From shock to a positive surprise…

While pandemic Covid19 was the biggest shock to the world, discovering a vaccine in a record time of fewer than 12 months is a pleasant surprise to humanity. 2020 will be known as one of the most volatile years, with Sensex recording the sharpest fall of 32% in 13 sessions and bouncing back to pre-covid levels in 76 trading sessions – one of the fastest recoveries in the last 30 years.

For most companies, the year of the pandemic was a period of financial hibernation. Corporate India has used this period wisely to improve efficiencies and to prune cost across functions. This is reflected in Nifty sales, which declined 6.7% YoY, while EBITDA/PBT/PAT grew 8%/14%/17% during 2QFY21. Ex-Financials, Nifty reported 310bps YoY EBITDA margin expansion. Corporate India is making efforts to retain some cost savings permanently.

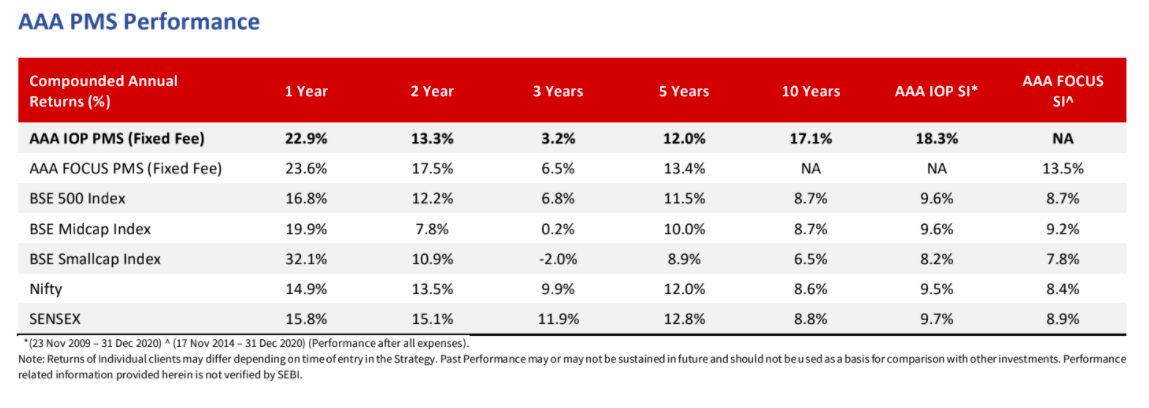

Just like agility is the mantra for corporate success, the same is true for Investment Managers. In early March, we raised cash levels, which helped us to protect capital. We used correction as an opportunity to reinvest the cash in the March-June period. Our early investments in speciality chemical and pharma were rewarding. While we remained agile, we equally focus on high-quality businesses that meet our 3M stock selection approach. Our zero exposure to sectors like airlines and hotels saved us from severe damage during covid times.

Economy set for a for faster growth

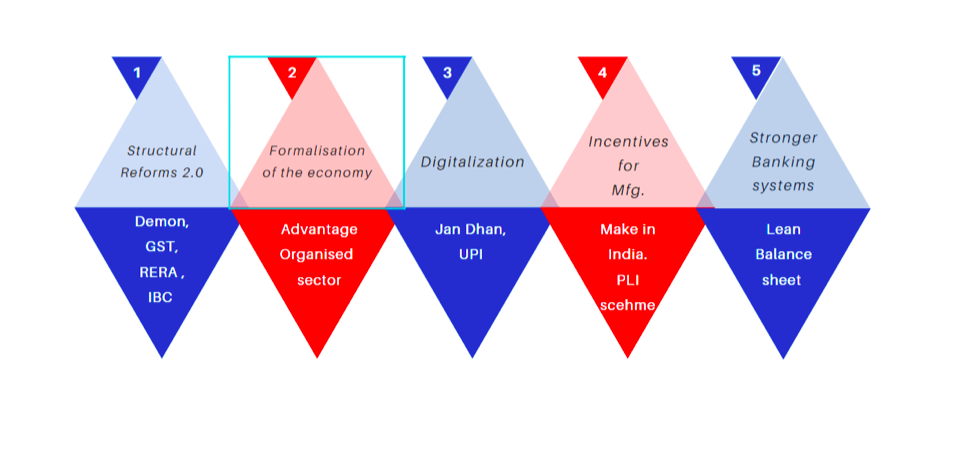

We believe the Indian economy is poised for faster growth as the pain of structural reforms is behind us. Indian government’s efforts to revive the Indian manufacturing sector through various initiatives like PLI scheme are impressive. Faster formalisation & digitization of the economy and a more robust banking system further accelerates the pace of normalization. Fast frequency data points are encouraging, and we will monitor them closely to see further progress on economic recovery.

