India’s equity market is entering a powerful new phase of optimism, driven by a rare and historic alignment of macroeconomic forces. For the first time in many months, a potent combination of softening inflation, bold monetary policy action, and aggressive fiscal support is setting the stage for a broad-based economic revival—making India one of the most compelling investment stories globally.

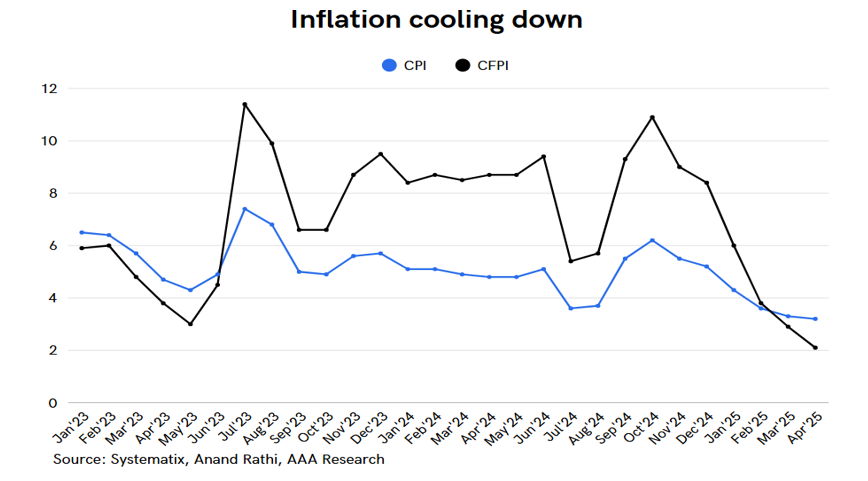

In recent months, inflation has steadily moderated—after staying within a manageable band, it has now softened further.

This welcome decline in price pressures comes at a critical time and provides much-needed breathing room for consumers, corporates, and policymakers alike. It comes at a time when the Reserve Bank of India (RBI) has stepped up decisively, not just with symbolic gestures but with game-changing intervention. In an aggressive and unprecedented move, the RBI reduced the Cash Reserve Ratio (CRR) by 100 basis points, and cutting the repo rate by 50 bps, unlocking liquidity into the banking system. More importantly, it has infused a staggering ₹10 lakh crores into the financial system, providing a solid foundation for credit growth, business expansion, and market buoyancy.

On the fiscal front, the government’s commitment to growth through capital expenditure is both clear and compelling. In FY25, actual government capex exceeded the full-year budgeted estimates—demonstrating strong execution and intent. Even more striking, in April 2025 (the first month of FY26), capex spending surged by an impressive 61% year-on-year. This is a strong signal of the government’s commitment to front-load growth through road, railways, housing and defence. The multiplier effect of this early and aggressive capex spending will reverberate across sectors—from construction and manufacturing to financials and services.

Adding further fuel to the demand engine, the Finance Minister’s historic income tax rate cut in the Union Budget marks a game-changing moment for India’s consumption story. This “gift” to the middle class is poised to lift disposable incomes, revive urban and rural demand, and unlock spending that had been stalled due to inflationary pressures and global uncertainty.

What we are witnessing is a synchronized policy pivot from both the RBI and the central government—something rarely seen in the past decade. The coordination between fiscal and monetary policy is not only timely but also highly effective. This alignment creates one of the most favourable macroeconomic backdrops India has seen in recent years.

The equity markets are already beginning to price in this optimism. While FY25 saw a modest 4% earnings growth for Nifty companies, we believe the environment is now primed for strong earnings rebound. We project Nifty earnings to grow by ~12% in FY26, driven by stronger consumption, and a revival in private capex. With liquidity flowing, interest rates stabilizing, and policy confidence rising, investor sentiment is turning increasingly constructive.

4QFY25 Report Card

During 4QFY25, Nifty delivered a 4% YoY PAT growth, in line with street estimates. This marks the fourth consecutive quarter of moderate earnings performance since the post-pandemic recovery phase that began in June 2020.

