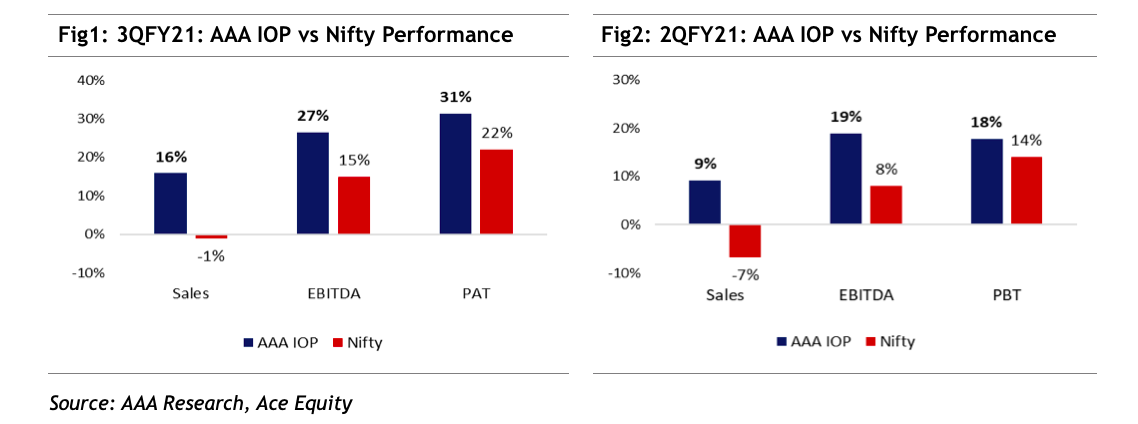

Early FY21, we mentioned three themes to play India’s economic recovery – 1. Acceleration of formalisation 2. China + 1 strategy and 3. Automation and Innovation (refer Key Investment Themes to Capitalize on the Covid-19 Crisis). Earnings performance reported by Corporate India indicates traction in each of these themes in 3QFY21. AAA portfolio companies being market leaders capitalised on these trends and continued to deliver robust performance in 3QFY21 (Fig1), after delivering resilient performance in 2QFY21 (Fig2). Against Nifty Revenue/Profit growth of -1%/22%, the AAAIOP portfolio delivered 16% revenue growth and 31% profit growth during 3QFY21. Such strong performance was driven by a better demand environment, gain in market share and cost efficiencies.

Acceleration of Formalisation

Our portfolio company, Century Plywood, reported industry-leading growth of 9% against flat/de-growth reported by the competitors in the building material space. The company remains upbeat and expects growth momentum to continue with a sharp revival in the secondary real estate market. Similarly, in the pipes sector, Prince Pipes reported industry-leading volume growth of 18% vs. 9%/15%/5% growth reported by Supreme / Astral / Finolex industries. Prince Pipes secured a tie-up with Lubrizol – the world’s largest CPVC compound manufacturer, becoming one of India’s only two companies to have such a tie-up. This will significantly expand capabilities and strengthens Prince’s agility and brand awareness in the market.

China + 1 Strategy

Pharma, Speciality chemical, and Electronics sectors are significant beneficiaries of the China+1 Strategy adopted by the global players.

Speciality chemical sector:

We have been bullish on the Specialty chemical theme for the last few years.

We further added to the sector weight, considering the huge opportunity driven by China + 1 strategy adopted by the global players. Our portfolio companies like SRF, Navin Fluorine, Balaji Amines reported healthy revenue growth of 16%/18%/72%, respectively. Management commentaries by speciality chemical players highlight a rising number of order inquiries by global innovators. As a measure to tap these growth opportunities, the majority of players have increased their overall capital expenditure for FY22-23 (AIL’s capex: INR12bn, SRF: INR13bn, Navin INR5.2bn). Going forward, we expect higher capital outlay driven by increased visibility on demand is likely to keep growth engines intact for our portfolio companies.