Elevated valuations: can it sustain?

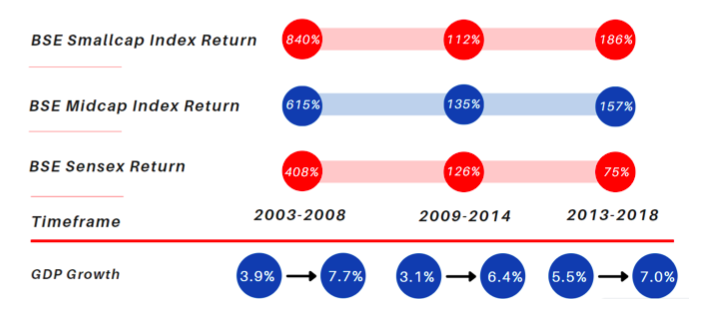

Both MSCI World Index and MSCI Emerging Markets Index are trading at decade high valuations. Sensex @47751 is at all-time high levels, and investors are rightly concerned about the current market valuations. However, one needs to look at valuations in the backdrop of earnings growth. We expect corporate earnings growth to revive to a strong double-digit over the next 2-3 years. Analysis of the last 20 years shows that strong growth in economic recovery drives strong, broad-based earnings growth, resulting in substantial market returns (refer below Fig). Higher earnings growth, improvement in ROE, and lower interest rates justify higher valuations for the equity asset class.

Our Investment Strategy:

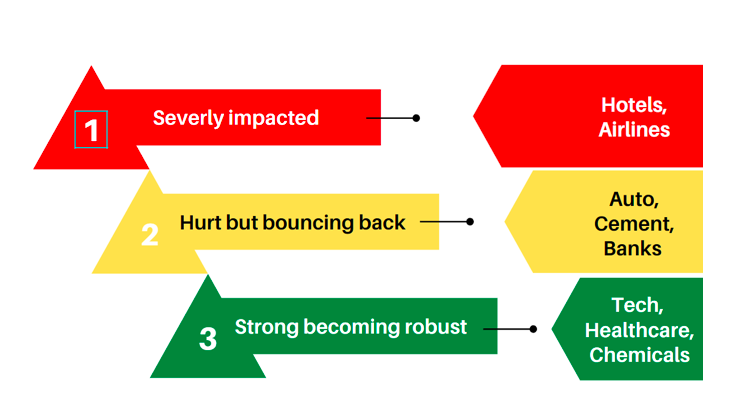

We bucket companies into three categories using a bottom-up framework: those in trouble that may take a longer time to recover; those that are impacted but should recover in FY22; and strong companies getting even more potent. Airlines and hotel sectors fall in the first bucket as it is more dependent on corporate. As globally corporate have experienced virtual meetings’ power resulting in significant cost savings, there is a likelihood of permanent cost reduction impacting airlines and hotel business. We are currently avoiding this bucket. Sectors like building

material, banking & finance, automobiles fall in the second bucket. The initial market sell-off hurt them badly, but it bounced back strongly as unlock down progressed. We have added our exposure to this basket. Technology and healthcare sectors are in the third bucket. We remain positive on this basket as technology companies capitalise on accelerating digitalisation trends globally while the healthcare and chemical sector benefits from the China + 1 strategy.

Globally investor community is debating between value and growth stocks. However, we believe that value stock can generate returns if there is an element of earnings growth in that firm. Notably, that firm’s business cycle should ensure the longevity of that earnings growth in the medium term. We believe that select cyclical sectors will do exceptionally well during the economic recovery period. Hence, we have increased investment in auto, banking, and select capital goods sectors during the last six months.

While we remain positive on the Indian equity market with a 3-5 years’ time frame, we expect the market to remain volatile, and like any other bull market, corrections are inevitable. One should capitalise on such an opportunity as there is a long run away ahead. We are positive on Mid and Smallcap companies within market cap categorisation as they tend to benefit more during the economic recovery. Notably, many large companies with sizable net profit are classified as Mid & Smallcap. The underperformance of Mid & Smallcap vs Nifty Indices during the last three years, further gives comfort on valuations. To capitalise on Emerging Giants’ opportunity, we are launching our new PMS plan – AAA Mid & Small cap PMS plan. In this plan, we intend to build a portfolio of 30-50 companies which are market leaders in their category with strong corporate governance and high growth potential with an investment horizon of 3-5 years (pl find more details: AAA Mid & Smallcap PMS Leaflet.pdf (alfaccurate.com)

Key risks: Important risks that concern us the most are: Effectiveness of the covid19 vaccine, reduced policy support by global governments and central bankers, rising commodity prices leading to higher inflation, and geopolitical shocks.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd. nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.