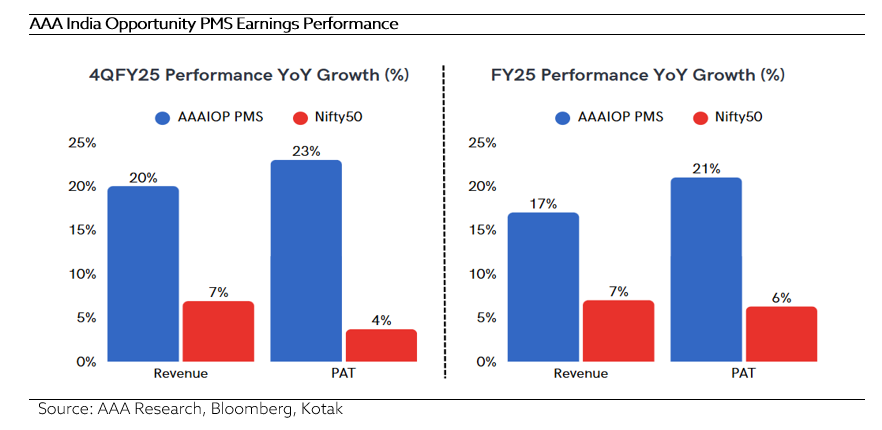

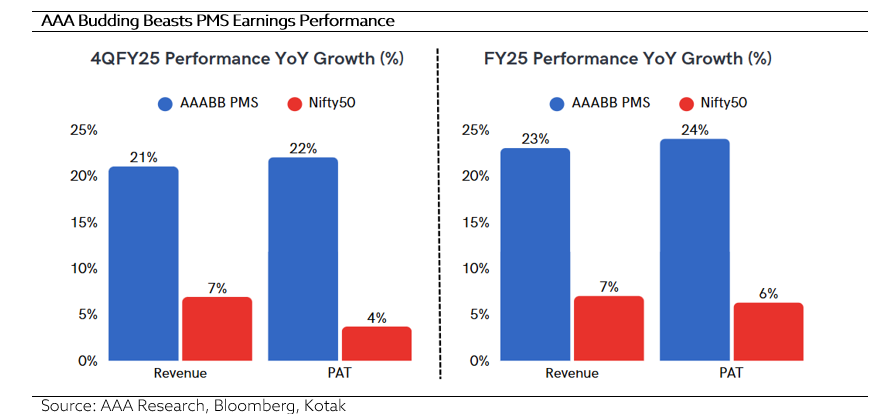

Against this backdrop, all AAA portfolios once again stood out by delivering robust revenue growth and strong profit expansion, clearly validating our disciplined stock selection strategy. Despite the broader economic slowdown that impacted several sectors, our portfolios continued to benefit from high-quality, fundamentally sound businesses with resilient earnings profiles and strong execution track records.

This consistent outperformance is a result of our unwavering focus on quality, growth, and valuation discipline, even in a decelerating macro environment. Our ability to identify structural winners ahead of the curve has not only cushioned the impact of sectoral slowdowns but has also helped generate alpha across market cycles.

In conclusion, India’s equity market stands at the cusp of a new growth cycle. The confluence of falling inflation, monetary easing, fiscal expansion, and tax incentives paints a bullish picture for both the economy and corporate earnings. On the valuation front, the Nifty is currently trading at approximately 22x FY26E earnings, which is in line with its 10-year historical average. While headline valuations may appear fair, they are well supported by an improving earnings outlook and a more favourable macro environment. Importantly, on a Price-to-Earnings Growth (PEG) basis, the Nifty trades at an attractive multiple of below 2x, suggesting reasonable valuations relative to expected earnings growth. For investors, this is a moment to stay invested, think long term, and ride the next wave of India’s structural growth story.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees worldwide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender / borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.