Electronics:

Our portfolio company, Dixon, has become the poster boy for Govt’s success in promoting manufacturing through PLI scheme. Dixon has received a license for PLI manufacturing in mobile and has already secured a tie-up with Nokia and Motorola. Motorola will be shifting its production from China to India. Dixon plans to scale up its mobile segment revenue from Rs. 537cr in FY20 to over Rs.100 bn in FY25. Further, the company will also be exploring PLI in Telecom, Lighting, and IT hardware. Dixon presently produces 30% of India’s washing machine, LED TV requirements, and 45% of LED bulb requirements having relationships with most major OEMs. With an entry in new segments, the company is poised for multi-fold growth over the next 4-5 years. During 3QFY21, it reported 119% revenue growth and 134% profit growth.

Pharma: Our portfolio company Divis has reported industry-beating revenue growth of 22% in the pharma space. Divis is planning to expand its presence for custom work for API, especially in the contrast media segment, which is a US$4-6bn market with very few players. Divis has identified the next 10 generic API molecules in the generics segment to sustain the growth momentum. JB Chemical has demonstrated industry-leading growth and profitability during the last three years. The company continued that journey even during 3QFY20. Backed by new product launches and an increase in MR productivity, JB reported revenue growth of 27% in 3QFY21 against industry revenue growth of ~12%. With the induction of a new management team with rich experience in the Indian pharma industry, the company is well-positioned to reach its target to become Top 20 companies in India (presently, it ranks 28th as per IPM).

Engineering:

Orient Refractories is a classic example of MNC becoming super aggressive in India. There are not many examples of MNC merging the unlisted business into the listed entity. In this case, the parent has decided to merge its unlisted subsidiaries RHI India Pvt Ltd and RHI Clasil Ltd with listed company Orient Refractories Ltd. The merger will bring diversification from flow-control refractories to the complete end-to-end solution to the steel companies. Post the merger; the company will emerge as the largest refractory company in India with a diversified product portfolio catering to the Steel, Cement, and Glass line refractories. Orient has registered 19% revenue growth in 3QFY21 vs 2.8% growth recorded by Vesuvius.

Automation

Increased focus of the corporate world to improve labour and cost efficiency helps our portfolio companies like ABB India and Honeywell Automation in the capital goods sector. Recently ABB got an order from OLA to deploy robotics and automation solutions at its mega-factory for electric scooters. ABB also bagged an order to execute the country's largest process automation and safety system projects in the agrochemical sector from Deccan Fine Chemicals. We believe the automation theme will only get stronger as private companies set foot on capital expansion.

Our Investment Strategy / Market Outlook

The emergence of taper tantrum fears in recent weeks has created flutters in the equity markets. The sell-offs primary reason appears to be a spike in the already up-trending US bond yields (spiked 50 bps over the past one month), resulting in a bond rout in DMs. However, we believe that the US economy is a long way from its employment and inflation targets. The Fed chief’s comments that the Fed is committed to using our full range of tools to support the economy and to help ensure that the recovery from this difficult period will be as robust as possible; this implies the continuance of accommodative stance. However, such events (spike in bond yield) can create a knee-jerk reaction in the equity market. In India, supportive government policy, comfortable financial conditions, and a strong economic recovery will lead to robust earnings growth over FY21-23. The street estimates Nifty EPS to report 20%+ CAGR over FY20-23; this is despite FY21 being the pandemic year. On valuations, Nifty trades at 21.6x PER (FY22) and 18.3x PER (FY23) compared to its 10yr average PE (1 year forward) 18.8x. We remain positive on market and recommend to use any correction as an opportunity to add to equity asset class with 3-5 years time horizon.

Key risks: Effectiveness of the covid19 vaccine, reduced policy support by global governments and central bankers, rising commodity prices leading to higher inflation, and geopolitical shocks.

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with AlfAccurate Advisors Pvt Ltd is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither AlfAccurate Advisors Pvt Ltd. nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavour to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (is) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (is) discussed herein or may perform or seek to perform investment banking services for such company(is)or act as advisor or lender borrower to such company(is) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without AlfAccurate Advisors Pvt Ltd.’s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.