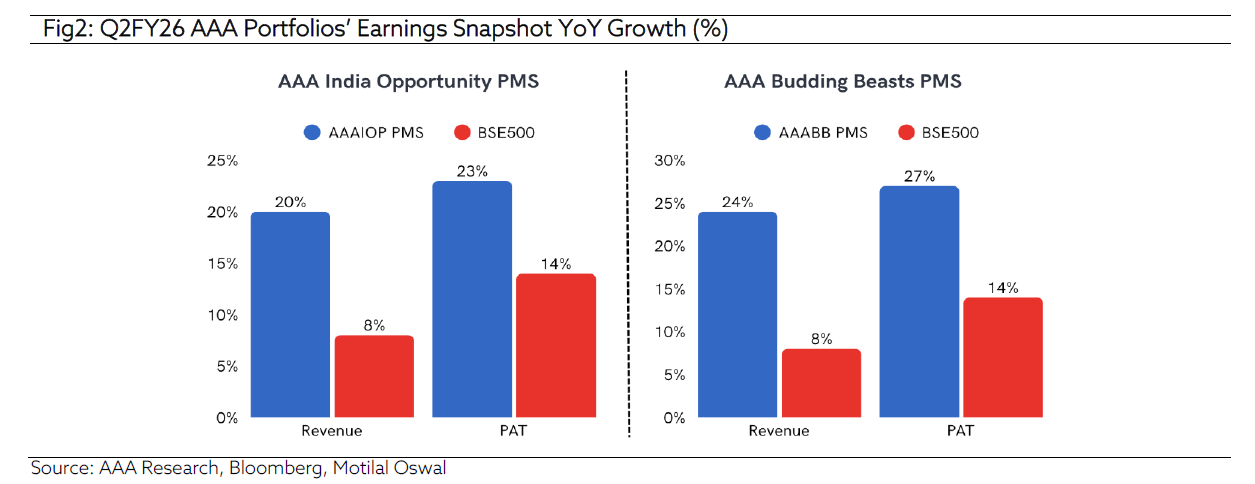

During 2QFY26, the BSE-500 delivered healthy double-digit earnings growth—the highest in five quarters—despite geopolitical headwinds and muted consumption trends. Against this backdrop, all AAA portfolios once again stood out by reporting robust revenue growth and strong profit expansion, reaffirming the strength of our disciplined stock-selection strategy. AAA IOP PMS delivered an impressive 20% revenue growth and 23% net profit growth, while AAA Budding Beasts reported 24% revenue growth and 27% profit growth. This consistent outperformance reflects our unwavering focus on quality, growth and valuation discipline. Our ability to identify structural winners early—businesses with resilient earnings profiles, strong execution and durable competitive advantages—has helped cushion the impact of sectoral slowdowns and enabled us to generate meaningful alpha across market cycles.

Where do we go from here?

We are now seeing a powerful trinity of capex, consumption and credit growth moving in sync. Government-led capex is supporting jobs and income, lower rates and policy-driven income support are reviving consumption, and rising demand is accelerating credit growth. This synchronised expansion is exactly what is needed to lift corporate earnings out of the subdued phase seen in FY25.

With macros improving and demand picking up, we expect earnings to grow 8.4% in FY26 and accelerate to 17.4%+ in FY27. Over time, markets mirror earnings and with earnings momentum turning decisively upward, equity performance should follow.

Valuations remain reasonable in this context. The Nifty trades at ~20.5x FY27 earnings, about 5% below its 10-year average. With macro tailwinds strengthening, micro fundamentals improving and earnings visibility rising, the current setup is particularly attractive.

In summary, the combination of low inflation, lower interest rates, fiscal support, a multi-year capex cycle, rising credit growth and a clear consumption revival creates a favourable macro configuration in recent years. With both macros and micros aligned, we believe 2026 holds the potential for a meaningful upside surprise for Indian equities. We remain structurally bullish on the equity asset class.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.